Telegram Coin BANANA Skyrockets 55% in a Day as Binance Announces Listing

Telegram coin Banana Gun (BANANA) emerged as one of the best-performing assets of the last day, rising by more than 50%.

The crypto asset enjoyed bullishness from the Binance listing but failed to register considerable inflows.

Telegram Coin on Binance

BANANA price rose on the occasion of the Telegram coin finding listing on Binance as the crypto exchange also announced its launch on the Binance Airdrop Portal. This led to a massive demand for the cryptocurrency.

This resulted in Banana Gun’s native token surging considerably, but the metrics do not suggest a further rise in price.

The recent bullish trend also led to the Telegram coin becoming overbought, as indicated by the Relative Strength Index (RSI). The bullish momentum saturated within a day, signaling a potential short-term correction.

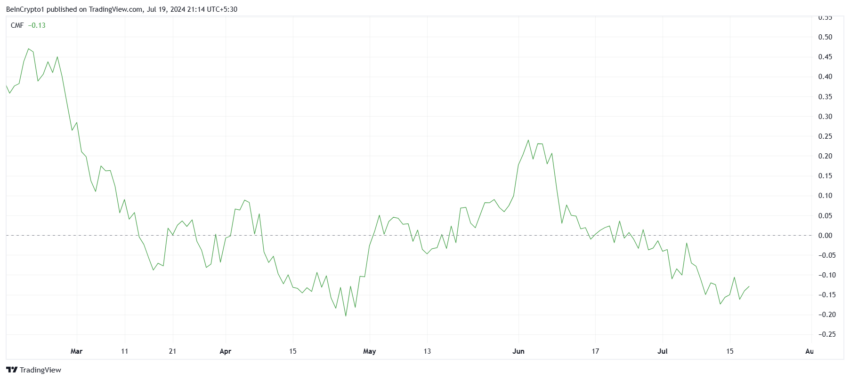

In contrast, BANANA’s Chaikin Money Flow (CMF) indicator showed a different scenario. The CMF denoted that the asset experienced no significant inflows.

Instead, outflows were dominating BANANA. This suggests a lack of buying interest and potential downward pressure on the asset’s price.

While the Telegram coin faced a swift saturation of bullish sentiment, BANANA struggled with persistent outflows, highlighting a stark contrast in market dynamics between the two assets. This suggests that the rise in price was largely due to speculation and hype, making the uptick an empty rally.

Read More: What Are Telegram Bot Coins?

BANANA Price Prediction: No New All-Time High Soon

BANANA’s price hit an all-time high of $87.03 during yesterday’s intra-day rise but failed to close at this price, falling to $70.06, closing the day at a 30% rise. As a result, $70.61 now acts as crucial resistance for the Telegram coin.

With the asset’s bullishness saturating and the inflows diminishing, the likely outcome will be a drawdown to $65.00 or lower. This would wipe out a chunk of the recent surge unless BANANA sees high demand following its listing on Binance on July 20.

Read More: Crypto Telegram Groups To Join in 2024

BANANA Price Analysis. Source: TradingView

BANANA Price Analysis. Source: TradingView

However, if the investors accumulate more BANANA and refrain from selling for profits immediately, the $70.61 barrier will be breached, and the altcoin will rise to $75. Even then, a new all-time high is out of the question for some time.