Optimism earns nearly $45 million in revenue, eyes double-digit gains

- Optimism, an Ethereum scaling solution, collected nearly $45 million in revenue per recent data.

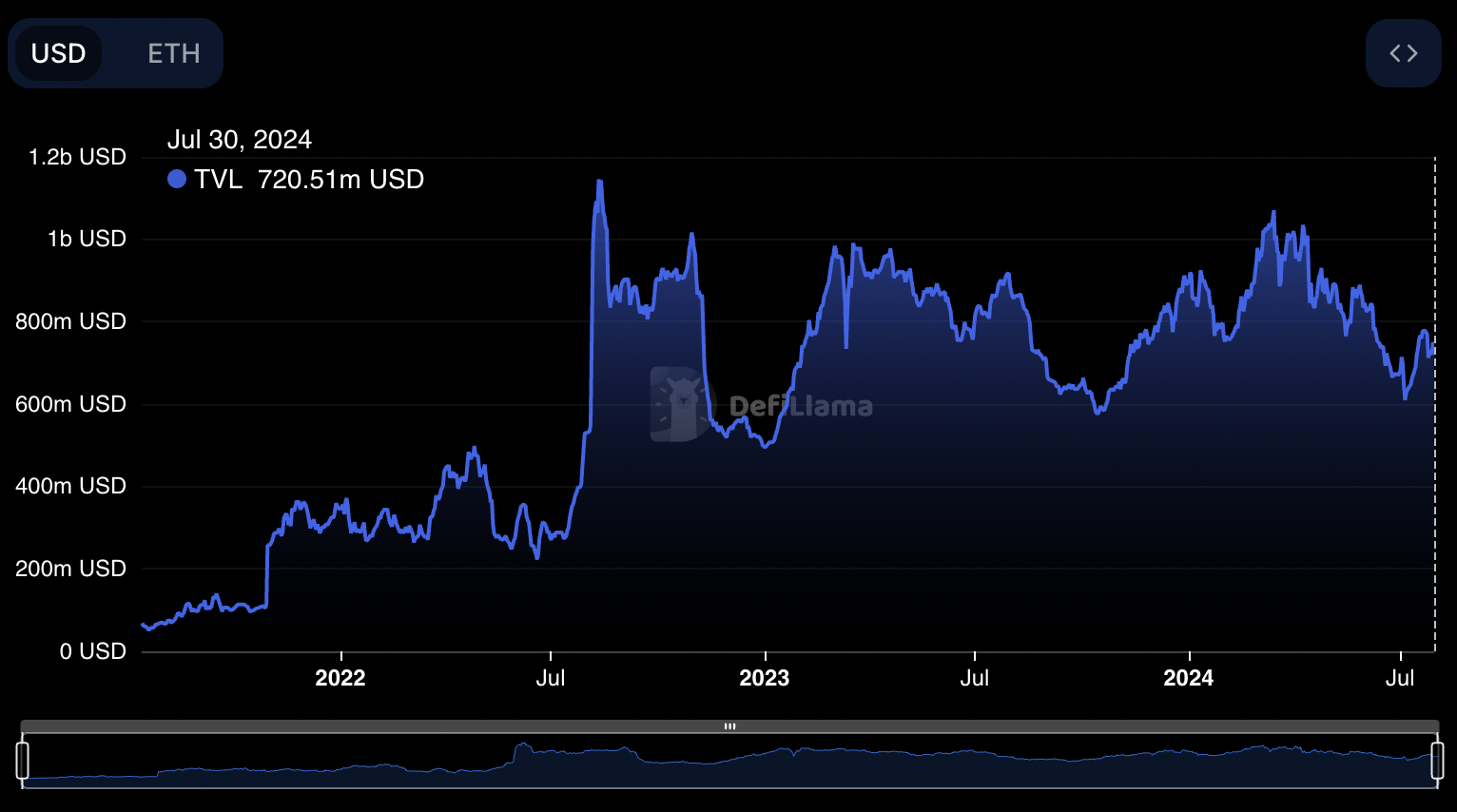

- Layer 2 chain surpassed $720 million in total value of crypto assets locked in the Optimism ecosystem.

- OP extends gains by nearly 2% on Tuesday, eyes $2 target.

Optimism (OP), an Ethereum scaling solution has generated 14,300 Ether worth nearly $45 million. The Optimism Collective has generated the revenue from sequencer fees or the fees generated when a transaction is executed on the chain.

DeFiLlama data shows the total value of assets locked in Optimism crossed $720.50 million early on Tuesday.

Optimism extends gains with recent developments

Optimism rallied nearly 2% early on Tuesday. The Layer 2 Ethereum scaling token trades at $1.638 at the time of writing. Ryan Wyatt of the Optimism collective noted that the chain has generated 14,300 Ether in revenue from transactions executed in its network.

There are a total of 26 Optimism Stack Chains sharing their revenue.

Optimism is the Superchain

— Ryan Wyatt (@Fwiz) July 30, 2024

To date, the Optimism Collective has generated 14.3K ETH in revenue from the sequencer fees that OP Stack chains in the Superchain!

There are 26 OP Stack Chains in the Superchain sharing revenue today, with more on the way pic.twitter.com/rdes8x1eoF

The Layer 2 chain has over $720 million in cryptocurrencies locked, meaning traders trust the chain and its transparency.

TVL of Optimism

OP could rally to its $2 target, extending gains by 22.6%. Optimism faces resistance at $1.815 and $1.822, a multi-month resistance level. OP could find support in the Fair Value Gap (FVG) between $1.532 and $1.581.

The Moving Average Convergence Divergence (MACD), a momentum indicator, shows that OP could retreat to a support level and collect liquidity before rallying toward its target.

OP/USDT daily chart

OP could find support at the $1.222 level, the July 5 low, in the event of a correction.