Bitcoin Sentiment Spikes After Mild Price Jump: Crowd Too Excited Too Quickly?

Data shows that the positive sentiment around Bitcoin has spiked on social media after BTC’s return above $58,000, implying investors may feel FOMO.

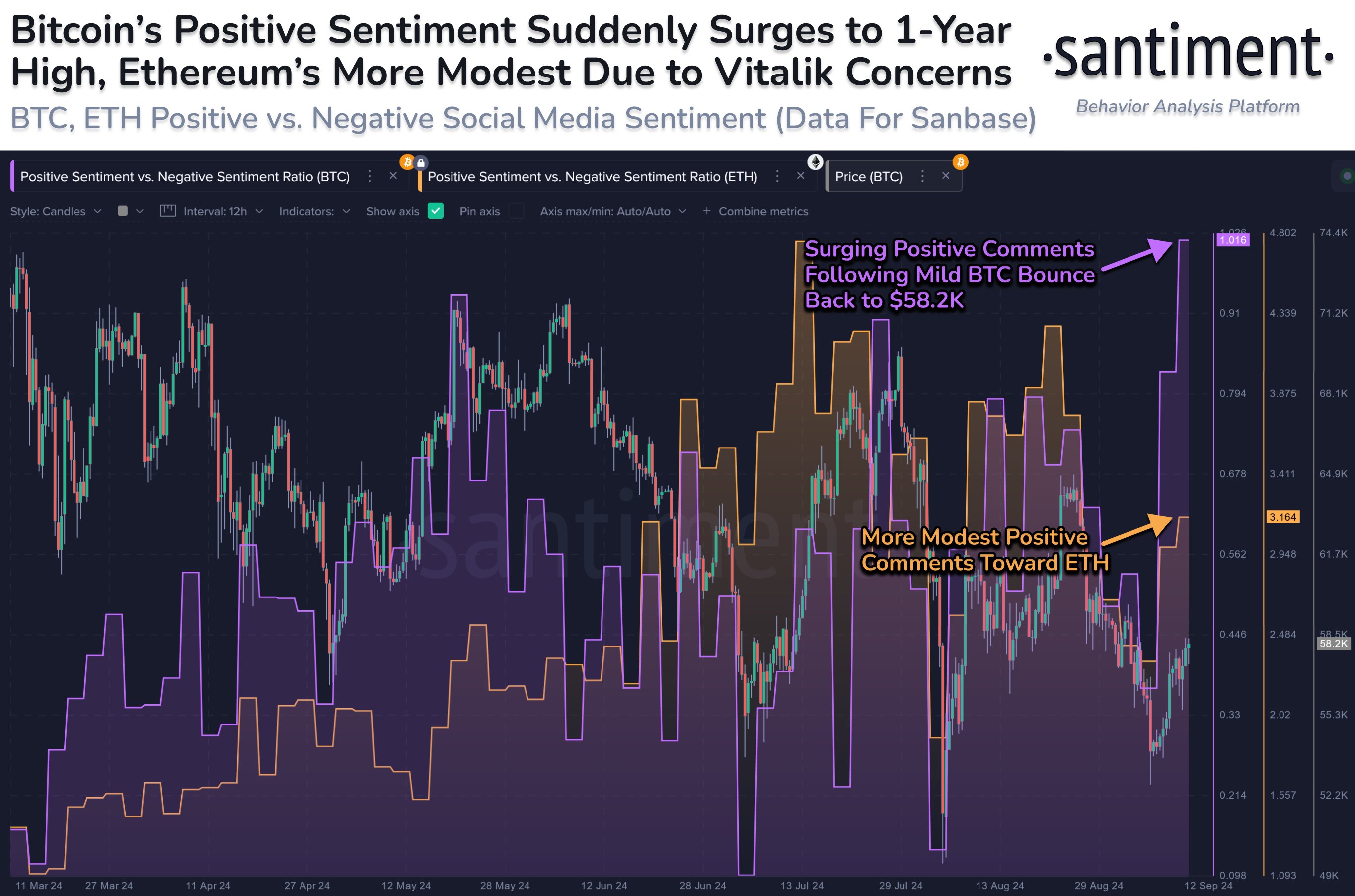

Bitcoin Positive Vs. Negative Sentiment Ratio Has Spiked Recently

According to data from the analytics firm Santiment, the crowd has recently shown a sudden burst of optimism around Bitcoin. The indicator of relevance here is the “Positive Sentiment vs. Negative Sentiment Ratio,” which, as its name suggests, keeps track of the ratio between the positive and negative comments on social media related to a given coin.

The analytics firm sources posts/threads/messages from platforms like Twitter, Reddit, Telegram, and 4Chan. To determine whether these posts are negative or positive, Santiment puts them through a machine-learning model.

When the indicator has a value greater than 1, the comments related to positive sentiment outweigh the negative ones. On the other hand, being under the threshold suggests that most social media users share a negative sentiment.

Now, here is a chart that shows the trend in the Positive Sentiment vs. Negative Sentiment Ratio for the top two coins in the sector, Bitcoin and Ethereum, over the past few months:

As displayed in the above graph, a huge spike in positive sentiment vs. negative sentiment was observed for Bitcoin after the latest cryptocurrency recovery.

The peak of this spike has corresponded to twice as many positive posts as negative ones cropping up on the major social media platforms. This is the first time the indicator has reached such a high level.

While this indicates that the investors feel bullish about the asset, the optimism scale could be concerning. This is because BTC has historically tended to go against the expectations of the majority, with the probability of a contrary move rising, the more sure the crowd has become of a direction.

Since the positive sentiment has exploded after only a mild jump in the price, FOMO may be taking over the market a bit too soon. This could lead to a potential top for Bitcoin. As for when BTC’s fates might turn bullish again, the analytics firm says:

Look for traders to “slow their roll” and start to express FUD again. When the crowd begins conveying doubt again, BTC will truly begin testing its March all-time high market values.

Interestingly, whereas FOMO around Bitcoin is taking over social media, the users are still only showing a modest amount of optimism towards Ethereum. This could naturally play into the favor of ETH’s price.

BTC Price

Bitcoin has been encountering trouble pulling off a sustained move above $58,000, with the coin seeing another rejection today to $57,800.