XRP Price Prediction: Crypto Whales’ $177 Million Buy Signals Rally

XRP price has struggled to maintain a stable rise above the 50% Fibonacci retracement line at $0.60. The altcoin has repeatedly failed to break above this level, now finding itself stuck beneath the 38.2% Fib line at $0.55.

Although the altcoin is showing signs of a potential recovery, the market remains cautious. Recent activity by large investors, particularly crypto whale addresses, has sparked optimism for an upward move in the XRP price.

Crypto Whales to the Rescue

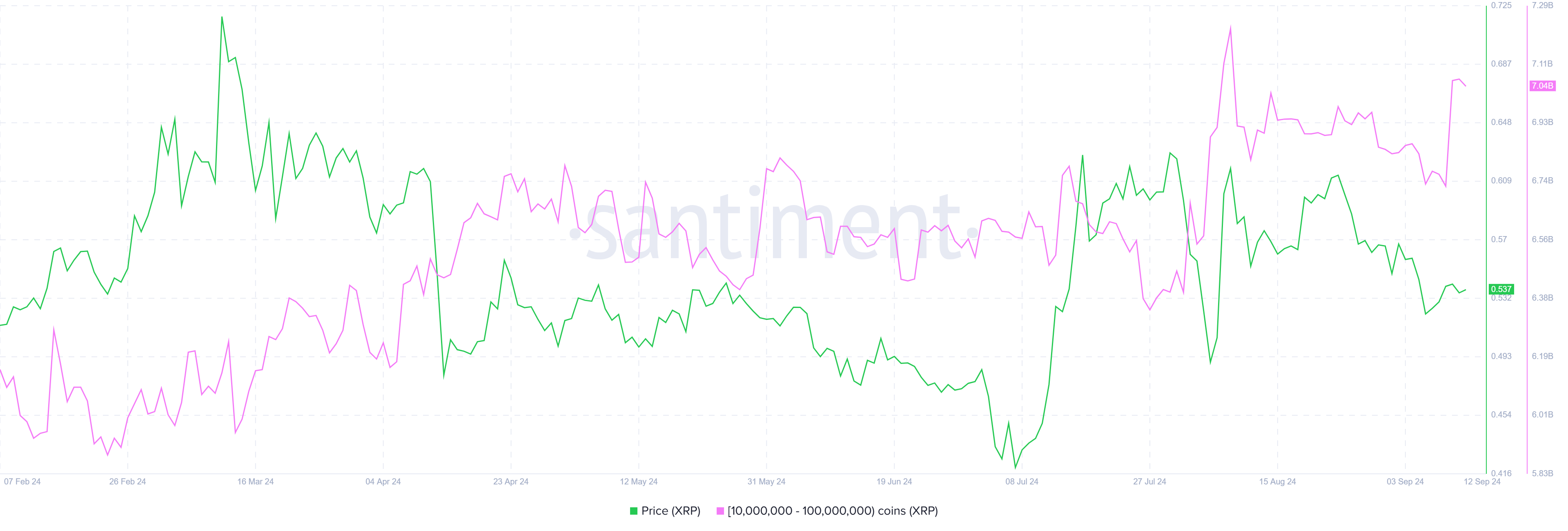

Crypto whale addresses, which hold between 10 million and 100 million XRP, have played a significant role in XRP’s price movements. Over the past week, these addresses have accumulated more than 330 million XRP, amounting to $177 million. This massive accumulation suggests that the crypto whales anticipate a price rise in the near term.

The influence of these crypto whale addresses on XRP’s price cannot be underestimated. Large accumulations tend to signal positive market sentiment, often leading to price rallies. Thus, leveraging this accumulation, XRP could experience renewed momentum, potentially breaking the resistance levels it has struggled with recently.

