Worldcoin (WLD) Price Breaks $2 Barrier Ahead of $58 Million Token Unlock

Worldcoin (WLD), the cryptocurrency tied to OpenAI’s CEO Sam Altman, is the biggest gainer among the top 100 cryptos today. In the last 24 hours, Worldcoin’s price has increased by 15.50% while trading at $2.09.

As the token gains momentum, this analysis examines the factors behind the recent price surge and the potential implication of a major token unlock scheduled for next week.

Worldcoin Rising Demand, Adoption to Counter Supply Shock

Worldcoin’s price increase could be attributed to the broader upswing in the prices of Artificial Intelligence-themed tokens. In addition, the adoption of World ID verification in Poland, Malaysia, and Guatemala appears to have contributed to the recent price surge.

According to the open-source digital identity project, the launches came at a crucial time for the countries.

“The new launches come on the heels of a summer that saw significant growth in both the advancement of AI and its corresponding potential for costly online fraud,” Worldcoin wrote in a blog post.

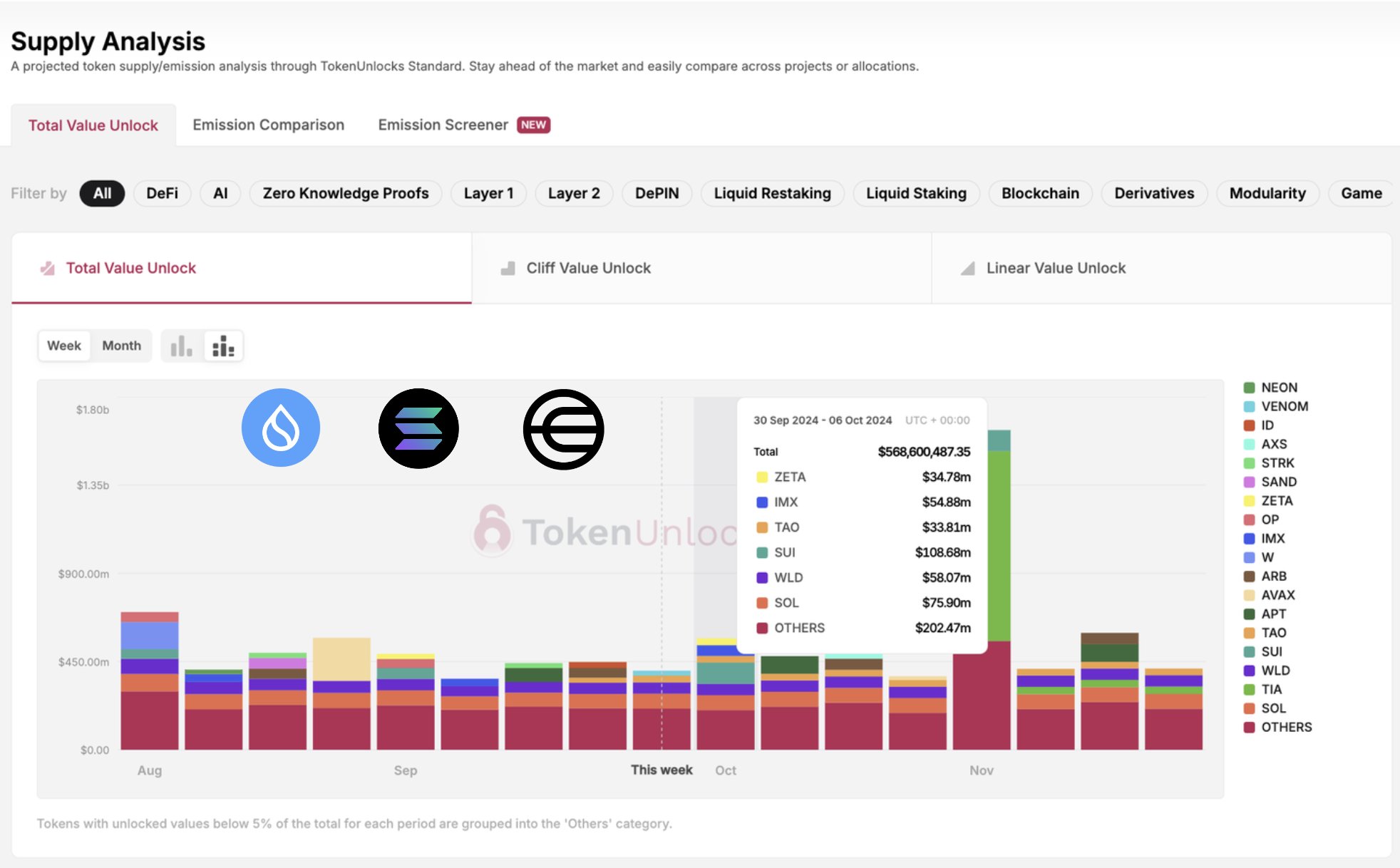

This development also comes ahead of Worldcoin’s token unlock. Valued at $58 million, the event is scheduled to occur between September 30 and October 6.

