Bitcoin price could fall below $40,000 as altcoins might outperform in 2024, hedge fund analysts say

- Bitcoin price has crashed by over 12% in the past week to fall from $46,700 to $40,901 at the time of writing.

- Pantera Capital’s report suggests that the market is set to move into Phase 2, wherein altcoins will outperform BTC.

- Bitcoin’s dominance has hit a three-month low and is close to falling below commanding 50% of the crypto market.

Bitcoin price was expected to witness an extensive bull run following the approval of spot BTC ETFs, but, surprisingly, this did not happen. In fact, the biggest cryptocurrency in the world is trending downwards at the moment, lurking around monthly lows. This might give the altcoins a very crucial opening to take over BTC.

Bitcoin to lose in Phase 2

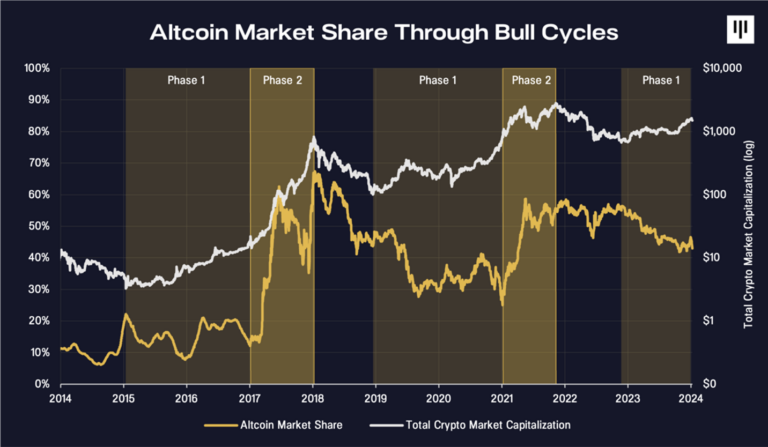

Pantera Capital, one of the largest and oldest crypto-focused hedge funds, released its report for what to expect in 2024, and it does not seem too good for Bitcoin. Bitcoin and altcoin rallies tend to move in cycles, with the first phase generally being the former riding the bullishness and the second phase witnessing altcoins taking over the market.

Bitcoin outperforms altcoins in Phase 1 and vice versa in Phase 2. This phenomenon was witnessed in the past during the 2015-2018 bull run and then again during the 2019 - 2022 bull run cycle. In both cases, the last year ended up being Phase 2, where alts outperformed BTC.

Bitcoin bull cycles

Coming to the macro bull cycle that began in 2023, Bitcoin has already witnessed a 3X growth while altcoins collectively witnessed only 2X. In the overall crypto market growth, BTC had a 67% share while alts had a 33% contribution.

Bitcoin and altcoin growth share

This might change going forward since BTC is surprisingly losing the bullish momentum rather rapidly despite the Bitcoin halving coming up soon. This event might be BTC’s last shot at a bull run. Otherwise, the altcoins will likely see more growth this year.

Bitcoin loses dominance, literally

Bitcoin's dominance in the crypto market is coming down along with the price. At the time of writing, Bitcoin price can be seen hovering around $41,000, with the potential of further decline still on the cards. The Relative Strength Index (RSI) is below the neutral line, and the cryptocurrency failed the bullish divergence as well.

BTC/USD 1-day chart

This resulted in Bitcoin’s dominance falling from over 54% to 50.9% at the moment. With the dominance being at a three-month low, the altcoins are already clearly taking over, commanding the other 50%. If this dominance falls below 50%, BTC might be on track to being surpassed by alts.

Bitcoin dominance

This could also result in the Bitcoin price falling through the $40,000 psychological support level and creating a new year-to-date low of around $35,000. When that happens, it is completely dependent on the response of the market to the halving event.