Top Crypto News This Week: Ethereum ETF Optimism, ARB $66 Million Token Unlock, and More

This week, major news and developments have captured the attention of both crypto investors and enthusiasts alike.

From the growing optimism surrounding the Ethereum ETF launch to the significant token unlock by Arbitrum, the crypto scene is buzzing with activity.

Ethereum ETF Approval Imminent: Industry Buzz and Predictions

Analysts and industry leaders have expressed their enthusiasm for the imminent approval of spot Ethereum (ETH) exchange-traded funds (ETFs). Nate Geraci, president of ETF Store, recently shared his optimism on social media, stating that the approval of these ETFs is expected this week. He cites no “good reason for any further delay at this point.”

Matt Hougan, Bitwise’s Chief Investment Officer, echoes this sentiment. He highlighted the minimal amendments required in the latest filings and indicated a closer approach to the approval finish line.

Read more: Ethereum ETF Explained: What It Is and How It Works

Experts believe that the launch of a spot Ethereum ETF could positively impact ETH’s price action and the broader crypto industry. Sami Start, Co-founder and CEO of Transak, explained that the spot Ethereum ETF could further legitimize digital assets and spur the adoption of decentralized technologies and tokenized assets.

“It’s more instructive to look within the Ethereum ecosystem itself and consider the opportunities that exist there. […] ETH is the native currency of dozens of interconnected L2s and is the trading pair against all of the ERC-20 assets it supports. […] And, it’s likely to be here that we see the first institutional exploration of decentralized technology as bolder players move beyond the constraints of the centralized ETF model,” Start elaborated to BeInCrypto.

XDEFI Wallet Rebranding Generates Excitement

On July 12, non-custodial Web3 wallet XDEFI hinted on its X (Twitter) account that it would reveal more details about its rebranding plan this week. Earlier in June, Emile Dubié, CEO and co-founder of XDEFI, announced that the team had started redesigning the wallet, investing significantly in their design system. Dubié emphasized the importance of a well-defined design system for consistency and a cohesive user experience.

“We acquired 230,000 users without an airdrop or a points system. Our UX/UI has been lagging behind as we were focused on adding chains. We’ve been working on a very different interface since early last year. It’s coming together nicely; the new version is what self-custody should look like. Everything was built based on years of feedback,” he explained.

Many crypto community members expressed their enthusiasm for the upcoming XDEFI iteration. This excitement is evident in XDEFI’s native token, which increased by 7.43% over the last 24 hours. At the time of writing, it is currently trading at $0.072617.

XDEFI Price Performance. Source: BeInCrypto

XDEFI Price Performance. Source: BeInCrypto

Cosmos v18 Upgrade to Introduce Permissioned CosmWasm

Layer-0 blockchain Cosmos announced on June 20 that its v18 upgrade will be released mid-July. This upgrade will introduce permissioned CosmWasm to the Cosmos Hub. It will also enhance ATOM’s functionality, utility, and cross-chain composability.

“This update will bring new capabilities to the Hub, enhancing ATOM’s functionality, utility, and cross-chain composability,” the team stated.

Permissioned CosmWasm requires each contract to be reviewed and approved by governance, ensuring added security and quality control. This approach minimizes the risks of potential exploits and discourages spam or wasteful contracts. By governance-gating each contract, Cosmos Hub aims to ensure that only well-vetted, purposeful contracts are implemented.

The goal is not to compete with AEZ chains like Neutron but to leverage CosmWasm for tasks that are difficult or impractical through other means. This addition will enhance the Hub’s ability to handle complex functionalities efficiently. Permissioned CosmWasm on the Cosmos Hub is a step towards a more secure, efficient, and capable ecosystem.

Sanctum’s Native Token CLOUD to Launch on Jupiter Launchpad

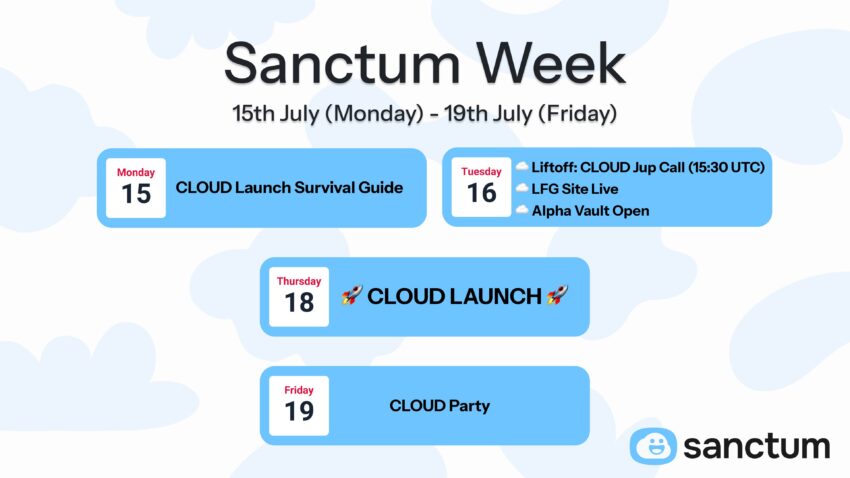

On July 10, Sanctum, a Solana-based liquid staking platform, announced its plan to launch its native token CLOUD on the decentralized exchange (DEX) Jupiter launchpad on July 18. On July 16 at 15:30 UTC, a special edition of the Planetary Call, called “Liftoff” with Jupiter, will provide additional information about the launch. After these, on July 19, Sanctum will host a CLOUD party.

