Crypto Today: Ethereum gas fees hit five-year low, Bitcoin rallies above $60,000, XRP breaks past $0.60

- Ethereum gas fees hit a five-year low, meaning less Ether is burned and the supply is on the rise.

- Bitcoin and XRP are back above key support levels at $60,000 and $0.60, respectively.

- Japanese public company Metaplanet bought over $3.4 million worth of Bitcoin.

Bitcoin, Ethereum, XRP updates

- Ethereum transaction fees hit a five-year low recently, lowering the burn of Ether, per Kaiko research report. The validator that processes transactions receives a tip of gas fees from all transactions in the block. The base fees are then burned and permanently removed from circulation to help reduce the supply of Ether.

- With gas fees dipping to a low, less and less Ether is being burned, leading to an increase in the altcoin’s supply since April. Despite demand drivers like institutional capital inflow to Exchange Traded Funds (ETFs), rising supply has the potential to dampen ETH’s price in the near future.

- Bitcoin and XRP prices broke sticky resistance levels at $60,000 and $0.60, respectively. The two cryptocurrencies rallied on Tuesday amidst a market-wide recovery supported by an increased appetite for risk. The top 30 cryptocurrencies by market capitalization yielded gains in the past 24 hours, according to CoinGecko data.

Chart of the day

NEAR/USDT daily chart

NEAR is in a downward trend since the March 15 top of $9.010. The token trades at $4.113 at the time of writing, extending gains by nearly 3% on Tuesday. If momentum holds, NEAR could rally another 30% towards the Fair Value Gap (FVG) extending between $5.373 and $5.395.

NEAR faces resistance at $4.279, which acted as a key support level for the token between February and August and the FVG between $4.450 and $4.572.

The Relative Strength Index (RSI) reads 43.80, climbing towards the neutral level at 50.

NEAR could sweep liquidity in the imbalance zone between $3.430 and $3.655, as seen in the NEAR/USDT chart above.

Market updates

- Japanese public firm Metaplanet added over $3.4 million worth of Bitcoin to their holdings per an announcement on Tuesday.

*Metaplanet purchases additional 57.27 $BTC* pic.twitter.com/jvk3heTCOA

— Metaplanet Inc. (@Metaplanet_JP) August 20, 2024

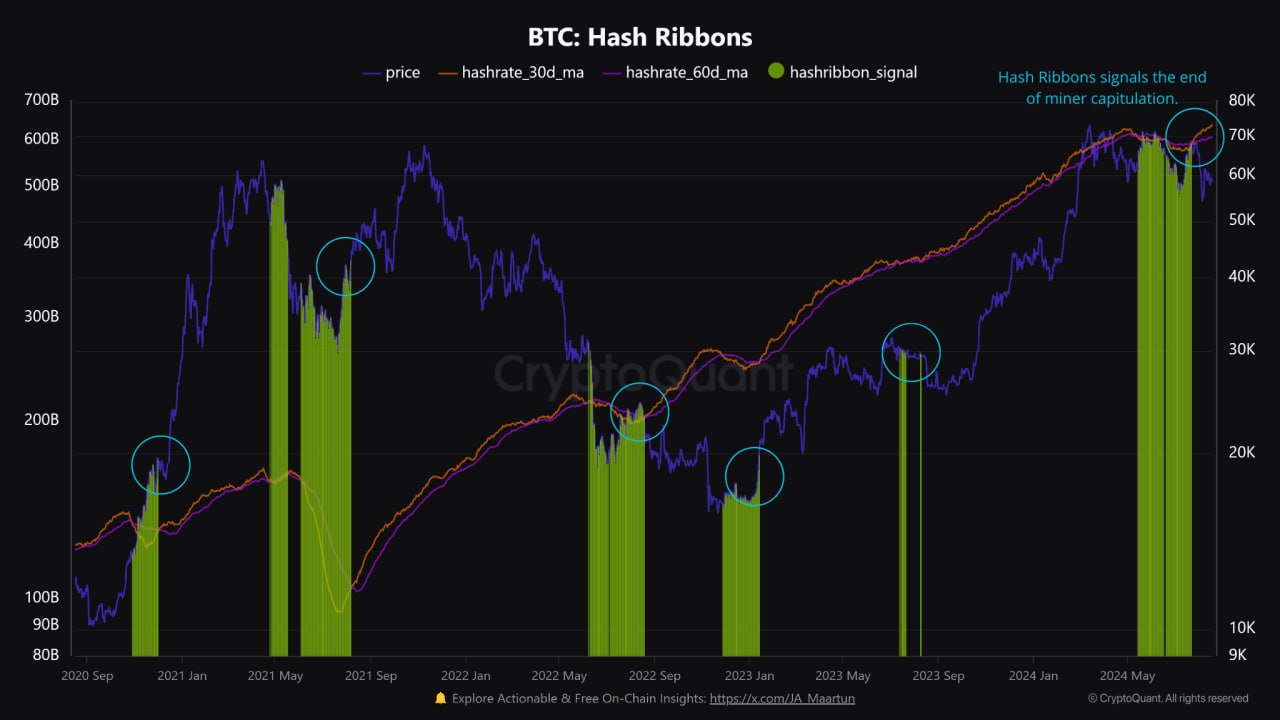

- CryptoQuant data shows that for the first time since the halving, the block reward for miners was reduced to 3,125 BTC. This marks the end of miner capitulation. It often precedes higher prices as the selling pressure on the asset reduces in the weeks following capitulation by miners.

