Litecoin price is set for a decline after it fails to close above resistance barrier

- Litecoin price faces rejection by the 50-day EMA around $66, impending decline ahead.

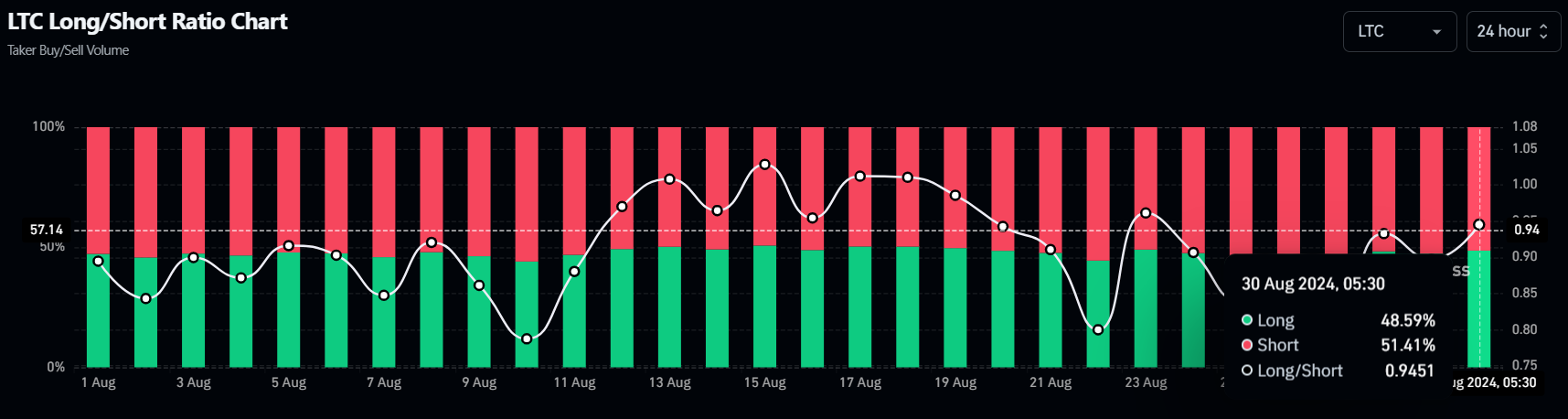

- On-chain data paints a bearish picture as LTC's long-to-short ratio is below one.

- A daily candlestick close above $68.80 would invalidate the bearish thesis.

Litecoin (LTC) price failed to close above the 50-day Exponential Moving Average (EMA) around $66. At the time of writing, it trades slightly down by 1% at $61.96 on Friday. Moreover, LTC's long-to-short ratio paints a bearish picture as it stands below one.

Litecoin price is poised for a decline as it fails to close above 50-EMA

Litecoin price trades inside a falling wedge pattern formed by connecting multiple high and low levels with a trendline from mid-April. LTC faces resistance around the 50-day EMA at $66.23, which roughly coincides with the upper trendline of the falling wedge pattern. As of Friday, it trades slightly below 1% at $61.96.

If the 50-day EMA near $66.23 holds as resistance, LTC could decline 9% to retest its weekly support at $56.00.

The Relative Strength Index (RSI) and the Awesome Oscillator (AO) on the daily chart trade below their neutral levels of 50 and zero, respectively. Both indicators suggest weak momentum and an impending bearish trend on the horizon.

LTC/USDT daily chart

According to Coinglass's data, LTC's long-to-short ratio stands at 0.94. This ratio reflects bearish sentiment in the market, as the number below one suggests that more traders anticipate the price of the asset to decline, bolstering Litecoin's bearish outlook.

LTC long-to-short ratio

Despite the bearish outlook shown by technical analysis and on-chain data, if the Litecoin price produces a daily candlestick close above $68.80, it would invalidate the bearish thesis because it would post a higher high on the daily time frame. This could see Litecoin's price rise by 11% to revisit the July 29 high of $76.78.