FET Price May Struggle to Rise as Another 27% of Fetch.Ai’s Supply Sees Profits

Fetch.ai’s (FET) price is in the middle of a bullish momentum and, at the same time, at a high risk of noting a decline.

The surge in profits this week is triggering the potential of profit-taking, which could bring FET back down to $1.04.

Fetch.ai Investors Could Cash Out

FET price growth over the last few days resulted in a major rise in profits. According to the Global In/Out of the Money (GIOM) indicator, about 748 million FET worth more than $1.06 billion turned profitable this week.

This supply was bought between $1.22 and $1.37 and represents about 27% of the entire circulating supply of FET. Following the recent migration of OCEAN and AGIX, the supply increased, leading to a higher amount of FET-bearing profits.

Read More: How Will Artificial Intelligence (AI) Transform Crypto?

FET GIOM. Source: IntoTheBlock

FET GIOM. Source: IntoTheBlock

The merger of Fetch.ai, Ocean Protocol, and SingularityNET will result in the Artificial Superintelligence Alliance and its token, ASI. While the first phase completed the migration, the second phase, expected to take place before the end of July, will launch ASI.

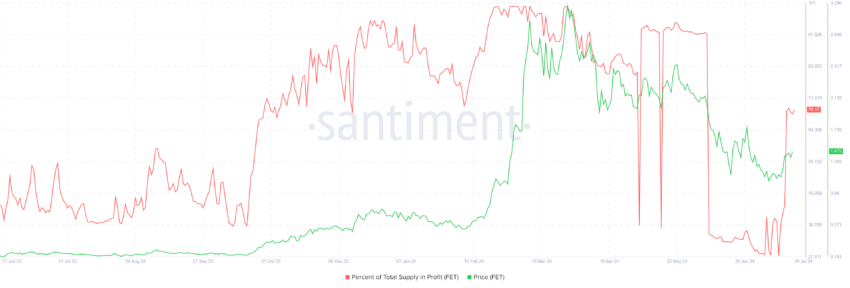

However, this also opens up the altcoin to the potential for profit-taking. Following this week’s increase in profit-bearing supply, about 70% of the total FET became profitable. This was a surge from 42%.

Generally, the market notes selling around the 80% mark, but considering this is the first time these investors have noted such high gains in a month, selling could start earlier. This could result in the FET price taking a hit.

FET Supply in Profit. Source: Santiment

FET Supply in Profit. Source: Santiment

FET Price Prediction: Preventing Decline

At the moment, the FET price is trading at $1.44, attempting to secure the $1.40 price into support. However, if the profit-taking is intense, the altcoin could lose this support level.

The consequent drawdown would pull FET to $1.20 or $1.04 again. Since $1.04 and $1.71 currently form the consolidation range for Fetch.ai’s native token, the altcoin may remain rangebound.

Read More: Top 9 Artificial Intelligence (AI) Cryptocurrencies in 2024

FET Price Analysis. Source: TradingView

FET Price Analysis. Source: TradingView

On the other hand, if the support remains intact, the FET price could bounce towards $1.71. Breaching this resistance would invalidate the bearish thesis, sending the crypto asset on a run-up.