Celestia (TIA) Short Traders Dominate Futures Market as Altcoin Lingers in Bear Territory

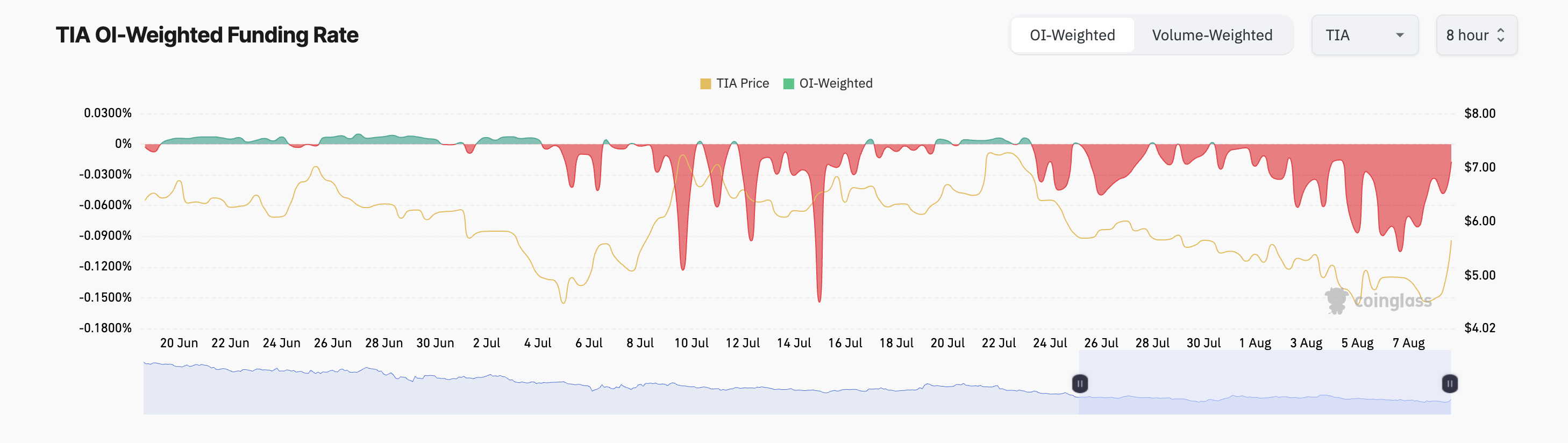

The Celestia (TIA) futures market has seen an upswing in demand for short positions in the past few days, as evidenced by the negative funding rate across cryptocurrency exchanges.

This has occurred despite the token’s rally to a seven-day high.

Celestia Traders Bet Against Price Rally

At press time, TIA is trading at $5.58. Early Friday, the altcoin reached a seven-day high of $5.63 before experiencing a slight correction.

Over the past 24 hours, TIA’s value has surged by 20%, positioning it as the second-highest gainer among the top 100 assets by market cap during this period. This uptick comes after Monday’s general market decline, which caused the altcoin’s value to plummet to 30-day lows.

Despite the recent rally, TIA’s futures traders remain unfazed, continuing to open short positions. A short position is a strategy where an investor bets on the price of an asset to drop. This sentiment is reflected by negative funding rates across cryptocurrency exchanges.

Celestia Funding Rate. Source: Coinglass

Celestia Funding Rate. Source: Coinglass

Funding rates in perpetual futures contracts are used to keep the contract price aligned with the spot price. Coinglass shows that TIA’s funding rates have remained negative since July 23, currently sitting at -0.017%.

When an asset’s aggregated funding rate across cryptocurrency exchanges is negative, it indicates that more traders are betting on a price decline than those anticipating a rally. This bearish signal shows that traders expect prices to fall, as they are willing to pay to keep their short positions open.

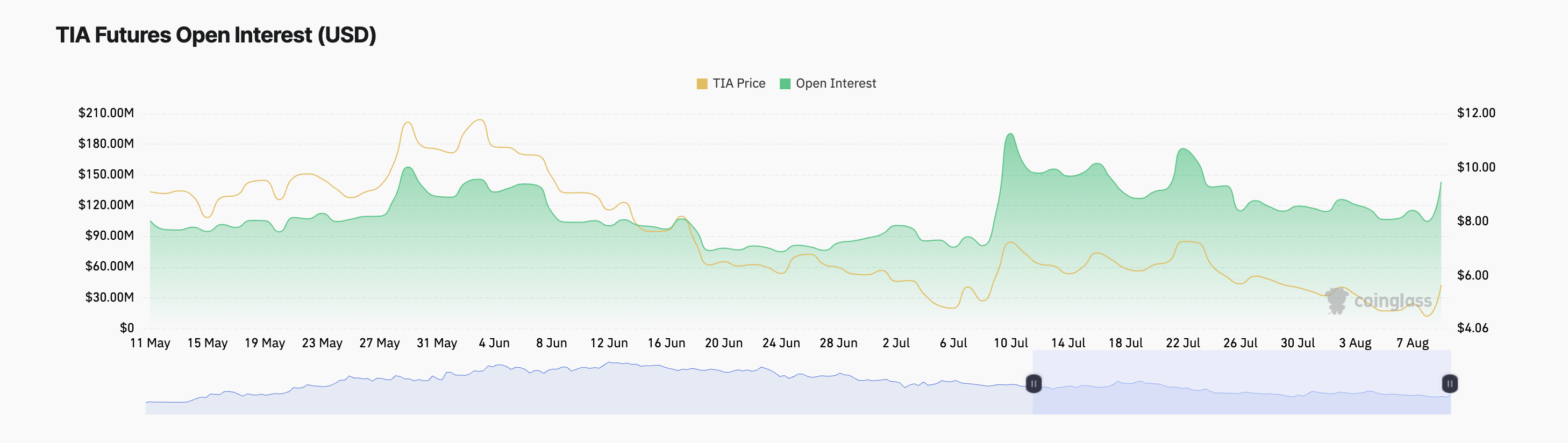

While TIA records negative funding rates, its futures open interest has spiked. So far this week, it has risen by 35%. At press time, the token’s futures open interest is $143 million.

Read more: What are Perpetual Futures Contracts in Cryptocurrency?

Celestia Futures Open Interest. Source: Coinglass

Celestia Futures Open Interest. Source: Coinglass

Futures open interest refers to the total number of outstanding futures contracts that have not yet been settled. A spike in open interest typically signals that more traders are entering new positions, which is generally seen as a bullish indicator.

However, TIA presents a different scenario. The rising open interest, combined with negative funding rates, suggests that new traders are predominantly taking short positions, while existing traders are doubling down on their bets against the market.

TIA Price Prediction: Buyers Stay Away From Accumulating

TIA’s Relative Strength Index (RSI) confirms the altcoin’s low demand, with the key momentum indicator currently at 49.03, just below the 50-neutral line. This suggests that selling pressure is outweighing buying activity.

RSI measures an asset’s market conditions, ranging from 0 to 100. Values above 70 indicate an overbought asset, which may be due for a decline, while values below 30 suggest an oversold asset that could see a rally.

With an RSI of 49.03, TIA shows weak buying activity compared to sell-offs. If this trend continues, the altcoin’s price could drop to $3.90.

Read more: Which Are the Best Altcoins To Invest in August 2024?

Celestia Daily Analysis. Source: TradingView

Celestia Daily Analysis. Source: TradingView

However, if market sentiment shifts from bearish to bullish and the funding rate turns positive, its value may climb to $7.96.