Bitcoin price loses 8% in a week 110 days away from BTC halving event

- Bitcoin is trading sideways below the $43,000 level on Thursday.

- BTC halving event is 110 days away, experts consider this a typical catalyst for Bitcoin price.

- Altcoin season kicked off on January 14 and BTC dominance shrunk to 47.5%.

Bitcoin market participants are likely indecisive as BTC trades sideways below $43,000 on Thursday, January 18. Bitcoin price declined nearly 8% in the past week, as altcoin season marks its beginning.

BTC halving event, considered a catalyst for Bitcoin price, is 110 days away.

Also read: Bitcoin records largest transaction of 2024, $665.3 million BTC transferred on Tuesday

Daily Digest Market Movers: Bitcoin price action disappoints traders, halving draws close

- Bitcoin price drops below its two-year high of $48,989. BTC is trading sideways below the $43,000 level on Thursday. At the time of writing, Bitcoin price is $42,809. BTC price observed nearly 8% losses in the past week.

- BTC price action disappointed market participants alongside decrease in Bitcoin dominance.

- The dominance of the largest asset by market capitalization has dropped to 47.5%.

Bitcoin dominance. Source: CoinGecko

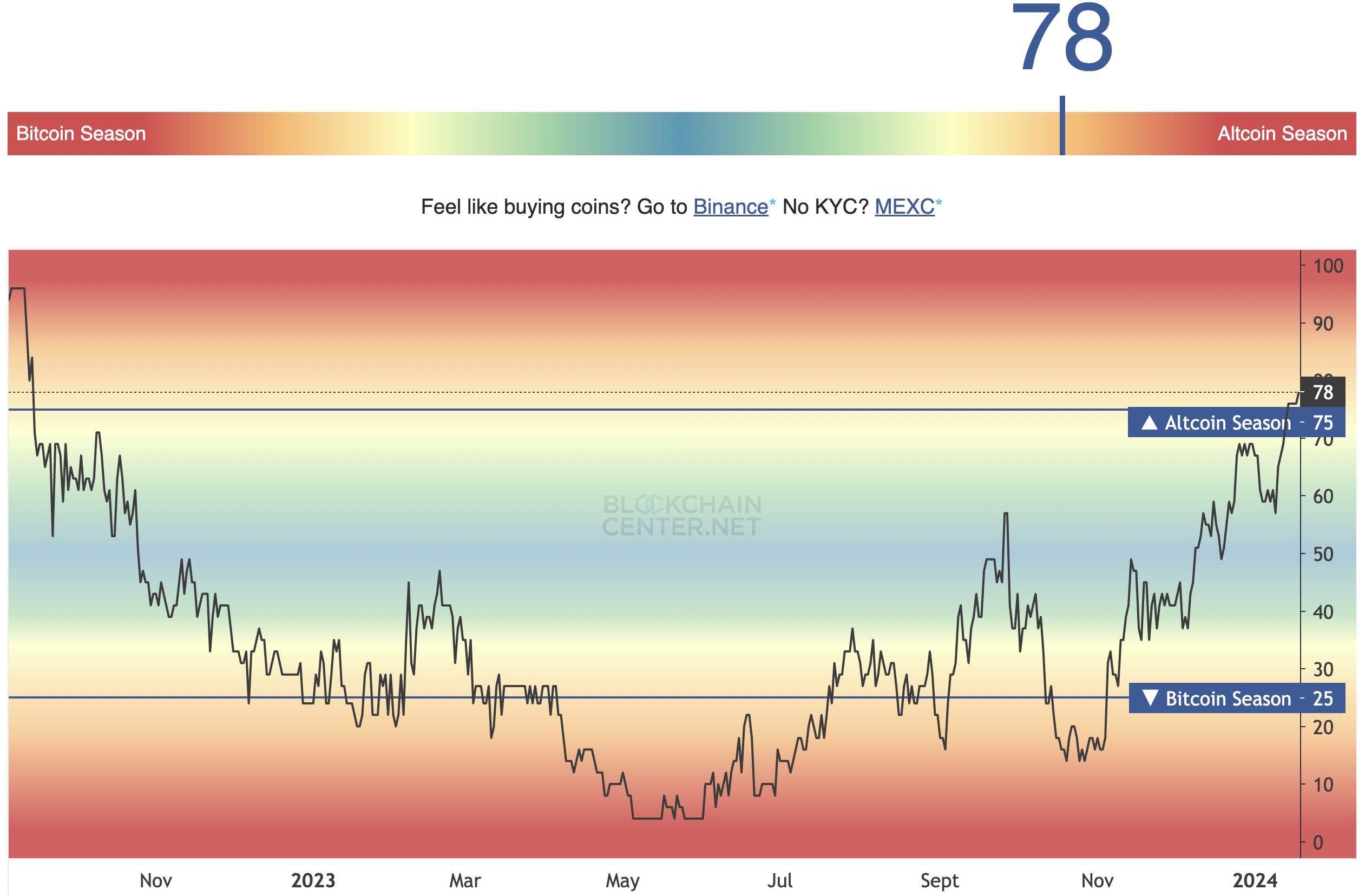

The Altcoin Season Index, an indicator that tracks whether 75% of the top 50 cryptocurrencies performed better than Bitcoin, reads 78 on January 18. The indicator signaled that Altcoin Season kicked off on January 14.

Altcoin Season Index. Source: Blockchaincenter.net

Experts consider the Bitcoin halving event a catalyst for BTC price. The halving event is 110 days away, according to data from the countdown timer on Nicehash.com. The event will slash the reward for mining BTC blocks, meaning miners will receive half the current reward for verifying transactions on the Bitcoin blockchain.

The mining reward will be slashed to 3.125 BTC per block, post the fourth halving in April 2024.

Technical Analysis: Bitcoin price trades below $43,000 level

Altcoin season likely event that took the shine away from Bitcoin price action. BTC price traded sideways below the $43,000 level on Thursday. In the past week, BTC price dropped nearly 8%, yielding losses for holders.

The asset’s price dropped below the 50% Fibonacci Retracement of the BTC price decline between November 2021 and 2022. At the time of writing, Bitcoin price is $42,843, below the 50% Fibonacci Retracement at $43,074. This marks a key resistance in BTC price recovery. The other two key resistances are represented as R1 and R2 in the chart below, they represent the imbalance zone between $43,589 and $45,613.

BTC/USDT 1-day chart

A daily candlestick close above the $43,074 level could invalidate the bearish thesis for Bitcoin price.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.