Robinhood and Revolut Eye Stablecoin Market as Regulation Threatens Tether’s Dominance

Robinhood and Revolut are considering stablecoin launches, as Markets in Crypto-Assets (MiCA) regulation may disrupt Tether’s market domination in the EU.

However, neither firm has made concrete assurances, and there are other competitors.

Tether’s Market Domination

Bloomberg reports that Robinhood and Revolut, two massive fintech firms, are considering entering the stablecoins market. The two companies hope to loosen Tether’s overwhelming dominance in the stablecoin market. Neither company has officially made firm commitments on the subject, and no employees have spoken on the record.

Read More: A Guide to the Best Stablecoins in 2024

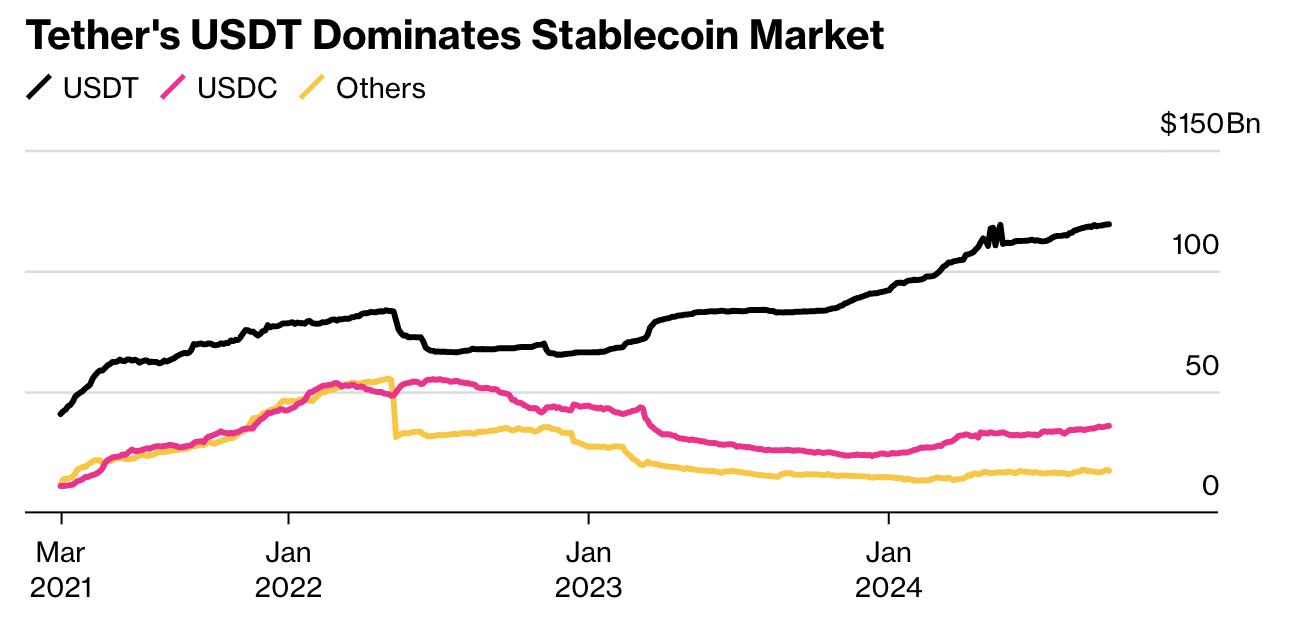

Tether’s Growing Stablecoin Dominance. Source: DefiLlama

Tether’s Growing Stablecoin Dominance. Source: DefiLlama

Still, the timing is very ripe. Robinhood and Revolut would not be the only major capital firms looking into stablecoins.

On Thursday, Ethena Labs launched a new stablecoin backed by the BlackRock USD Institutional Digital Liquidity Fund (BUIDL). This stablecoin is designed to emulate the stability of traditional stablecoins by tying its value to BUIDL, a fund that includes US dollars, short-term US Treasury bills, and repurchase agreements.

MiCA: A Huge Opportunity

The reason for this high level of interest is simple. MiCA, the EU’s new comprehensive crypto regulations, is set to take effect soon, and it includes stringent rules for stablecoins.

Circle already possesses the relevant licensing to operate in the EU, but it hasn’t seriously challenged Tether’s dominance in over two years. If Tether can’t meet compliance, the entire EU market would be ripe for new competition. That’s a prize too tempting to ignore, especially for massive firms like Robinhood and Revolut.

“Many businesses have looked at the likes of Circle and Tether and the figures they’ve posted. It sounded like a beautiful business model, and there are many out there that might want to replicate tha,” Thomas Eichenberger, Chief Product Officer at Sygnum, said.

After all, Bloomberg noted, Tether employed around 100 people when it banked $5.2 billion in profit earlier this year. In asset under management (AUM), it’s comparatively gargantuan.

Stablecoins are a growing market worldwide, especially in emerging economies. Increasing numbers of customers are using stablecoins as a store-of-value or everyday purchases. Their use in helping users evade US sanctions has also gathered large interest.

Even before the specific opportunity of MiCA, the possibility of breaking Tether and Circle’s duopoly has attracted investors. PayPal launched its own stablecoin for this exact purpose a year ago, and today, it’s approaching $1 billion. Tether has nearly $120 billion, though. If the entire EU has the chance to outcompete it, there will be no shortage of contestants.

Read More: What Is Markets in Crypto-Assets (MiCA)?

Nonetheless, Robinhood and Revolut have not made any firm commitments yet. To take advantage of MiCA, however, they’ll have to act fast. Many exchanges in the EU have partially delisted Tether stablecoins, but there are some holdouts.

Tether will operate in a legal grey area, and in any event Circle is already compliant. A very wide range of outcomes is possible.