Ethereum ETFs will catapult ETH to new all-time high: Bitwise

- Ethereum ETFs will push ETH to a new all-time high above $5,000, says Bitwise.

- Citi predicts ETH ETFs will attract around $5 billion in net inflows within six months of launch.

- Peter Brandt suggests ETH could rally 60% if it makes a key move.

Ethereum (ETH) is up nearly 2% on Tuesday following predictions from Bitwise chief investment officer (CIO) Matt Hougan that ETH ETFs could help push ETH to a new all-time high above $5,000. Other predictions from Citi Bank and trader Peter Brandt also align with Hougan's position.

Daily digest market movers: Ethereum ETFs deciding factor for new all-time high

Bitwise CIO Matt Hougan predicted that inflows across Ethereum ETFs will boost ETH's price to a new all-time high above $5,000.

"By year-end, I'm confident the new highs will be in. And if flows are stronger than many market commentators expect, the price could be much higher still," said Hougan in a recent memo to investors.

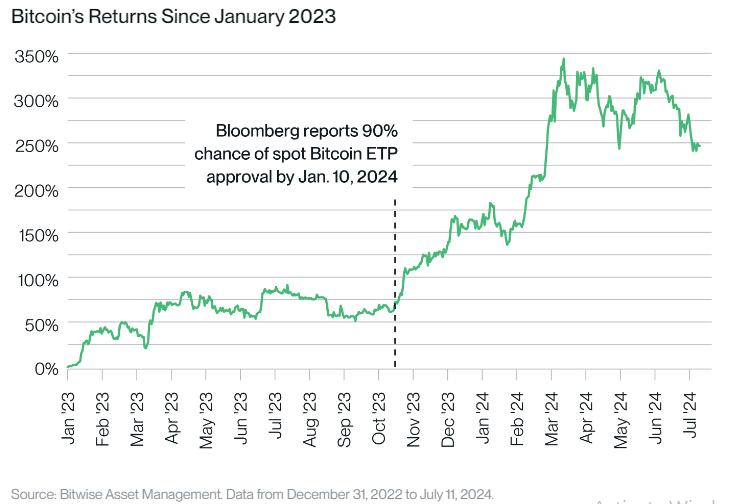

Hougan believes ETH ETFs will have a bigger impact on ETH's price than Bitcoin ETFs had on BTC due to the new demand that ETFs bring to commodities without altering their fundamentals. BTC has seen a 110% rise since October, when Bloomberg announced the SEC would likely approve Bitcoin ETFs.

Bitcoin’s Returns since January 2023

He compared Bitcoin's previous 1.7% inflation rate to Ethereum's, which has hovered from negative to 0% in the past year. ETH has maintained such a deflationary status since the implementation of Ethereum Improvement Proposal 1559 (EIP-1559), which reduces the amount of ETH in circulation upon every transaction on the Mainnet.

"Significant new demand meets 0% new supply? I like that math. And if activity on Ethereum ticks up, so does the amount of ETH being consumed. That's another lever of organic demand working in investors' favor," stated Hougan.

Hougan also highlighted how the lower economic cost of Ethereum's consensus mechanism reduces the selling pressure on ETH, unlike that of Bitcoin miners, who have to sell a portion of their holdings to cover up costs.

Lastly, he mentioned how increased staking and ETH usage in DeFi protocols have already removed over 40% of ETH off the market.

Hougan believes these factors, combined with his earlier predictions of ETH ETFs raking in $15 billion in the first 18 months of launch, primes Ethereum for a new all-time high.

Meanwhile, banking giant Citi predicted in a research report last week that Ethereum ETFs could see up to 30%-35% of the flows seen in Bitcoin ETFs. That would give an equivalent of about $4.7 billion to $5.4 billion of net inflows, noted Citi analysts.

The Securities & Exchange Commission (SEC) will likely greenlight ETH ETFs for trading next Tuesday. This follows updates from Bloomberg analyst Eric Balchunas and Reuters, which claimed sources told them the regulator asked issuers to submit their final S-1 drafts this week in preparation for a Tuesday, July 23 launch.

ETH technical analysis: Could Ethereum rally 60% to $5,627?

Ethereum is trading around $3,460 on Tuesday, up over 2% on the day. In the past 24 hours, ETH witnessed over $45 million in liquidations, with shorts leading the line at $25.36 million and longs at $19.92 million in liquidations.