Bitcoin Hash Ribbons

- IntoTheBlock data shows on-chain activity in AAVE picked up pace, with the number of active addresses doubling in three months.

On-chain activity for $Aave has surged this month, with the number of active addresses doubling compared to three months ago. pic.twitter.com/uox73kQmT6

— IntoTheBlock (@intotheblock) August 20, 2024

Industry updates

- Tether Treasury mints 1 billion USD Tether on Tron early on Tuesday. The treasury has minted a total of 33 billion tokens in the past year, of which 19 billion was minted on Tron and 14 billion on Ethereum, per Lookonchain data.

- Julio Moreno, head of research at CryptoQuant, says total stablecoin market capitalization has hit a record high at $165 billion. This implies there is higher liquidity in the crypto market.

Everyone talking about global M2 breaking out, but I'm looking at total stablecoin market capitalization:

— Julio Moreno (@jjcmoreno) August 19, 2024

Fresh record high above $165 Billion.

This implies higher liquidity in the crypto markets. pic.twitter.com/DExOJBrR2Y

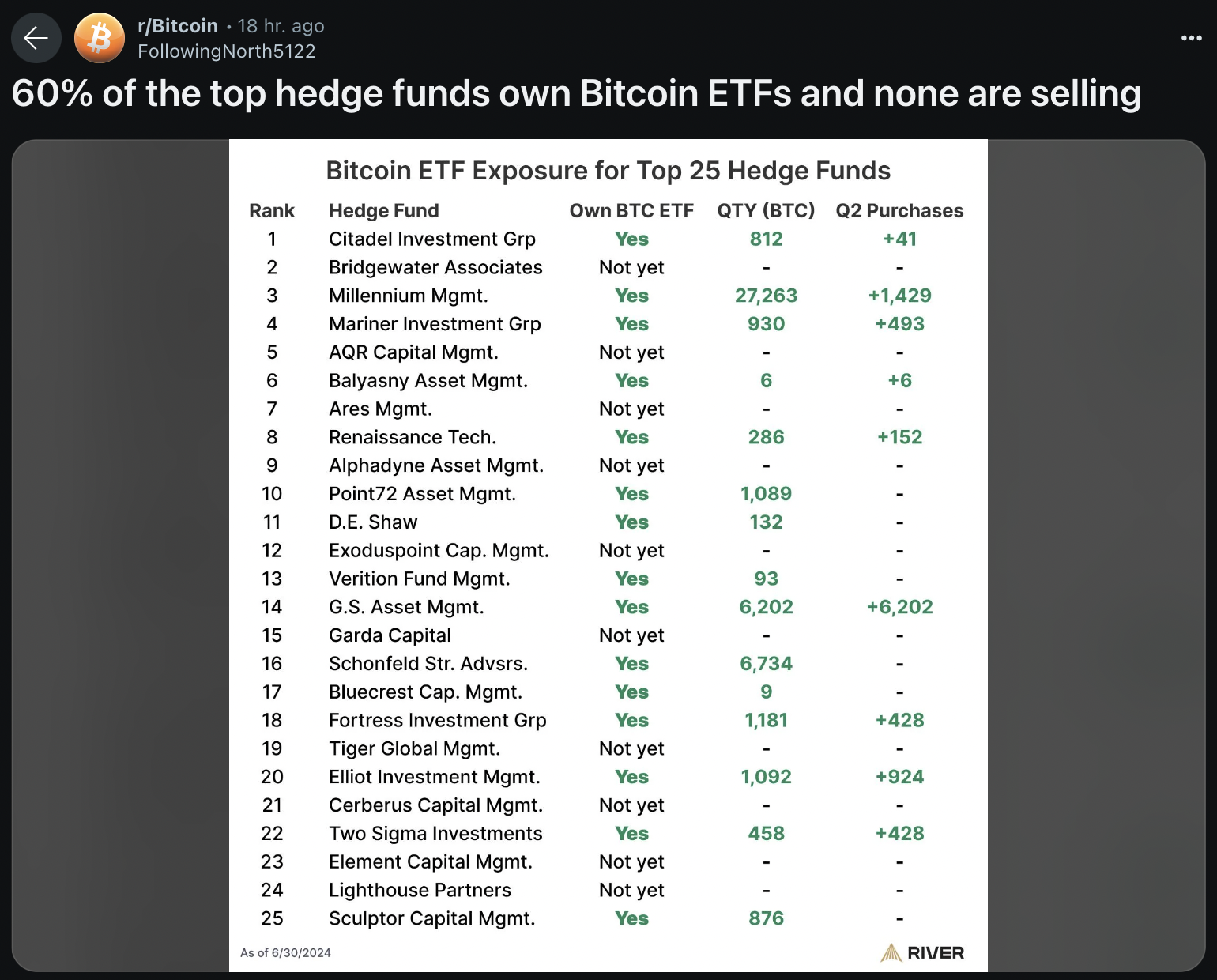

- A post in the r/Bitcoin subreddit listed top hedge funds with exposure to Bitcoin, supporting the thesis of strong institutional demand for the asset.

Hedge funds with Bitcoin exposure

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.