CLOUD Token Launch Timeline. Source: X/sanctumso

CLOUD Token Launch Timeline. Source: X/sanctumso

The total supply of CLOUD is 1 billion tokens. According to Sanctum, 18% of the total supply will be allocated to the issuance. The team will distribute 10% of the supply through the initial airdrop, while 8% will be used to provide liquidity in the LFG launch pool.

The token will facilitate the management of capital and control, enabling holders to shape decisions related to the platform’s direction and resource management. In order to qualify for the Sanctum Verified Partner program, participants will need to stake CLOUD, with CLOUD holders casting votes to decide on the acceptance of partners.

Radiant Capital Announces v3 Launch and Expansion to Base

On June 27, Radiant Capital, a decentralized finance (DeFi) platform that builds the first omnichain money market atop LayerZero, announced that it is in the final stretch for the launch of its v3. The platform also revealed its plan expansion to Base, Coinbase’s layer-2.

According to the team, Radiant v3 and the expansion to Base will happen in July. However, they have not yet specified the exact date of these events.

Radiant also announced its integration with Stargate v2, allowing seamless lending and borrowing of assets cross-chain with low fees. Security remains a cornerstone for Radiant, with audits by OpenZeppelin and BlockSecTeam, monitoring by HypernativeLabs and Chainalysis, and comprehensive risk management measures in place.

Arbitrum and Other Major Token Unlocks This Week

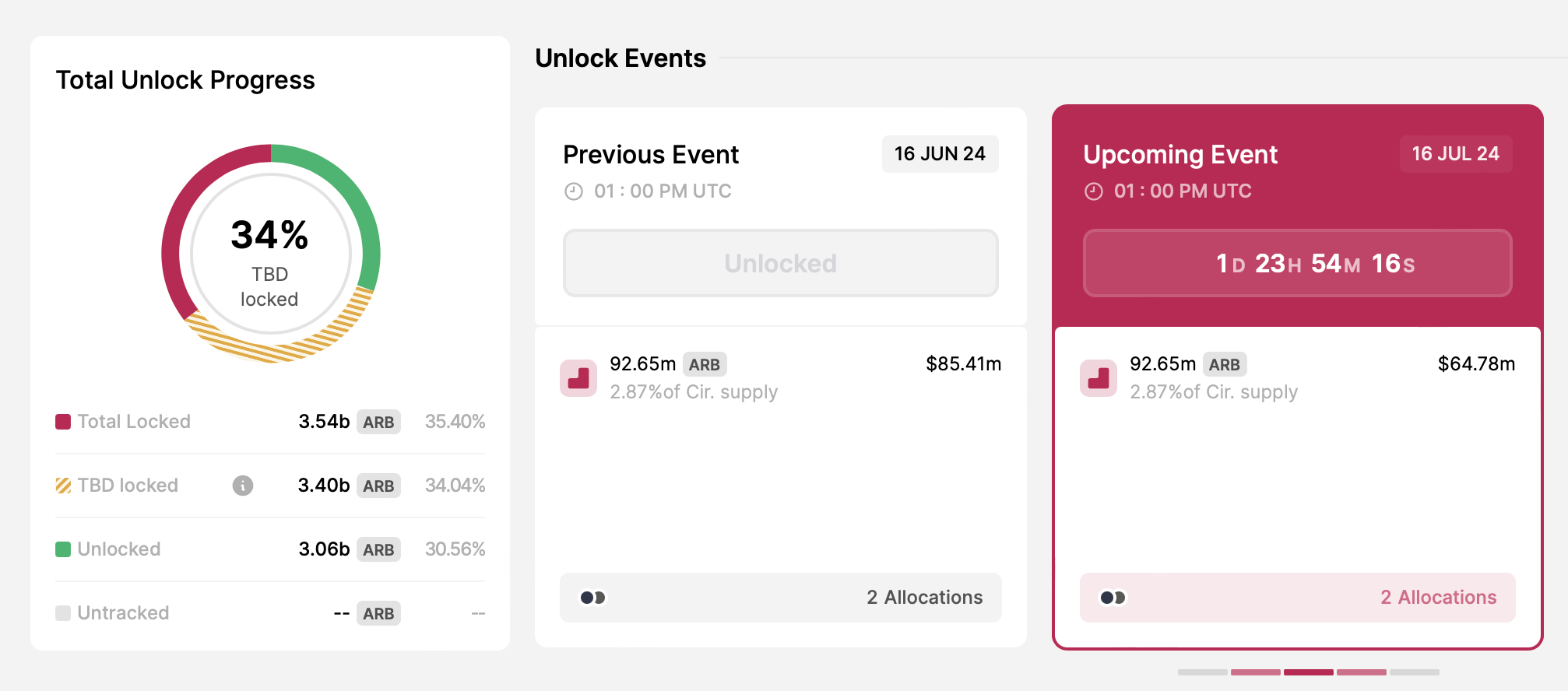

This week will witness several token unlocks. On July 16, Arbitrum will unlock 92.6 million ARB tokens worth approximately $66 million at the current market price. These unlocked tokens will go to its team, advisors, and investors.

Read more: Arbitrum (ARB) Price Prediction 2024/2025/2035

ARB Token Unlock. Source: token.unlocks

ARB Token Unlock. Source: token.unlocks

Other projects, including Axie Infinity (AXS) and ApeCoin (APE), will also unlock their tokens this week. This increase in token releases could affect the prices of these cryptocurrencies. Read this article for further detailed information on major crypto token unlocks this week.