Crypto Today: Bitcoin, Ethereum and XRP rally as meme coins PEPE, WIF, FLOKI make double-digit gains

- Bitcoin extended gains, battling rising selling pressure from Mt.Gox transfers.

- Ethereum and XRP remain correlated with Bitcoin post price rallies on Tuesday.

- Ethereum rallies amidst optimism for the anticipated Spot Ether ETF approval by the US SEC.

- Meme coins PEPE, WIF, FLOKI rallied in double-digits in the last 24 hours, per CoinGecko data.

Bitcoin, Ethereum and XRP updates

- Bitcoin resists sell-off even as news of Kraken exchange users gearing to receive Mt.Gox transfers makes headlines. The largest asset by market capitalization sustained above key support and trades above $63,800 on Tuesday. Bitcoin holds the $62,000 level as US spot Bitcoin ETFs registered inflows

- Ethereum traders await news of the US Securities & Exchange Commission (SEC) approval of the Spot Ether Exchange Traded Fund (ETF). Ethereum ETF launch could push Ether to new all-time high, on one condition.

- Ethereum (correlation coefficient with Bitcoin is 0.94) and XRP (correlation coefficient with Bitcoin is 0.53) remain highly correlated with Bitcoin and prices are influenced by BTC market movers.

- XRP extends gains as Ripple spends $1 million to support pro-XRP attorney John Deaton in the campaign against Senator Elizabeth Warren.

Memecoin updates

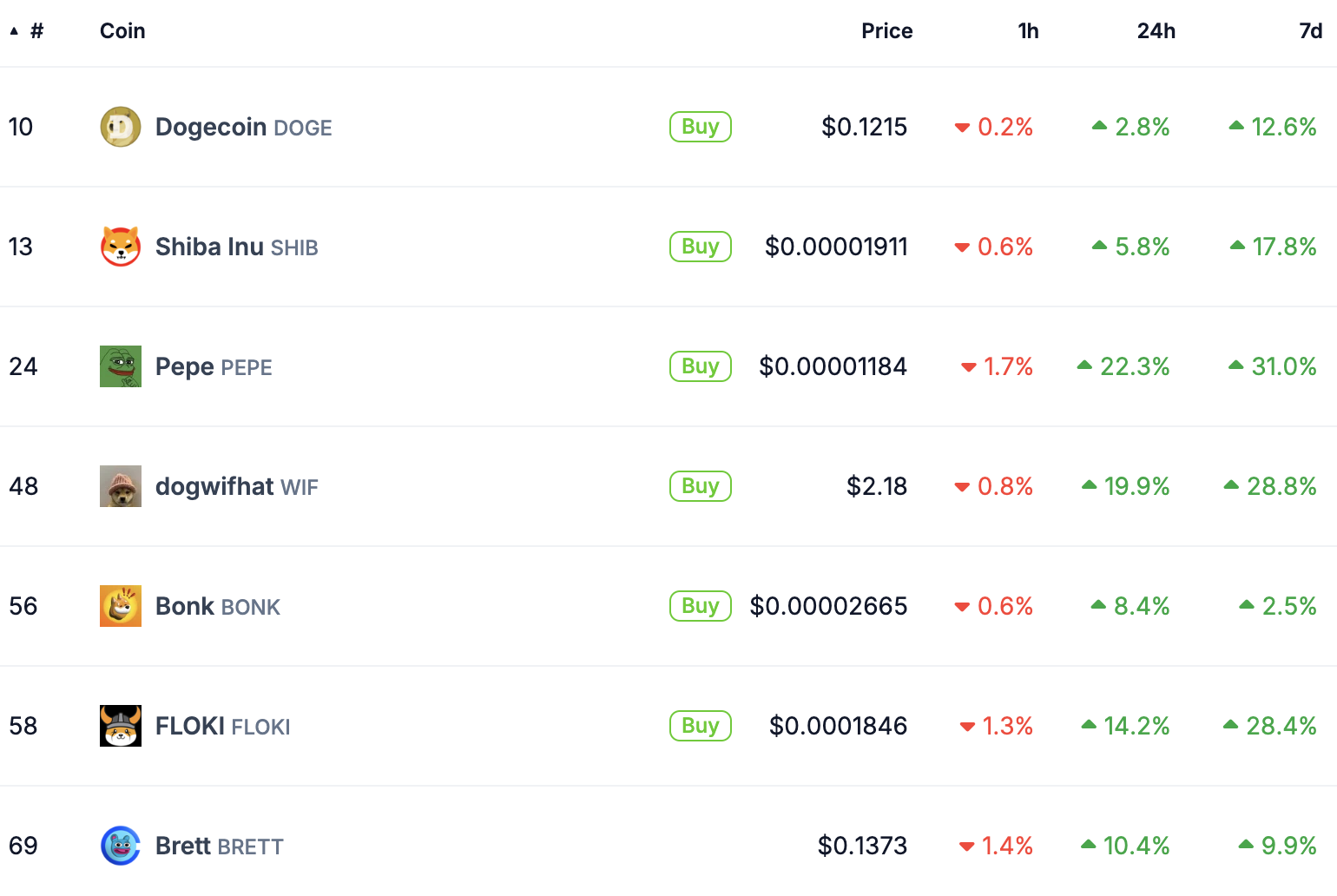

- Coingecko data shows meme coins rallied in double-digits in the last 24 hours.

