Bitcoin FOMO: Social Media Users Calling To Buy Sub-$66,000 Dip

Data shows that traders on social media have been calling to buy during the latest Bitcoin dip below $66,000, a sign that FOMO is active in the market.

Bitcoin Investors Are Displaying FOMO After The Recent Decline

As the analytics firm Santiment pointed out in a new post on X, the recent drawdown in the cryptocurrency has instigated the second-largest spike of buying interest in social media users in the past two months.

The indicator of interest here is the “Social Volume,” which keeps track of the amount of discussion related to a topic or term in which users on the major social media platforms are participating.

This metric makes this measurement by counting the unique number of posts/threads/messages on these platforms that mention at least one keyword.

The reason the indicator counts the posts rather than the mentions themselves is that sometimes, a large number of mentions can appear on social media. Still, the location of these mentions could be restricted within niche circles.

The total number of posts mentioning a topic only spikes when users in the wider social media also engage with the term. As such, the Social Volume can provide a more accurate representation of the actual degree of talk related to the keyword.

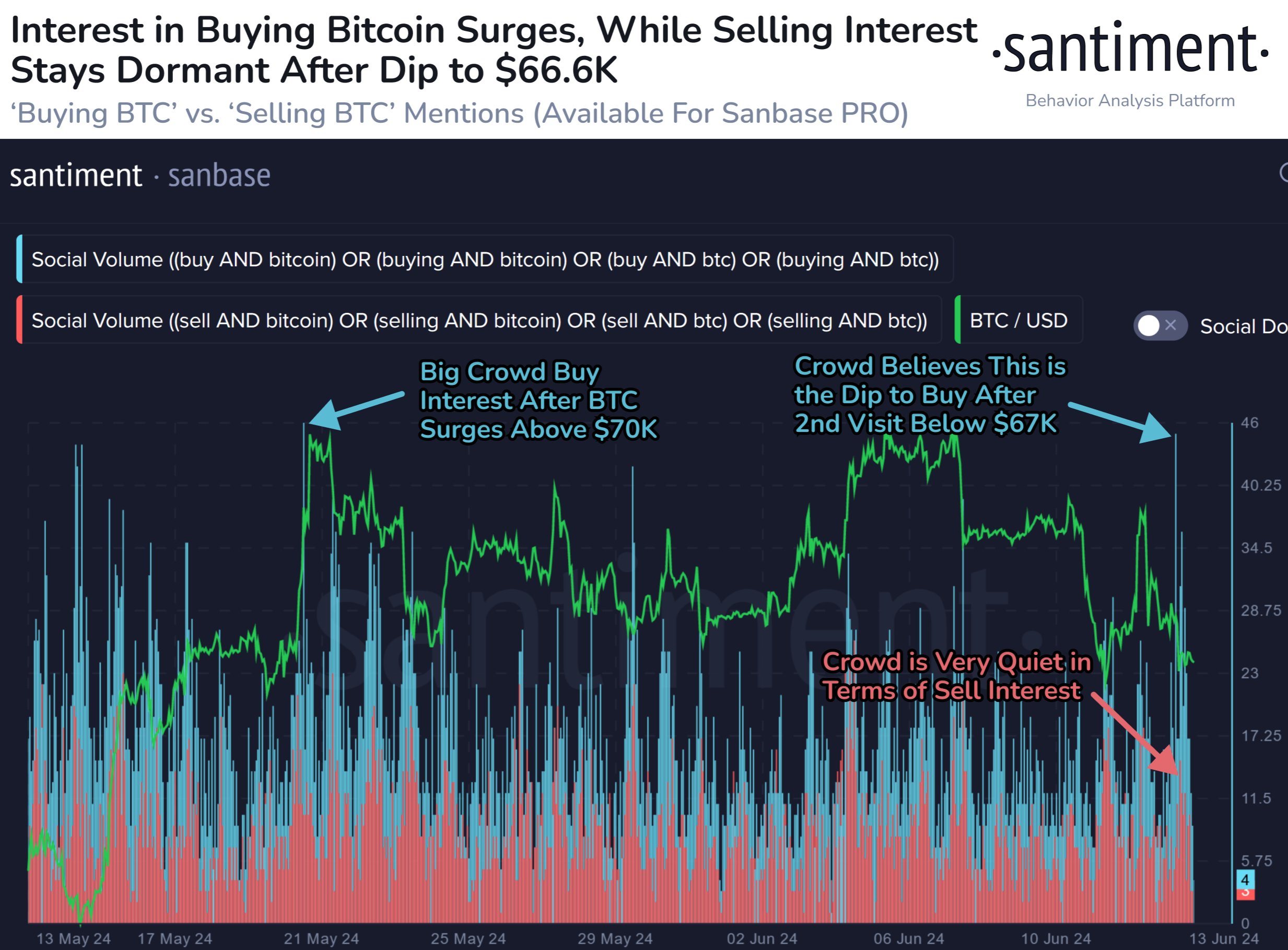

In the context of the current discussion, Santiment has used this indicator to pinpoint data related to terms connected with buying and selling Bitcoin. The chart below shows how the social volume for these two topics has changed over the past month or so.

As is visible in the above graph, the combined Social Volume of phrases related to “buy Bitcoin” has just observed a large spike. This sharp increase in the indicator has come as the cryptocurrency price has been going down.

It would seem that users on social media believe this dip to be a worthy buy. The chart shows that the scale of this buying interest is the largest witnessed in the market since BTC’s rally above $70,000 last month.

It’s also apparent, however, that BTC topped out not soon after this Social Volume spike came. This has often been the pattern observed, as the price becomes more likely to be corrected when FOMO takes over the crowd.

Generally, any negative effects of FOMO can be canceled out if a sufficient amount of FUD also arises in the market simultaneously. As highlighted in the graph, though, the Social Volume of the terms related to “sell Bitcoin” has stayed low amid the spike in calls for buying.

As such, this high amount of optimism around the drawdown could suggest that the bottom is perhaps not here for the cryptocurrency yet.

BTC Price

It would appear that the bearish effect of the social media FOMO may already be influencing Bitcoin as its price has seen a further drop below $66,000 following the Social Volume spike.