ETFs, Whales, and Long-Term Holders Buy Bitcoin: Is the Bottom In?

After weeks of turbulence, signs are emerging that Bitcoin might be approaching a crucial turning point.

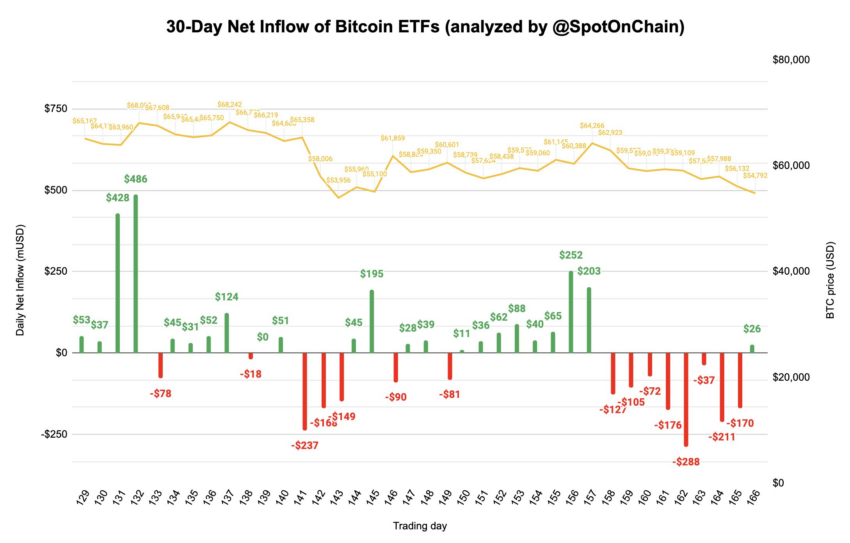

US-listed Bitcoin exchange-traded funds (ETFs) posted net inflows of $28.7 million on September 9, marking a reversal after a prolonged outflow streak that saw $1.2 billion leave the market. This is the first net inflow since late August, coinciding with Bitcoin’s price rebound of 6%.

Bitcoin Buy Orders Get Filled, Signaling Local Bottom

The renewed inflows suggest growing interest among professional investors. While ETFs have suffered since August 27, the return of inflows could be an early indicator of shifting sentiment. September is traditionally bearish for Bitcoin, but this uptick in ETF demand provides a potential counterpoint.

“The net flow turned positive after 8 days of heavy outflows. Yesterday’s only outflows belonged to Grayscale (GBTC) and BlackRock (IBIT), the 2 largest US Bitcoin ETFs,” analysts at SpotOnChain said.

Bitcoin ETFs Inflows. Source: SpotOnChain

Bitcoin ETFs Inflows. Source: SpotOnChain

Meanwhile, a prominent whale on Bitfinex has been aggressively buying Bitcoin, accumulating around 450 BTC daily. This move comes as Bitcoin’s price hovers below $60,000, a level at which the whale appears confident in the asset’s long-term potential.

Accumulation patterns on Bitfinex, where these trades are taking place, show a clear dominance in the order book, signaling a strong belief in Bitcoin’s resilience.

Bitfinex Margin Long Positions. Source: Coinglass

Bitfinex Margin Long Positions. Source: Coinglass

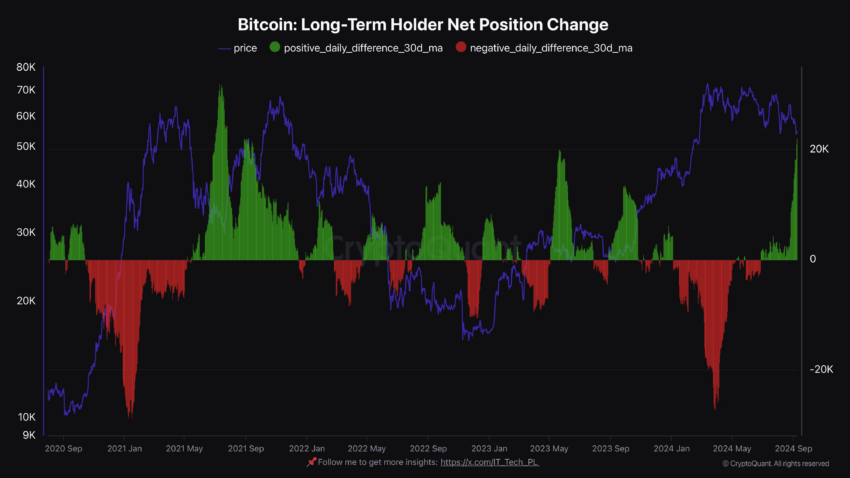

At the same time, long-term holders (LTH) are increasing their Bitcoin positions. Data reveals a net increase in LTH positions, historically a bullish signal. When long-term investors accumulate, it often indicates confidence in the cryptocurrency’s future growth potential.

The stability provided by LTH accumulation may help anchor Bitcoin’s price and set the stage for a rebound.

Bitcoin Long-Term Holders Positions. Source: CryptoQuant

Bitcoin Long-Term Holders Positions. Source: CryptoQuant

Despite the rising buying pressure, analysts at Bernstein and even seasoned trader Peter Brandt remain cautious. Brandt sees a 65% chance that Bitcoin could drop below $40,000 before reaching any new highs. Brandt’s technical analysis places probabilities of Bitcoin hitting $80,000 at 20% and surging to $130,000 by September 2025 at 15%.

Meanwhile, Bernstein analyst Gautam Chhugani said that the election outcome, whether Donald Trump or Kamala Harris prevails, could significantly impact Bitcoin’s future course.

“We expect the delta between the two political outcomes to be wide. We expect Bitcoin to claim back new highs, in case of a Trump win and by Q4, we expect Bitcoin to reach close to $80,000-$90,000 range. However, if Harris wins, we expect Bitcoin to break the current floor around $50,000 and test the $30,000-$40,000 range,” Chhugani explained.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

As ETFs, whales, and LTHs continue to accumulate, the market watches closely for any signs that Bitcoin may be near its bottom. For now, uncertainty lingers, but the growing buying pressure suggests optimism is brewing.