Crypto Today: Bitcoin could trigger $4 billion short liquidations on crossing $73,000, XRP rallies, ETH lags

- Bitcoin hovers around $70,000, nearly $4 billion in shorts on line if BTC crosses $73,000.

- Ethereum fails to make progress towards $3,500 resistance, Ripple extends gains by nearly 5% on Tuesday.

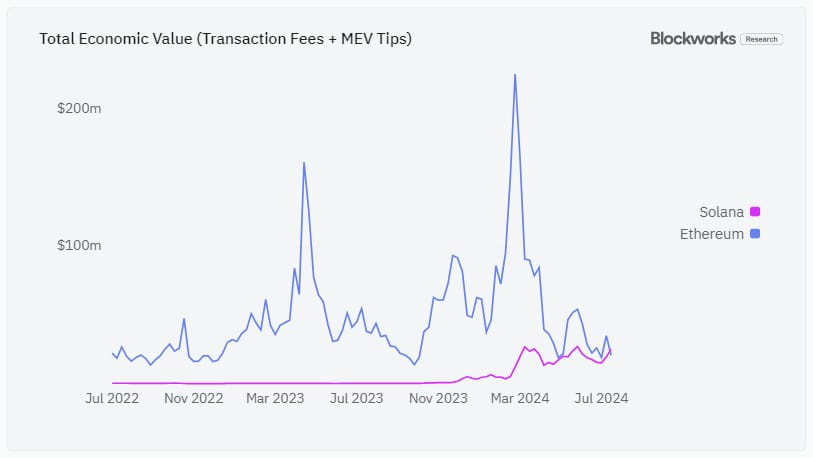

- Solana exceeds Ethereum in key metrics like total transaction fees, SOL hovers around $180.

Bitcoin, Ethereum and XRP updates

- Bitcoin trades close to $70,000 early on Tuesday. The sentiment among traders is bullish per IntoTheBlock data. Over 80% of wallet addresses holding Bitcoin are profitable at the current price level, raising concerns of “selling pressure” on the asset.

- Analyst Quinten Francois notes that nearly $4 billion in shorts are set to be liquidated if Bitcoin price crosses $73,000.

$4 Billion short liquidations if $BTC reaches $73,000

— Quinten | 048.eth (@QuintenFrancois) July 30, 2024

- Ethereum fails to rally to key resistance at $3,500, struggles at $3,100 on Tuesday.

- Ripple traders are awaiting a settlement/outcome in the US Securities & Exchange Commission (SEC) lawsuit.

- Ripple gears for showdown with SEC, final ruling in lawsuit likely this week

- XRP extends gains by nearly 5%, stays above key psychological resistance $0.60.

Chart of the day

DOGE/USDT daily chart

Dogecoin (DOGE) trades at $0.1294 at the time of writing. DOGE is likely to collect liquidity at the support at $0.1169. This marks a nearly 9% decline in the meme coin’s price.

DOGE could extend gains by nearly 24% and rally to its target at $0.1601, the 50% Fibonacci retracement level of the decline from the March 28 top of $0.2288 to the July 5 low of $0.0913.

Dogecoin faces resistance at the Fair Value Gaps (FVG) between $0.1358 to $0.1348; and $0.1583 to $0.1621.

Looking down, the meme coin could find support at the July 5 low of $0.0913.

Market updates

- Solana has surpassed Ethereum in total transaction fees on the weekly timeframe, per Blockworks data.

Total Economic Value per Blockworks data

- Binance Launchpool supports DeFi BNB assets in their Web3 wallet, per an official announcement on X. This means decentralized BNB assets would count towards user holdings for rewards.

#Binance Launchpool now supports DeFi BNB assets in the Web3 Wallet.

— Binance (@binance) July 30, 2024

Eligible decentralised BNB assets now count towards your BNB holdings for rewards.

More info here https://t.co/AKQBLcwExG pic.twitter.com/LtvTKPnU30

- Glassnode data shows that over 65.8% of the Bitcoin supply has been inactive for over one year, over half of the supply was “inactive” for over two years.

Industry updates

- One Trading, a regulated crypto exchange in Europe, received greenlight by the Dutch financial regulator. Authorities granted the exchange an Organised Trading Facility (OTF) License for their crypto derivatives platform.

We are delighted to announce @OneTradingEU has been granted an Organised Trading Facility (OTF) License by the Dutch financial regulator bringing crypto futures onshore in the EU.

— One Trading (@OneTradingEU) July 29, 2024

With this new licence, One Trading becomes the only perpetual futures trading venue in the EU. pic.twitter.com/hzkAVwmlce

- Ethereum celebrates its ninth anniversary on July 30, Vitalik Buterin tweeted on X:

Happy 9th birthday, Ethereum!

— vitalik.eth (@VitalikButerin) July 30, 2024

Looking forward to seeing what the next decade brings. pic.twitter.com/bXq56mIff7

- Compound Finance’s security advisor explains why two proposals were cancelled to resolve a situation, promoting a staking product.

Proposal 289 and 290 have both been cancelled in a resolution to the situation with Humpy and the rest of the Compound DAO.

— Michael Lewellen (@LewellenMichael) July 30, 2024

Compound contributors, led by @alphagrowth1 will pursue a staked COMP product in exchange for Humpy cancelling his proposal.https://t.co/8YwN7qKrS8 pic.twitter.com/WGrS3cufV1