AAVE price tumbles 20% in 2024 despite doubling its total value locked

- AAVE nosedived 20% in 2024 despite 100% increase in the total value of assets locked on the crypto lending platform.

- Whales holding between 1 million and 10 million AAVE have increased their holdings by over 75% in 2024.

- AAVE whales have distributed their holdings at losses in the past three months, per on-chain tracker Santiment.

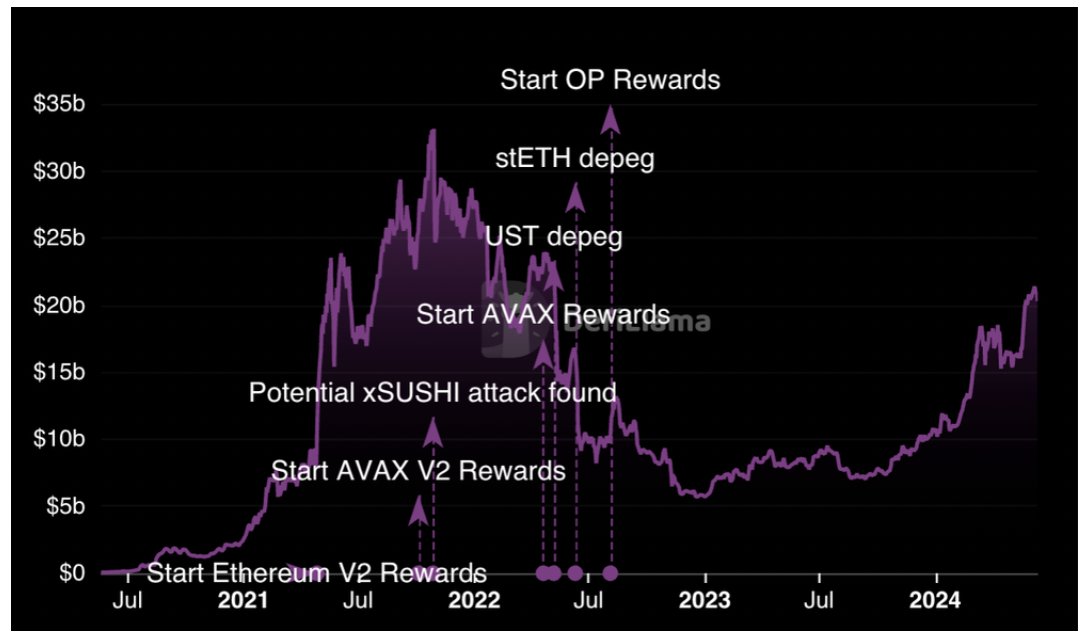

AAVE, a decentralized crypto lending platform, has noted a massive spike in the total value of assets locked (TVL). Rising TVL is considered indicative of higher relevance among market participants and trust in the platform.

Whales have scooped up AAVE in 2024 during the dip in the DeFi token’s price.

AAVE wiped out nearly 20% of its value year to date.

AAVE doubles locked crypto assets, loses value

The DeFi lending platform has observed an upward trend in its TVL from late 2023 to 2024. In 2024, Aave’s TVL climbed over 100% to $12.464 billion, as seen on DeFiLlama. Aave’s TVL increased consistently as market participants continued to lock assets on its lending platform despite the decline in the native token’s price.

The three largest components of Aave’s TVL in terms of tokens are WSETH, WBTC, and WEETH. The majority of the assets locked are from the Ethereum chain, the second and third largest are Arbitrum and Polygon. The rise in TVL indicates that AAVE has witnessed growing adoption among DeFi traders.

AAVE TVL on DeFiLlama

Additionally, data from crypto intelligence tracker Santiment shows that whales holding between 1 million and 10 million AAVE tokens have increased their holdings of the DeFi token by over 75% in 2024. This is evident from Santiment’s supply distribution metric.

[12.59.49, 13 Jun, 2024]-638538796522118205.png)

AAVE whale holdings distribution vs. price

Whale transactions valued at $100,000 and higher, $1 million and higher and the Network Realized Profit/Loss (NPL) metrics show that large wallet investors have realized losses on AAVE holdings in April, May and June.

The Santiment chart below shows spikes in whale transactions and realized losses on several occasions in the past three months.

[13.02.17, 13 Jun, 2024]-638538799063998095.png)

AAVE whale transactions and NPL

AAVE extends losses, down nearly 5% on Thursday

AAVE extended its losses and wiped out nearly 5% of its value on Thursday. In the past seven days, AAVE price dipped nearly 18% on Binance. The DeFi token has noted a spike in its supply on exchanges.

Exchange supply climbed over 4% in June, signaling a rise in selling pressure on AAVE. The DeFi token is at risk of further decline in price.