Trump Coins Debut as His Campaign Faces Donation Shortfalls Against Harris

Former US President Donald Trump has launched his first official commemorative silver coin, called “Trump Coins.”

This move comes as Trump’s campaign faces dwindling donations, impacting his election prospects.

Trump Coins Arrive as Campaign Trails Harris

On September 21, Donald Trump introduced the first edition of his Official Trump Coins. These limited-edition silver medallions, named “The President Donald J. Trump First Edition Silver Medallion,” will be available for purchase starting Wednesday, September 25, 2024. Each coin is priced at $100, according to the Trump Coins website.

Indeed, Trump emphasized that the coins symbolize America’s greatness, celebrating freedom and prosperity and putting the country first.

“Trump Coins are designed by me and minted right here in the USA. This beautiful, limited-edition coin commemorates our movement, our fight for freedom, prosperity and putting America first, we always put America first,” Trump said.

Read more: How Can Blockchain Be Used for Voting in 2024?

Notably, the product’s webpage clearly states that the coins are not tied to any political campaign. It also clarifies that neither Trump, the Trump Organization, nor any related entities sell them.

Meanwhile, this release comes during the week that the former President launched his new DeFi venture and around a month after he launched his fourth NFT collection. Market observers said these moves are part of Trump’s effort to court crypto traders.

Interestingly, the timing of these products coincides with a decline in Trump’s campaign donations compared to his Democratic rival, Vice President Kamala Harris.

Federal Election Commission (FEC) filings show Harris outpaced Trump in August, raising over $189 million, while Trump secured just $44 million. Overall, Harris’s fundraising, including support from the Democratic National Committee and other groups, reached $361 million. In contrast, Trump’s efforts totaled $130 million.

Over the past months, both candidates have garnered support from different financial sectors. Harris has drawn significant contributions from traditional finance, including Wall Street and Silicon Valley figures. Meanwhile, Trump has attracted notable donations from the crypto sector, including contributions from the Winklevoss twins.

Read more: How Does Regulation Impact Crypto Marketing? A Complete Guide

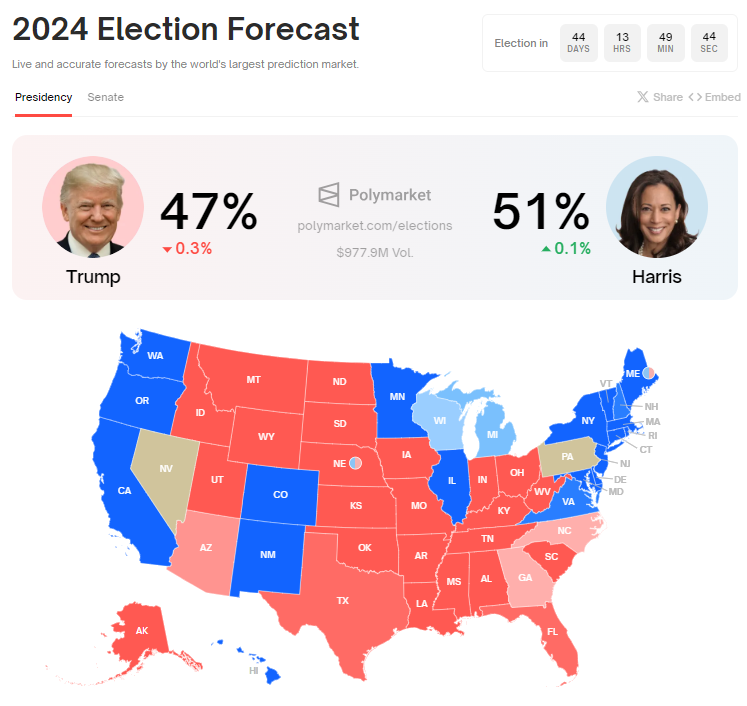

Trump and Harris Election Chances. Source: Polymarket

Trump and Harris Election Chances. Source: Polymarket

Despite this support, Trump’s election chances seem to be slipping. According to data from Polymarket, industry bettors give Harris a 51% chance of winning the election, edging out Trump at 49%.