Bitcoin long positions signal retail traders attempt to buy the dip

- Bitcoin retail traders remain bullish despite the recent correction.

- Over 70% of accounts on Binance are in a net long position, data from Hyblock Capital shows.

- Bitcoin long positions worth over $18 million were liquidated in the past 24 hours even as BTC sustains above $67,000.

Retail traders appear to be confident about a Bitcoin (BTC) price rebound despite the correction seen on Tuesday, data on long and short positions shows, as the largest crypto asset by market capitalization holds above $67,000.

Bitcoin retail traders are net bullish

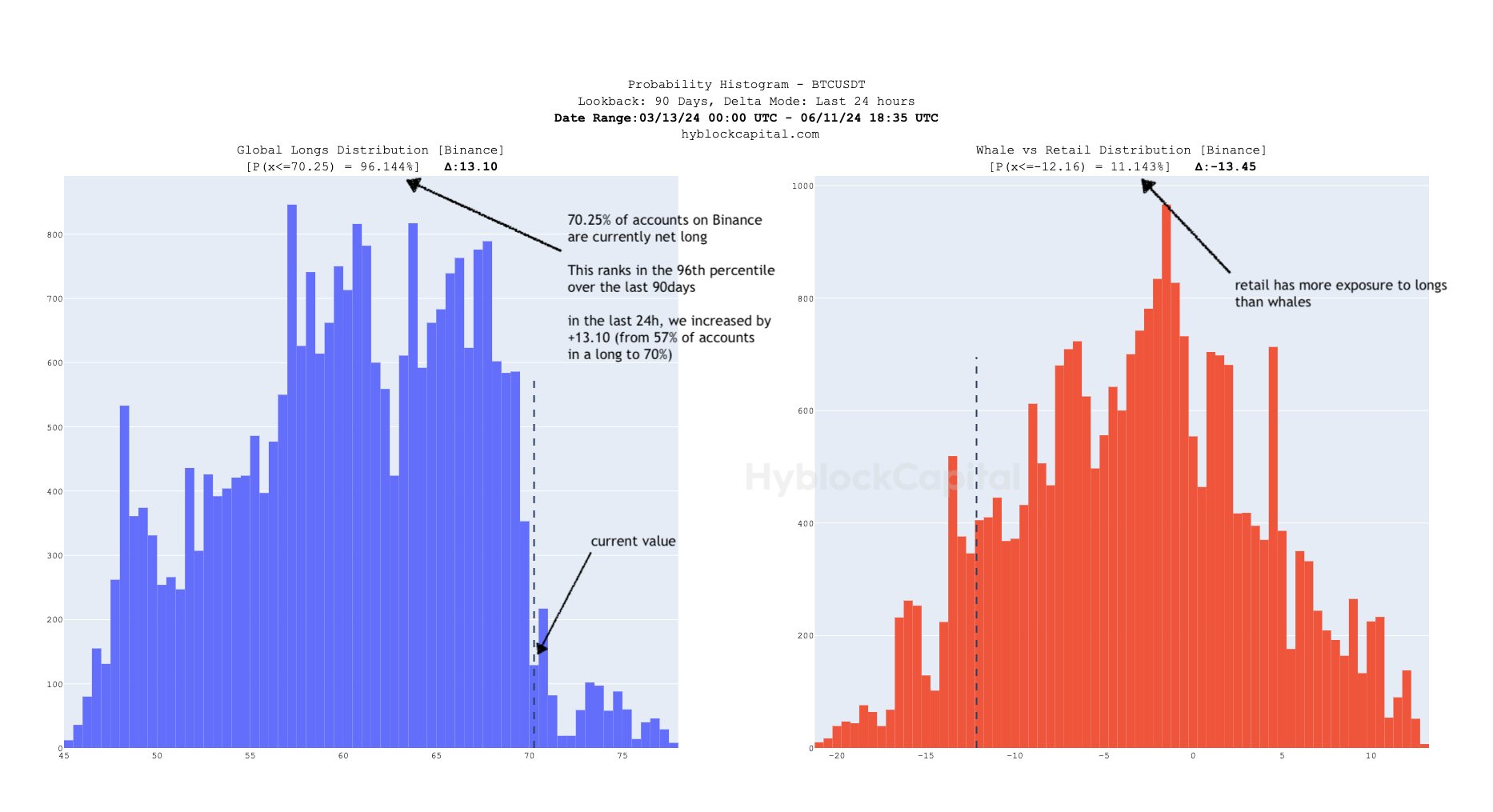

Data from Hyblock Capital on the derivatives traders on Binance shows that 70.25% of the accounts on the platform are net long on BTC, suggesting that they mostly anticipate the asset to rally.

This is higher than the 57% seen on Tuesday, signaling that retail traders are seeing the recent correction as an opportunity to buy Bitcoin at a price bottom.