Worldcoin Token Unlock. Source: Token Unlocks

Worldcoin Token Unlock. Source: Token Unlocks

Token unlocks typically introduce supply into the market, which can influence price movements. As a result, WLD may experience increased volatility during this period.

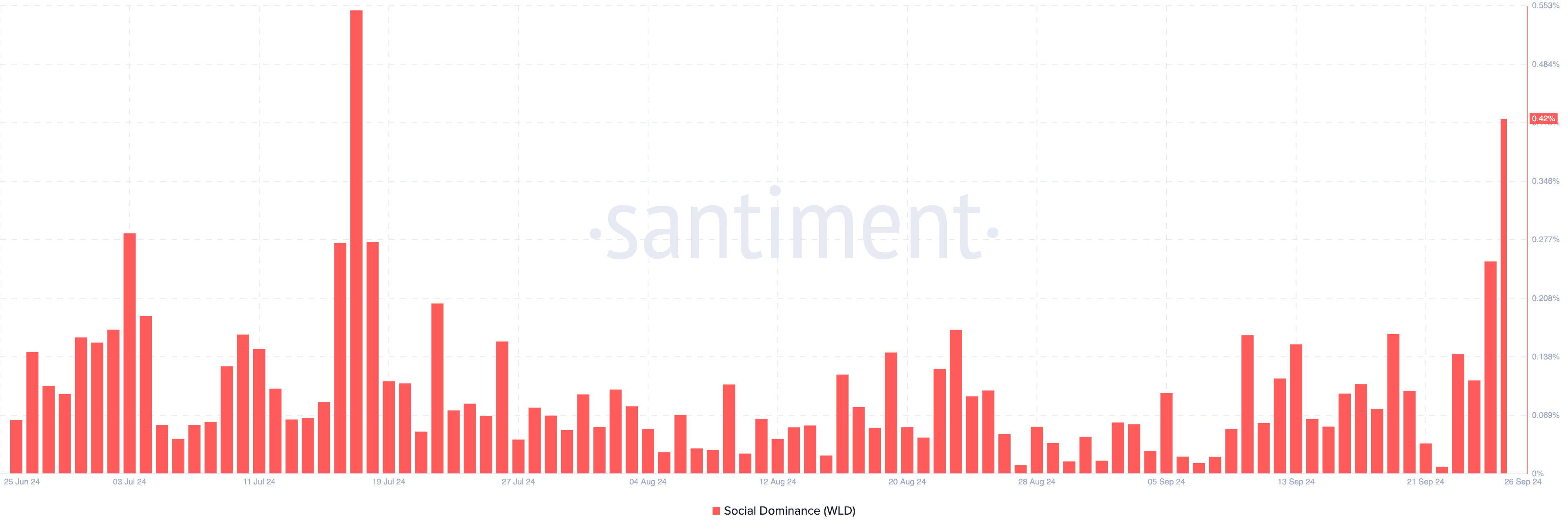

Furthermore, on-chain data from Santiment shows a spike in Worldcoin’s social dominance. This sudden increase indicates a rise in Worldcoin-related discussions. It also suggests that demand for WLD might increase, which could contribute to a further price hike.

Read more: Where To Buy Worldcoin (WLD): 5 Best Platforms for 2024

Worldcoin Social Dominance. Source: Santiment

Worldcoin Social Dominance. Source: Santiment

Beyond that, the Coins Holding Time has risen by 310% in the last seven days. Coins Holding Time measures the amount of time a cryptocurrency has been held without being sold.

When it decreases, it signals that holders are selling, which could negatively affect prices. In this case, the significant uptick in the metric reflects strong confidence in Worldcoin’s short-term potential. If this upward trend continues, it may push the price higher.

Worldcoin Coins Holding Time. Source: IntoTheBlock

Worldcoin Coins Holding Time. Source: IntoTheBlock

WLD Price Prediction: 20% Run to $2.50

From a technical standpoint, Worldcoin’s rally occurred as a result of the breakout from a descending triangle. This bearish technical pattern is formed by a series of lower highs converging with a horizontal support line.

Typically, it signifies that sellers are gaining control over the market, and the downtrend is likely to continue. However, the daily WLD/USD chart shows that the altcoin has support at $1.41, broke out of the pattern, and invalidated the bearish outlook.

Later on, Worldcoin’s price faced resistance at $1.64. But bulls were able to breach the hurdle, eventually leading the price to hit $2.09. As it stands, the cryptocurrency has encountered a roadblock at $2.10.

Read more: Worldcoin (WLD) Price Prediction 2024/2025/2030

Worldcoin Daily Price Analysis. Source: TradingView

Worldcoin Daily Price Analysis. Source: TradingView

The analysis shown above reveals that WLD could break this resistance. If successful, Worldcoin’s price could jump 20% and hit $2.50 within a few days.

However, investors need to watch out for the token unlock. If the supply shock outweighs demand for WLD, this forecast might not come to pass. Instead, the price could decline, potentially sinking to $1.75.