BitGo’s New WBTC Custody Plan Draws Scrutiny Over Justin Sun’s Role

BitGo, a leading crypto custodial platform, will shift its Wrapped Bitcoin (WBTC) to a new multi-jurisdictional and multi-institutional custody model. This decision has raised concerns in the crypto community, particularly because of the involvement of Justin Sun, founder of the TRON blockchain.

On August 9, BitGo revealed a 60-day transition period. The company plans to expand its custodial locations to include Hong Kong and Singapore.

Sun’s Role in WBTC Custody Sparks Concerns

In response to this development, prominent DeFi platform MakerDAO has begun assessing the potential risks associated with BitGo’s new WBTC custody strategy. The MakerDAO community is considering a proposal that could effectively reduce all active WBTC debts on the network to zero.

The proposal highlights fears that this new move might grant Sun significant influence over WBTC. Additionally, it references past issues with Sun’s interactions with other crypto projects, such as TUSD and Huobi’s USDT reserves, which were plagued by operational and transparency problems.

The broader crypto community has echoed these concerns. Some stakeholders worried that Sun could exploit his influence to mint excessive WBTC or manipulate Proof-of-Reserve data.

“BitGo partnering with Justin Sun for WBTC custody is up there with the most insane business decision I’ve ever seen,” Bitcoin Magazine writer Alex Bergeron stated.

Read more: What Is Bitcoin? A Guide to the Original Cryptocurrency

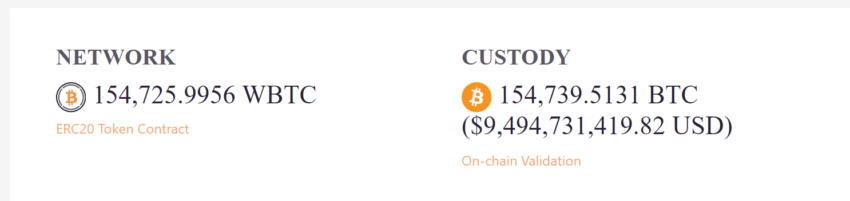

WBTC Balance on Ethereum. Source: WBTC.Network

WBTC Balance on Ethereum. Source: WBTC.Network

Meanwhile, BitGo CEO Mike Belshe has countered these concerns. He asserted that the platform’s security architecture prevents any form of manipulation. He also emphasized that BitGo will not authorize any minting without a corresponding BTC deposit.

“We recognize the community wants to know about JS involvement in anything, even though he doesn’t have the ability to move funds. That’s why we made sure to be very clear about his name,” Belshe stated.

The BitGO CEO further urged the community to conduct thorough due diligence before drawing conclusions. According to him, while Sun is involved in the project, he lacks the authority to move funds. Belshe also stated that the WBTC website will remain operational, providing near real-time proof of reserves.

Read more: Wrapped Bitcoin (WBTC) Price Prediction 2024, 2025, 2026, 2027, 2028

Sun, for his part, has clarified that his role with WBTC is purely strategic. He assured that he does not control the private keys to the WBTC reserves and cannot access the BTC reserves as rumored. Sun emphasized that his involvement aims to bolster decentralization, security protocols, and safety, reinforcing the critical role of the digital asset in the DeFi ecosystem.

“In simple terms, Bitglobal and Bitgo will not sign any unaudited transactions. The keys are still safeguarded using the same Bitgo cold wallet technology and offline keys, with backups in multiple countries and regions,” Sun added.