Bitcoin derivatives data on Binance

Bitcoin has wiped out nearly 4% of its value in the past seven days, but price is upnearly 1% on Wednesday, trading at around $67,900. on Binance.

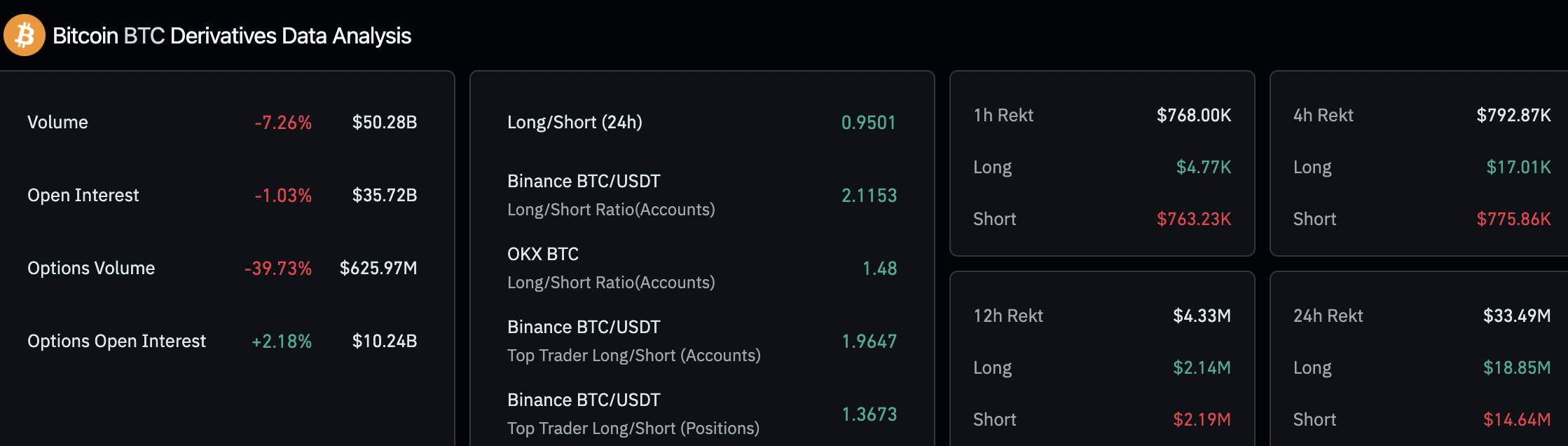

Meanwhile, data from crypto intelligence tracker Coinglass shows that $18.85 million in BTC long positions were liquidated in the past 24 hours following the price correction. The volume of long liquidations exceeds shorts. Despite the large volume liquidation of long positions, retail traders continue to bet on Bitcoin price rise.

Bitcoin derivatives data from Coinglass

BTC is ranging below $68,000 as holders prepare for two major US macro events, the US Federal Reserve’s Federal Open Market Committee (FOMC) meeting and the Consumer Price Index (CPI) report for May. The double-header has the potential to move markets, particularly for riskier assets such as cryptocurrencies.