Read more: XRP ETF Explained: What It Is and How It Works

XRP Whale Accumulation. Source: Santiment

XRP Whale Accumulation. Source: Santiment

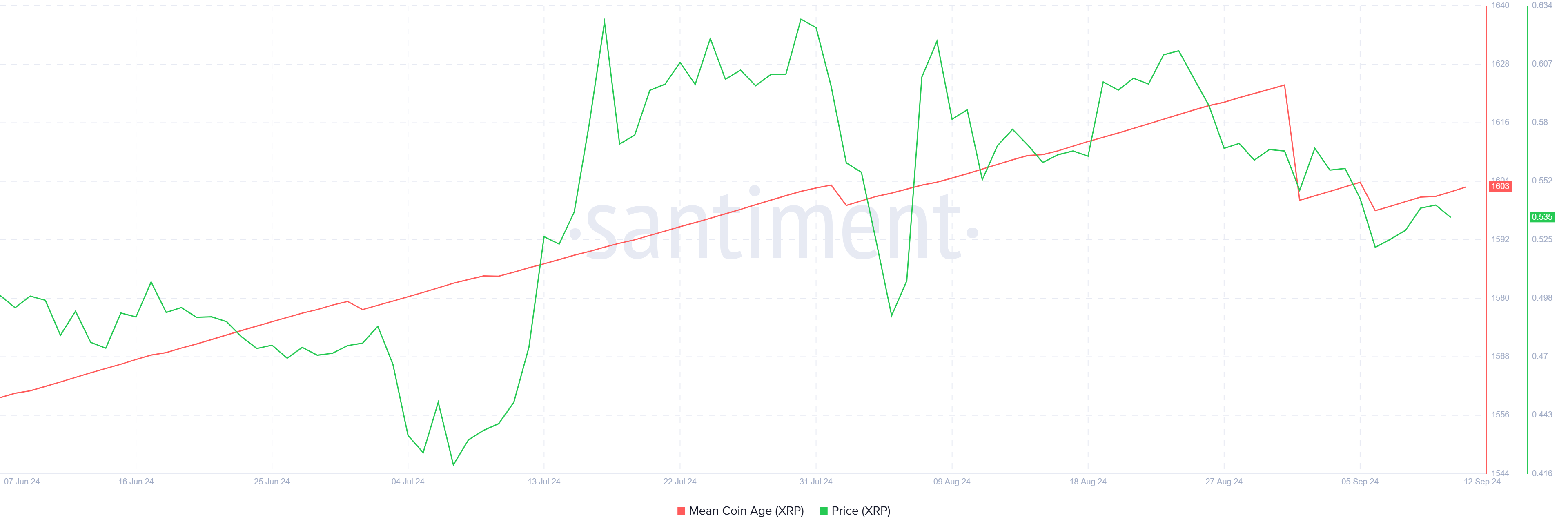

On the macro front, the Mean Coin Age (MCA) indicator provides insights into the behavior of XRP holders. Toward the end of August and the beginning of September, the MCA noted a downtick, indicating increased movement of XRP within addresses, a bearish signal. However, the last week has seen the MCA trend upward, suggesting that long-term holders are once again opting to HODL rather than move their XRP.

This shift in sentiment signals a return of confidence among investors, as the reduced movement of XRP within addresses indicates stability. The uptick in MCA suggests that the bullish momentum in XRP could be sustained, with HODLing behavior likely supporting price growth in the near future.

XRP MCA. Source: Santiment

XRP MCA. Source: Santiment

XRP Price Prediction: Minding Resistances

XRP has noted a modest 3% rise over the past five days, a positive yet underwhelming sign of recovery. The drop below the 38.2% Fibonacci retracement line at $0.55 could take time to overcome. This level has acted as resistance, keeping XRP below $0.55, similar to its consolidation phase from mid-April to mid-June.

However, the crypto whale accumulation and the uptick in MCA signal the potential for XRP to breach the $0.55 barrier. If this level flips into support, XRP could recover its early September losses, allowing the cryptocurrency to regain upward momentum and continue its ascent.

Read more: Ripple (XRP) Price Prediction 2024/2025/2030

XRP Price Analysis. Source: TradingView

XRP Price Analysis. Source: TradingView

On the flip side, a failed breach of $0.55 would likely lead to XRP hovering between this level and the 23.6% Fib line at $0.49. This lower level, known as the bear market support floor, could act as a buffer, preventing further declines. However, consolidation here would invalidate the bullish outlook, keeping XRP’s price trapped for the foreseeable future.