Dogecoin's recent lag provides opportunity for investors to ride potential 40% rally

- DOGE has maintained price patterns similar to those of BTC, ETH, and SOL despite its meme status.

- The popularity of other newer meme coins may be drawing attention away from DOGE.

- DOGE on-chain metrics and technical indicators suggest a rally may be on the horizon.

Dogecoin (DOGE) is up 1% on Tuesday, as a recent analysis shows that its price is following similar patterns to top cryptocurrencies like Bitcoin, Ethereum, and Solana. While the move has seen DOGE show lesser volatility compared to previous cycles, the meme coin could be set to resume its sharp movements with a potential 41% rally.

DOGE’s price sees lower volatility than in previous cycles

In the past few months, DOGE's price performance has followed similar patterns to those of BTC, ETH and SOL, which have far larger market caps and relevant use cases.

Considering DOGE's meme coin status, it is expected to demonstrate higher volatility than these assets, but that has yet to be the case in the current cycle. Unlike the 2020/2021 cycle, when DOGE saw significant price spikes, it has maintained significantly lower volatility.

DOGE/BTC/ETH/SOL Price comparison

One major reason may be the popularity of recent large-cap meme coins like PEPE, WIF, BONK, BRETT, etc. Investors may now be approaching DOGE as the "BTC" of meme coins, which they hold onto for the long haul rather than short-term speculative purposes like in previous years.

This is evidenced in DOGE's larger market cap, which would be less affected by retail speculative traders.

Is now a good time to get in on DOGE?

On the flip side, the emergence of these other meme coins may have caused DOGE to receive less attention from investors.

The Santiment Weighted Sentiment indicator helps capture a balanced overview of an asset's social volume combined with investors' sentiments. The indicator spikes when there's increased social volume around an asset, and the messages are largely positive. It dips when the volume is still high, but the sentiment is negative. If the social volume is high but the sentiment is mixed, it stays around 0. If the volume is low, it also stays around 0.

DOGE's weighted sentiment has remained largely under 0 in the past three months and is currently at -0.247, indicating less or a slightly negative interest from investors.

[23.43.12, 16 Jul, 2024]-638567726746834109.png)

DOGE Key On-chain data

This could also be a potential buy opportunity, as prices often rebound when the weighted sentiment figure goes below zero.

Additionally, despite its recent rise, DOGE's 30-day Market value to Realized Value (MVRV) ratio is still at low levels. As a result, DOGE could be set for a rally in the coming days.

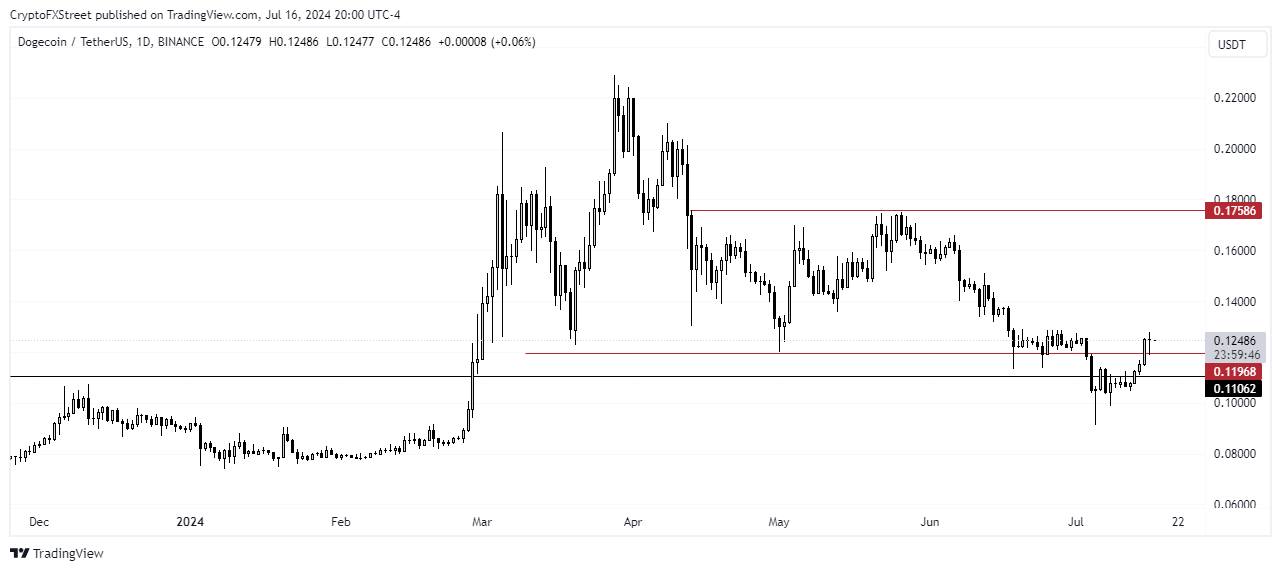

DOGE just ascended into a key price range and may attempt to complete the upside of the range. Such a move will see DOGE rise 41% to $0.175.

DOGE/USDT 1-day chart

On the downside, DOGE could find support around $0.110, where investors purchased 22.15 billion DOGE tokens.