Could DOGE see a rally amid quietness in the meme coin sector?

- DOGE's funding rate briefly declined to its lowest level year-to-date after a temporary drop in its price.

- DOGE retailers may play a major role in its price movement amid increased exchange outflows.

- DOGE could rally soon, as a temporary decline in funding rate has previously seen its price post gains.

Dogecoin's price (DOGE) gained about 2% on Thursday, following a quiet day across the meme coin sector. Amid the calmer markets, DOGE's derivatives and on-chain data reveal key insight that may help predict its future price movement.

DOGE derivatives data post mix signs amid calmer meme market

The meme coin sector has become relatively calm in the past few days following a decline in Bitcoin's price. Several meme coins have experienced double-digit weekly losses, with DOGE shedding nearly 13% of its value. However, its derivatives and on-chain data reveal key insights on the next move for the top meme coin.

Read more: Meme coin dominance in altcoin market shrinks, DOGE, SHIB, PEPE, WIF, FLOKI on the verge of correction?

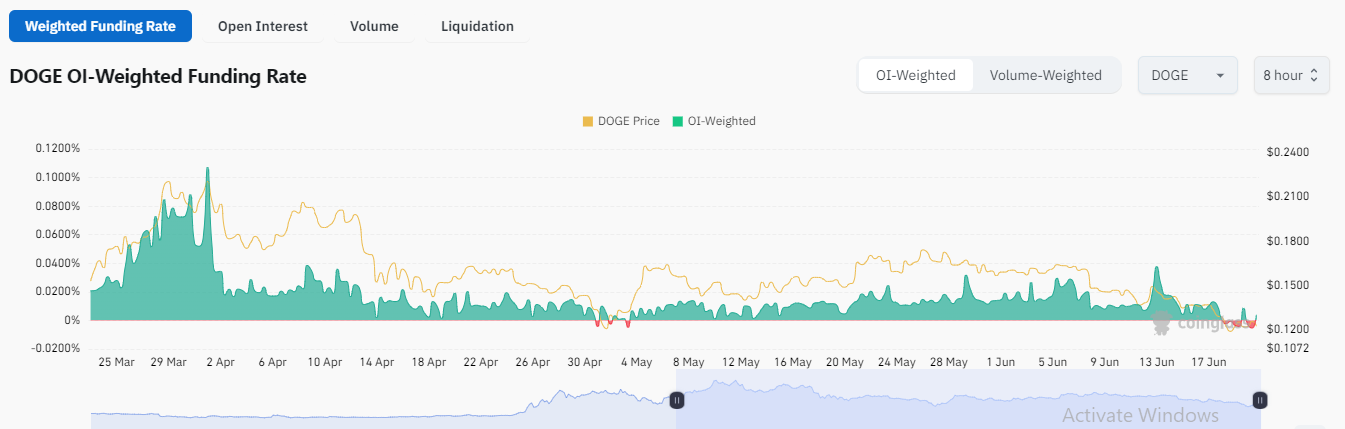

According to data from Coinglass, DOGE's funding rate reached -0.0053% in the early hours of Thursday, its lowest level since the beginning of the year. Funding rates are periodic interest rates charged on futures contracts traded on derivatives exchanges. A negative funding rate means long traders pay short traders, while vice versa if the funding rate is positive.

Dogecoin's funding rate initially turned negative on June 18 following a price decline that led to nearly $60 million in long liquidations from DOGE traders. The rate went further to -0.0053% on Thursday. While it's slightly positive again, the earlier downward move signifies increased bearish sentiment among traders.

DOGE OI-Weighted Funding Rate

Furthermore, DOGE's open interest (OI) declined from almost $1 billion on June 6 to $613 million on Thursday. Open interest signifies the total number of outstanding long and short positions in the market. The drop in DOGE OI indicates traders are becoming more cautious, which may lead to lesser volatility.

Also read: As meme coins go extinct, this Ethereum sector is likely to grow massively

On-chain data adds extra layer to the mix

In addition to the bearish sentiment, Whale Alert reported that an unknown wallet transferred 86,388,901 DOGE worth $10.6 million to the Robinhood exchange. Such increased exchange inflows could trigger a downward movement in price as it indicates traders may look to sell their assets.

However, on a larger time frame, IntoTheBlock data shows investors are accumulating DOGE with outflows outpacing inflows. Its 24-hour netflow change is at -209.12 million DOGE, meaning increased outflows.

Additionally, DOGE's large holders netflow to exchange netflow ratio declined to -0.01% on Wednesday, meaning retail traders are gaining control. A high ratio suggests large holders are more active than retail traders, while a lower ratio suggests the opposite. This aligns with an earlier report that DOGE large holders' holdings have declined.

Read more: DOGE sees high liquidations as meme coin sector bleeds heavily

Coupled with this, DOGE could bounce back up as its price has previously rallied after a temporary decline in funding rate, as captured in the chart above.

The $0.109 level remains as critical support for the largest meme coin in the case of a price decline, considering investors purchased nearly 43 billion DOGE around this price.