- The chart below shows the returns on top meme coins, as seen on Coingecko:

Coingecko data on meme coins

- Meme coins added 12% to their market capitalization and climbed to $52.9 billion on Tuesday.

- The 24-hour trade volume exceeds $9.66 billion.

Chart of the day

BONK/USDT daily chart

BONK trades at $0.00002678 at the time of writing. The meme coin has been in an upward trend since June 23, forming higher highs and higher lows. BONK could extend gains by 12% and rally to $0.00003006, the 50% Fibonacci retracement of the decline from March 4 top of $0.000048 to the April 13 low of $0.000012.

The Moving Average Convergence Divergence (MACD) indicator supports BONK’s recent gains, the green histogram bars above the neutral line show underlying positive momentum in BONK’s uptrend.

BONK could find support at the upper boundary of the Fair Value Gap in the chart above, at $0.00002536.

Market update

- Crypto community reports Kraken exchange has emailed users and notified successful receipt of creditor funds (Bitcoin and BitcoinCash) from Mt.Gox trustee. The exchange is expected to distribute funds within seven to fourteen days.

- Genesis Trading is suspected of executing bankruptcy liquidation procedures as the entity transfers 600 Bitcoin to Coinbase exchange. The $37.72 million transfer was tracked by on-chain tracker Arkham Intelligence.

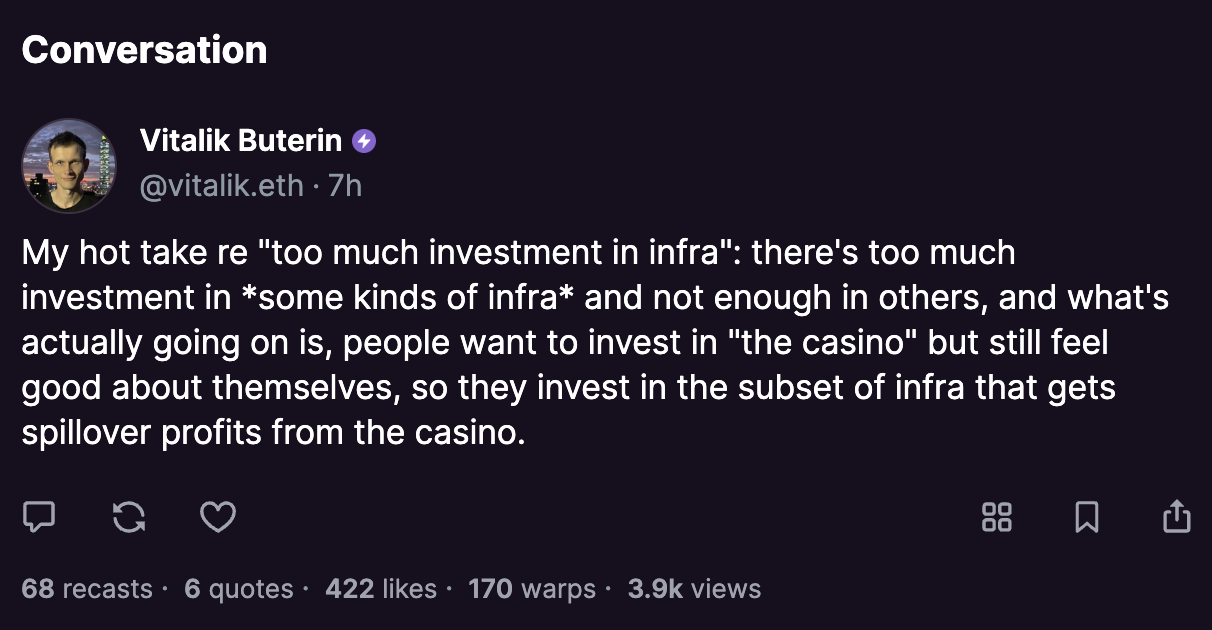

- Vitalik Buterins raises concerns on how investors are interested in projects that gain spillover capital from casinos, focused on “some kind of infrastructure.”

Vitalik on warpcast

Industry update

- Terra announced that the deadline for filing bankruptcy claims for Terraform Labs Pte Ltd. and Terraform Labs Limited has been set at 21 GMT on August 10, 2024.

1/ Important Notice for the Terra Community:

— Terra Powered by LUNA (@terra_money) July 15, 2024

The General Bar Date for filing claims in the Chapter 11 bankruptcy cases of Terraform Labs Pte Ltd (TFL) and Terraform Labs Limited (TLL) has been set to August 9, 2024, at 5:00 p.m. (ET).

- Cyber security platform Cyvers Alerts reports suspicious transactions in Lifi protocol. Warns users in an official tweet.

ALERT@lifiprotocol, Our system has raised suspicious transactions involving your https://t.co/3LzbDK99Ed

— Cyvers Alerts (@CyversAlerts) July 16, 2024

We recommend users to revoke their approvals for: 0x1231deb6f5749ef6ce6943a275a1d3e7486f4eae

More than $8M have been drained so far from users and mostly stablecoins!… pic.twitter.com/zsj9DZWnpU

- Eric Balchunas highlights how Bitcoin ETFs are in “two steps forward” mode or sustained inflow of funds.

the Bitcoin ETFs are in "two steps forward" mode after one step back in June with another $300m yesterday and $1b for week. YTD net total (the most imp number in all this) has crossed $16b for first time. Our est for first 12mo was $12-15b so already cleared that w 6mo to go. pic.twitter.com/0V7wE9D5OU

— Eric Balchunas (@EricBalchunas) July 16, 2024