Ethereum Dencun upgrade could go live on mainnet as early as March 2024

- Ethereum developers discussed the Dencun upgrade’s activation on the Goerli testnet in their All Core Developers Execution Call.

- Developers confirmed the timeline for the Dencun upgrade’s rollout on Sepolia and Holesky testnets.

- Ethereum Dencun upgrade is likely to see its mainnet release in March, despite a lack of Layer 2 readiness.

Ethereum core developers are committed to the Dencun upgrade’s testnet timelines. Despite the issues that arose on the Goerli testnet, the timeline has remained unchanged for Sepolia and Holesky testnet release of the upgrade.

Core developers picked 30 January for Sepolia and 7 February for Holesky rollout of the Dencun upgrade.

Also read: Lido DAO Community Staking Module to make mainnet debut in the second half of 2024

Ethereum developers set fixed timelines for Dencun upgrade

Ethereum developers stayed committed to the Dencun testnet timeline, according to the All Core Developers Execution call number 179. The timeline for testing remains unchanged and Galaxy Digital’s Christine Kim believes the likelihood of mainnet activation for the upgrade by the end of March is now 60%.

Layer 2 chains are not currently ready for the upgrade, however, developers are moving ahead with the testnet releases in the next three weeks. It is likely that Dencun goes live on mainnet as early as February if the upgrades on Sepolia and Holesky do not encounter issues.

Developers are likely to run additional tests and Layer 2 chains may want to perform client releases on Sepolia and Holesky before the mainnet upgrade. If this occurs, then the likelihood of mainnet release in February is limited to 30%.

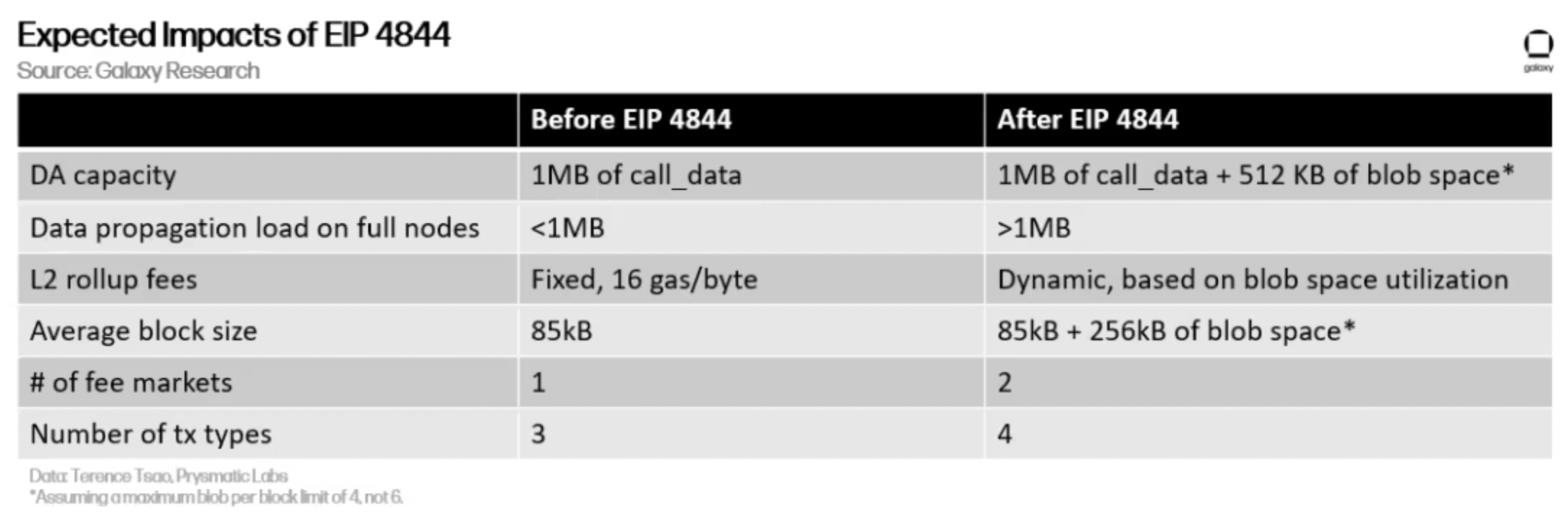

The implementation of EIP-4844 is expected to boost the features of Ethereum and drive adoption of the chain.

Expected Impacts of EIP 4844. Source: Galaxy Research

If major bugs are discovered in either of the two testnets, Dencun’s arrival on the mainnet could be delayed from March to April.

Key dates to watch out for are January 30 and February 7, dates for the Sepolia and Holesky forks.