Bitcoin wallets show signs of capitulation as BTC price trades in tight range close to $40,000

- Bitcoin wallet addresses have been on a decline since October 2023.

- BTC price drop below the $40,000 mark triggered liquidations in over 487,000 wallets holding upto 1 Bitcoin.

- Bitcoin price is range bound less than three months away from the upcoming BTC halving event in April.

Bitcoin price is range bound close to the psychologically important $40,000 level, nearly two weeks post Spot ETF approval by the Securities and Exchange Commission. Retail traders holding less than 1 BTC have shed their holdings, evident by the decline in Bitcoin wallets since October 2023.

Bitcoin price could plummet to the support zone between $38,304 and $38,957, in the event of further correction in the asset.

Also read: Bitcoin price eyes comeback above $40,000, traders unsure of where BTC is headed next

Daily Digest Market Mover: Bitcoin wallet addresses holding upto 1 BTC on a decline

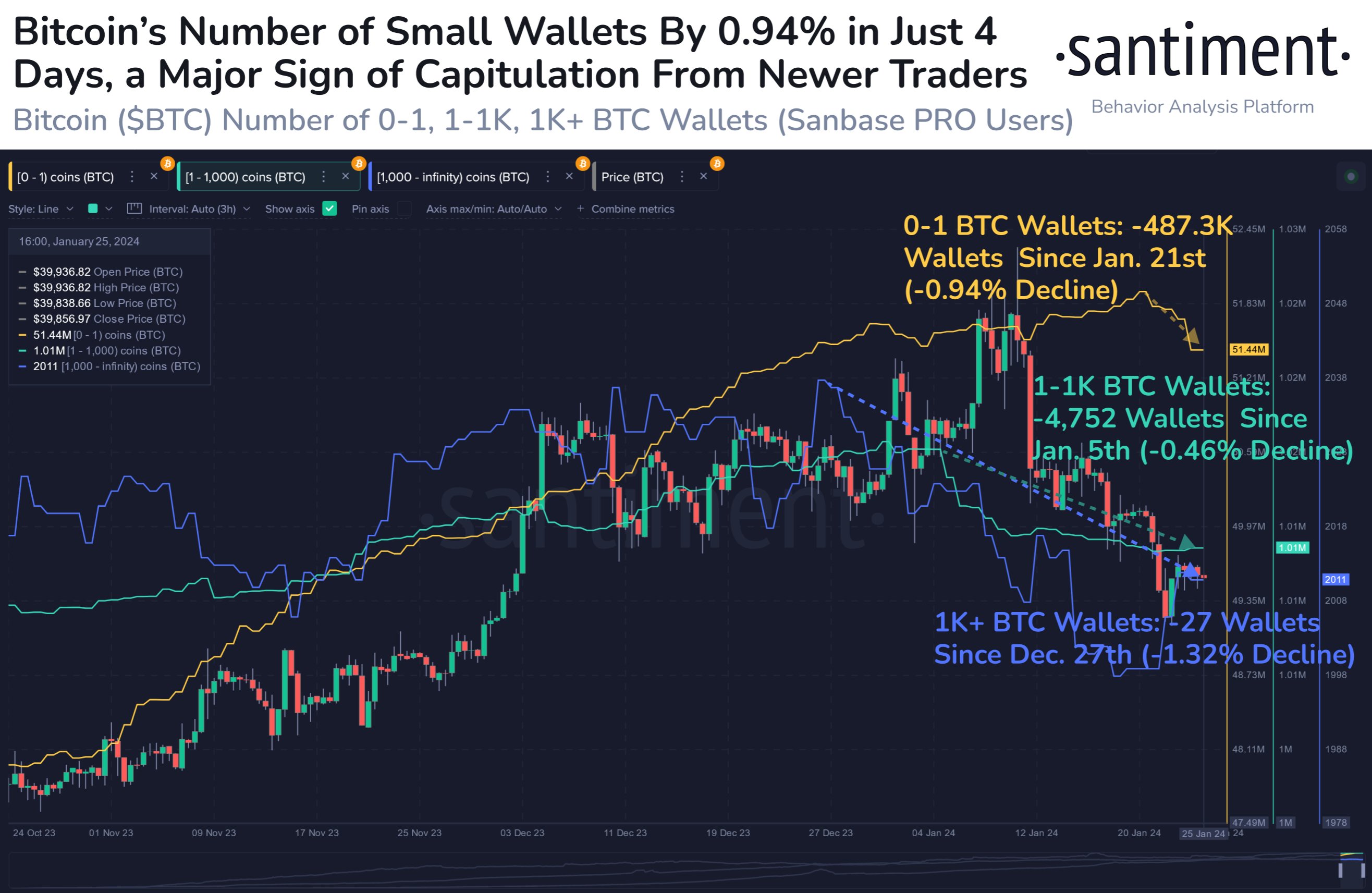

- According to Santiment data, the count of Bitcoin wallets holding up to 1 BTC has declined at a swift pace since early October 2023. In the past four days with Bitcoin price decline to a low of $38,555, 487,000 BTC wallets holding up to 1 BTC were liquidated.

- Bitcoin’s retail traders are therefore on a decline amidst BTC price correction.

Bitcoin small wallets holding up to 1 BTC on a decline. Source: Santiment

- Santiment analysts note that the sentiment among BTC traders since the ETF approval is the likely driver of the capitulation among retail traders.

- Bitcoin halving event that is set to slash the mining reward in half is less than three months away. Typically Bitcoin price declines in the days leading up to the halving and the event acts as a catalyst, pushing BTC to a new high in a stipulated time period.

- The halving event is 2 months and 28 days away, as of January 26.

- Experts consider BTC halving as the next key driver of Bitcoin price, after ETF approvals.

- While ETF approval turned out to be the “sell the news” event, halving could act as a bullish driver for Bitcoin, sending BTC price higher.

Technical analysis: Bitcoin price range bound close to $40,000

Bitcoin price is in a tight range close to the psychologically important level of $40,000. BTC price is $40,132, at the time of writing. The asset yielded nearly 3% weekly losses for holders. The ETF approval likely catalyzed a correction in Bitcoin, ushering a decline in BTC from its 2024 peak of $48,989.

Bitcoin price is at risk of dipping to its support zone between $38,304 and $38,957 where 512,030 wallet addresses acquired 258,320 BTC.

BTC/USDT 1-day chart

If Bitcoin price sees a daily candlestick close above resistance at $41,466, it is likely to invalidate the bearish thesis and send BTC towards its next key resistance at $43,074.

Cryptocurrency prices FAQs

How do new token launches or listings affect cryptocurrency prices?

Token launches like Arbitrum’s ARB airdrop and Optimism OP influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

How do hacks affect cryptocurrency prices?

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

How do macroeconomic releases and events affect cryptocurrency prices?

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence risk assets like Bitcoin, mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

How do major crypto upgrades like halvings, hard forks affect cryptocurrency prices?

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs. This has been observed in Bitcoin and Litecoin.