Immutable X price volatility to increase with $2.19 million worth of IMX tokens flooding markets daily

- Immutable X has been a strong performer in the gaming scene since December.

- 1.20 million IMX tokens worth $2.19 million will flood markets daily in a linear unlocks.

- Despite the bearish nature of unlocks, the gaming token could surge with tokens up for sale.

- A break and close below the $1.50 level would invalidate the bullish thesis.

Immutable X (IMX) price did well across December, with the gaming and metaverse sectors standing out while contending ecosystems struggled. While the project eventually found inflection with holders cashing in, things may change soon as the network has a linear unlocks event that will line up for the next month.

Also Read: ImmutableX Price Forecast: A potential 15% rally could be killed by spot Bitcoin ETF approval

Immutable X linear unlocks to start on Thursday

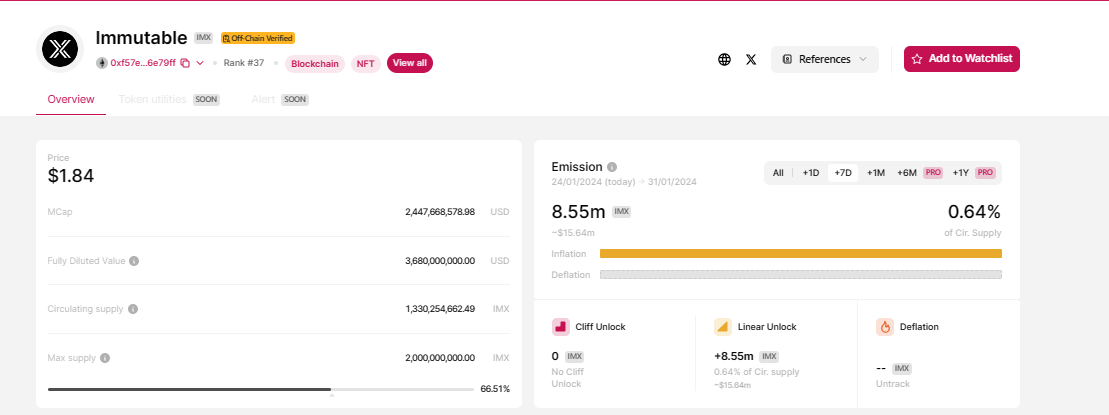

Immutable X (IMX) price volatility could increase soon, with the network preparing for a linear unlocks beginning Thursday, January 25. The event will go on for the next 28 days, with 1.22 million IMX tokens worth $2.19 million poured into the market daily during this time.

IMX Token Unlocks

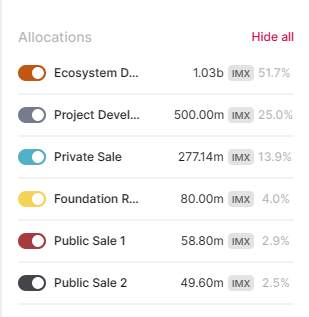

While some of the allocations will go towards ecosystem and project development and others to the foundation reserve, a significant amount will be channeled towards public and private sales, which could catalyze a value surge.

IMX Token Allocations

Meanwhile, the Immutable X price action has consolidated into a falling wedge pattern, which is a bullish technical formation that occurs when an asset’s price oscillates between two downward sloping converging trendlines and signals a reversal of a downtrend.

Immutable X price outlook with a falling wedge pattern in play

With a falling wedge pattern in action, the gaming token’s market value could be due for a strong move north soon with break above the upper boundary of the chart likely to happen soon. This will be confirmed by a break and close above the $2.00 psychological level.

In a highly bullish case, the gains could see Immutable X price extend the gains past the $2.50 level to reclaim the $2.59 range high. Such a move would constitute a 40% climb above current levels.

IMX/USDT 1-day chart

In the meantime, the odds continue to favor the downside, with both the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) indicator below their respective mean lines. With this, Immutable X price consolidation within the falling wedge pattern could continue for a few days before the forecasted bold move north happens.

If the bears have their way, however, Immutable X price could break below the lower boundary of the channel, potentially tagging the 100-day SMA at $1.53. In the dire case, IMX could extend the fall to the $1.50 level, below which the bullish thesis would be invalidated.