ETH's options open interest has risen 13% in the past 24 hours to $6.66 billion. Open interest is the total amount of unsettled contracts in a derivatives market. An increase in options OI combined with price growth indicates a potential for more upside in a market. As a result option traders could be expecting higher ETH price and are reacting accordingly.

This aligns with a recent prediction from popular trader and analyst Peter Brandt.

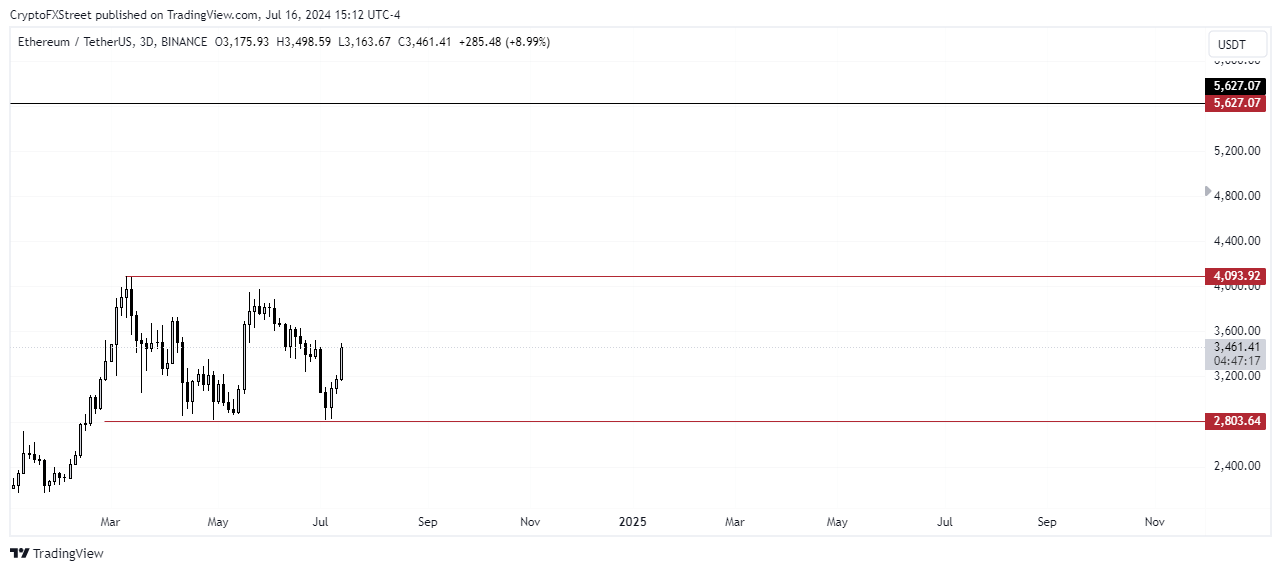

Brandt predicted that ETH could see a new all-time high soon after finding support at around $2,800, the lower boundary of a four-month plus rectangle, "which was a retest of the Feb completion of a horn bottom." If ETH can complete a move to the rectangle's upside of $4,093, Brandt suggests that it could set a new all-time high at $5,627.

ETH/USDT Weekly chart

In the short term, if ETH rises above $3,502, over $34.8 million worth of short positions will be liquidated from the market.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Serving as the basal network for the Ether (ETH) cryptocurrency, it is the second largest crypto and largest altcoin by market capitalization. The Ethereum network is tailored for scalability, programmability, security, and decentralization, attributes that make it popular among developers.

Ethereum uses decentralized blockchain technology, where developers can build and deploy applications that are independent of the central authority. To make this easier, the network has a programming language in place, which helps users create self-executing smart contracts. A smart contract is basically a code that can be verified and allows inter-user transactions.

Staking is a process where investors grow their portfolios by locking their assets for a specified duration instead of selling them. It is used by most blockchains, especially the ones that employ Proof-of-Stake (PoS) mechanism, with users earning rewards as an incentive for committing their tokens. For most long-term cryptocurrency holders, staking is a strategy to make passive income from your assets, putting them to work in exchange for reward generation.

Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) mechanism in an event christened “The Merge.” The transformation came as the network wanted to achieve more security, cut down on energy consumption by 99.95%, and execute new scaling solutions with a possible threshold of 100,000 transactions per second. With PoS, there are less entry barriers for miners considering the reduced energy demands.