Internet Computer Price Prediction: ICP’s V-shaped recovery rally under threat

- Internet Computer price has made multiple attempts at a bullish breakout, but all proved futile.

- A breach of the $13.22 mean threshold is key for ICP, nearly 8% above current levels.

- Another rejection could see the altcoin retest the $10.00 psychological level.

Internet Computer (ICP) price is pushing for a recovery rally and is about to complete a v-shaped. However, it faces overhead pressure from a supply zone.

Also Read: BNB, ICP, ARB, SEI: Four tokens unstirred by BTC dip as markets record largest altcoin liquidations in 2 years

Internet Computer price eyes 5% extension before possible rejection

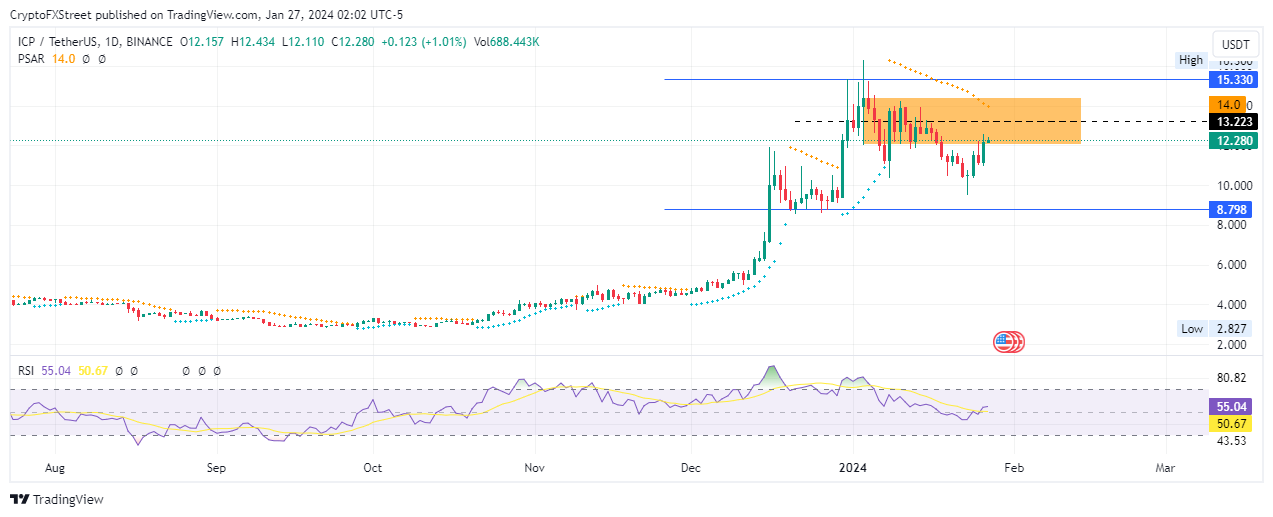

Internet Computer (ICP) price is up 30% since the January 23 low of $9.52, pushing north, as part of a v-shaped recovery rally. However, the supply zone between $12.01 and $14.43 threatens the upside potential for ICP.

The Relative Strength Index (RSI) is northbound above the 50 level, suggesting rising momentum. Increased buyer momentum could see ICP price extend the gains to test the midline of the supply zone at $13.22, with a break and close above this level confirming the continuation of the intermediary trend.

Such a move could see the Internet Computer price extend north to convert the supply zone into a bullish breaker. This would be confirmed by a flip of the $15.33 resistance level into support.

In a highly bullish case, the gains could send the Internet Computer price reclaim the range high of $16.30, last tested on January 3. Such a move would constitute a 30% climb above current levels.

ICP/USDT 1-day chart

On the flipside, a rejection from the supply zone could see the Internet Computer price drop, with a possible retest of the $10.00 psychological level. In the dire case, the dump could see ICP roll over to the $8.79 support, nearly 30% below current levels.