Bitcoin Rallies as Goldman Sachs, Citi, Morgan Stanley Predict More Rate Cuts

The Federal Reserve’s rate cuts have been good for Bitcoin and the broader economy. Major banks like Goldman Sachs, Morgan Stanley, Bank of America, and others have adjusted their predictions for the impact of these cuts.

These new predictions vary significantly between these banks’ respective analytics.

Big Boost for Bitcoin

The Federal Reserve decided on a 50-point rate cut, and different sectors of the crypto economy are rallying, including Bitcoin, which surged from $57,400 to $64,000. Bullish sentiment is sweeping through the financial and regulatory ecosystem, even from figures hostile to the industry.

For example, US Treasury Secretary Janet Yellen has been quite vocal in her criticism of crypto before, but she greeted these conditions warmly:

“The cut is a very positive sign for where the US economy is. It reflects confidence on the part of the Fed that inflation has come way down and is on a path back to the 2% target.” Yellen said.

It’s a small wonder that she has approved these cuts when Treasuries securities are also on the rise. Conventional wisdom seems to be that these cuts benefit everyone, but Bitcoin and the crypto market are particularly profitable.

Read More: TradFi Explained: Exploring Key Elements of Traditional Finance

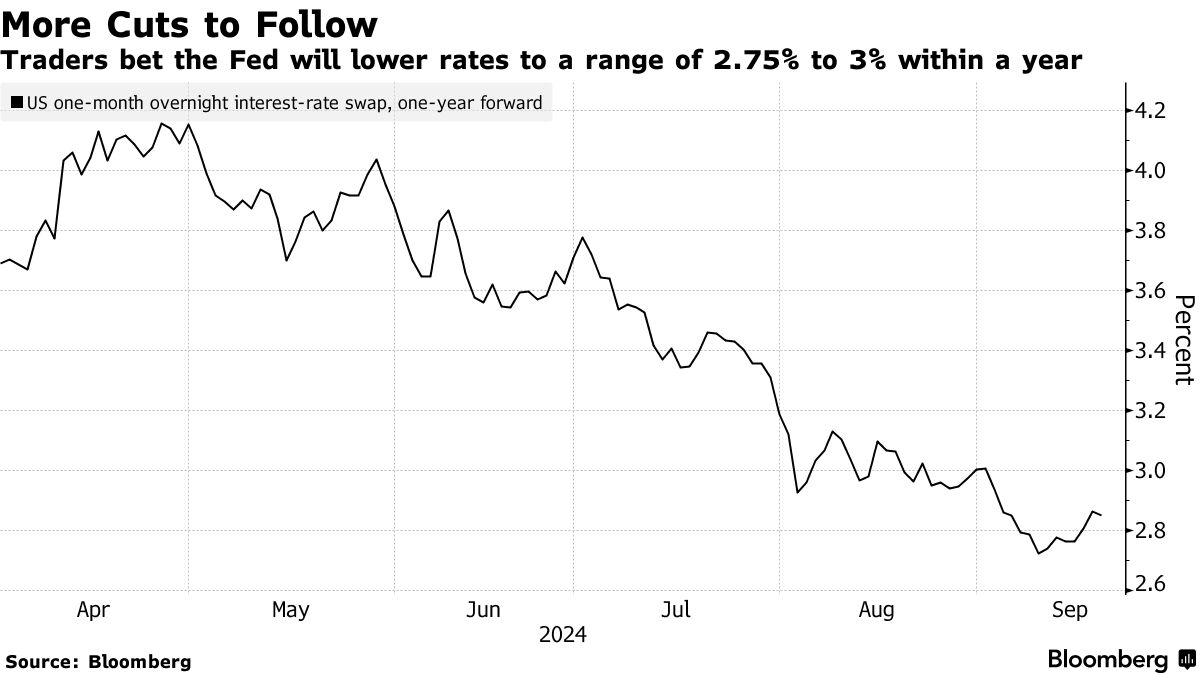

Data Suggesting Further Cuts. Source: Bloomberg

Data Suggesting Further Cuts. Source: Bloomberg

Several of the US’ largest investment banks have taken different approaches to the future. However, Bank of America made the most aggressive predictions and was the only big firm to actually raise its odds of rate cuts.

This attitude befits its pro-crypto stance. The firm expects a further 75-point cut by Q4 and a stunning 125-point cut in 2025. This would drop interest rates below 3% from its current range of 4.75%-5%.

“The first rate cut was larger than the firm anticipated, and in light of that we are skeptical that the Fed wants to deliver a hawkish surprise,” a spokesperson said.

Read More: 2023 US Banking Crisis Explained: Causes, Impact, and Solutions

Goldman Sachs was somewhat more moderate. Before recent events, it predicted 25-point cuts in Q4 2024 and now predicts that these cuts will be stretched out. It claims this 25-point cut will be reached incrementally between November 2024 and June 2025, targeting an overall interest rate of 3.25% to 3.50%.

Citigroup downgraded their predictions the most, turning a previous expectation of 125-point cuts by Q4 2024 into a 25-point one. Morgan Stanley’s own analytics team had the most conventional prediction, expecting a series of staggered minor cuts over the next few months.

In an exclusive interview with BeInCrypto, Rob Viglione, CEO of Horizen Labs, said that in the longer term, “lower interest rates will continue to favor risk-on assets like Bitcoin” as investors continue to seek higher returns outside of traditional investments. This could further support the Bitcoin rally.