Crypto market hit by correction, Ethereum, Solana, Dogecoin slip under key support

- Crypto market cap suffered a decline with the correction on Friday, Ethereum, Solana, Dogecoin struggled at key support levels.

- Ethereum, Solana and Dogecoin noted between 2% and 5% drop in their prices on the day.

- Open interest dropped in top cryptocurrencies after several long positions got liquidated in the recent correction.

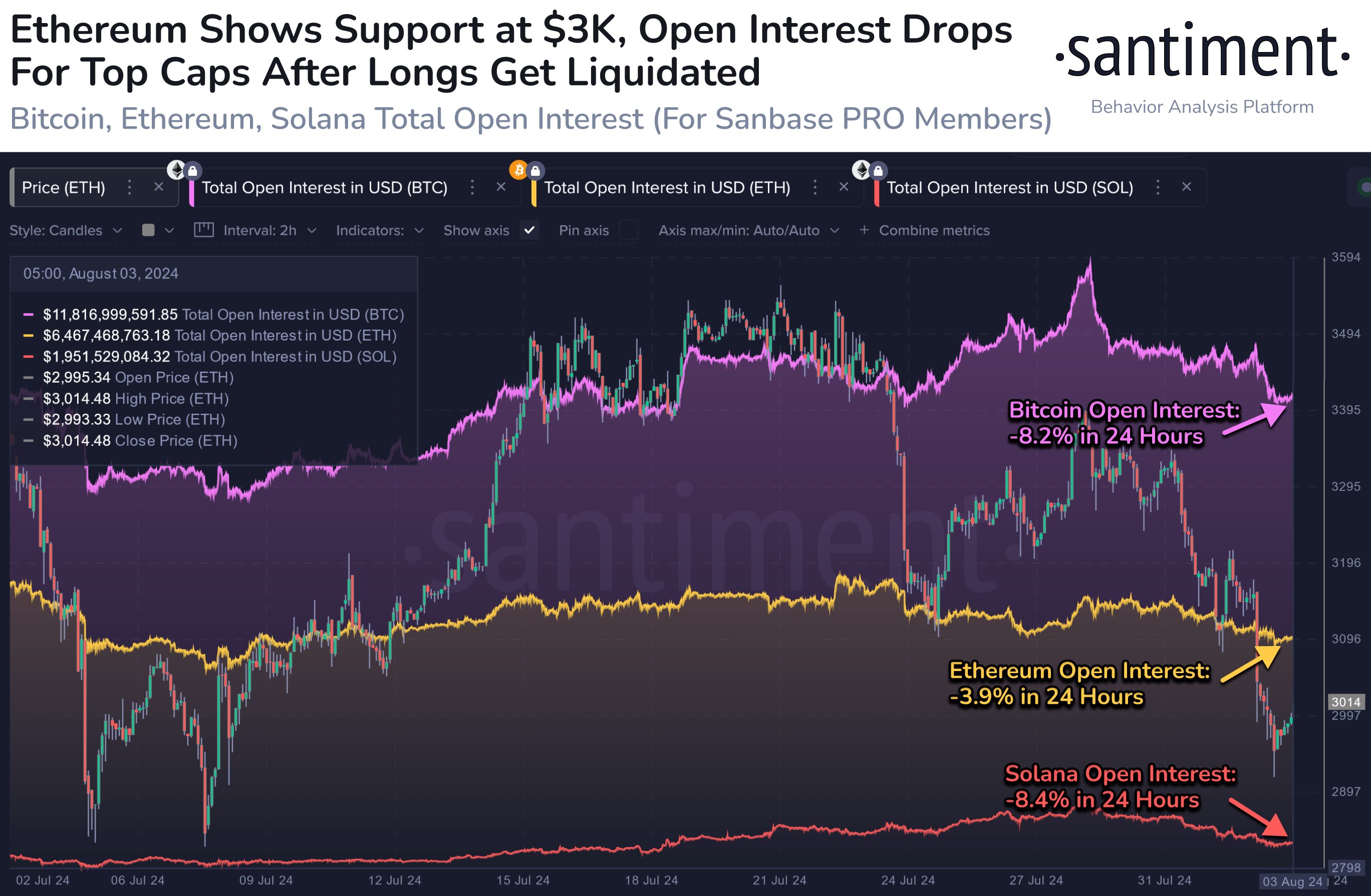

Crypto intelligence tracker Santiment data shows that the open interest in top cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) declined in the recent market correction. Ethereum, Solana and Dogecoin (DOGE) extend losses, early on Saturday.

A decline in open interest is typically a sign that traders are losing interest in an asset.

Ether, Solana and Dogecoin slip lower

Santiment data shows that Ether and Solana noted a drop in Open Interest (OI) from derivatives traders after several long positions were liquidated in response to the recent market correction. The open interest in BTC, ETH and SOL has dipped, as seen in the chart below:

Open Interest in Bitcoin, Ethereum, Solana

Ethereum and Solana failed to sustain above their key support levels at $3,000 and $150 early on Saturday. ETH, SOL and DOGE, three assets from the top 10 cryptocurrencies ranked by market cap have yet to start their recovery from the recent market correction, on Binance.

Analysts at Santiment fueled hopes of a “weekend relief rally” after the decline in asset prices. However, at the time of writing, Ether trades at $2,928, Solana trades at $145.27 and Dogecoin is exchanging hands at $0.1087.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.