Bitcoin ETFs Signal Historic Win, But Ethereum Likely to Steal BTC's Spotlight

- Bitcoin ETF approval failed to catalyze gains in BTC, instead Ethereum price rallied and traders turned their capital to the altcoin.

- SEC’s greenlight to Bitcoin ETFs likely fueled anticipation of Ethereum ETF approval, among market participants.

- Ethereum ETF’s final deadline is in May, this could catalyze gains in Ether.

Bitcoin ETF approval marks a key milestone in the crypto ecosystem as the largest cryptocurrency by market capitalization gains acceptance. However, instead of catalyzing gains in Bitcoin, the ETF fueled a rally in Ethereum.

Market participants are in anticipation of an Ethereum Spot ETF approval, this is likely one of the catalysts driving gains in Ether.

Also read: Bitcoin Spot ETF race sees Grayscale capture major share of trades on day 1, BTC price hits two-year peak

Bitcoin ETF approval ushers Ethereum gains

Bitcoin ETFs received Securities and Exchange Commission’s (SEC) greenlight. The watershed moment failed to catalyze BTC gains, instead, to market participants’ surprise, Ethereum price rallied, flipping the 2023 peak (close to $2,400) to support.

Ethereum price climbed to a peak of $2,600, on the first trading day for Bitcoin Spot ETFs. It is likely that capital is rotating from Bitcoin to Ethereum and altcoins, given there is a likelihood of Ethereum Spot ETF approval in May 2024.

ETH/USDT 1-day chart

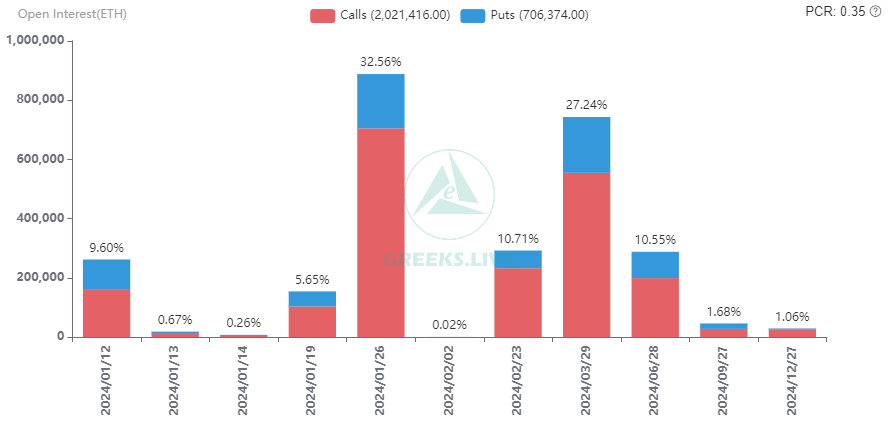

In the weeks and months leading up to Bitcoin ETF approval, derivatives traders anticipated higher Implied volatility in Ethereum in 2024, according to Greeks Live data. The metric represents traders’ expectations of price change. Implied volatility directly influences price of put and call options in the derivatives market. Traders are looking at Ether as the next asset that could receive the SEC’s nod for its Spot ETF.

Open Interest in Ether. Source: Greeks.Live

Why Bitcoin ETFs failed to catalyze a massive rally in BTC

The optimism surrounding Bitcoin ETFs peaked in October 2023. Based on Greeks Live data, the annualized 7-day Implied volatility hit 96% ahead of the SEC’s false announcement on January 10.

Since the ETFs received the SEC’s seal of approval, it has collapsed to 52%. Its important to note that derivatives traders are aware that there is a likelihood of a “sell the news” effect of an event, and this could usher in a decline in options prices as well. Therefore, typically Implied volatility peaks ahead of the key event and tends to decline in the days/ weeks after.

Holding a long position in an asset on a day of a key announcement from a regulator could expose traders to relatively high risk. This is likely to repeat closer to Ethereum ETF approval.

How Ethereum ecosystem stands to benefit from ETH’s rally

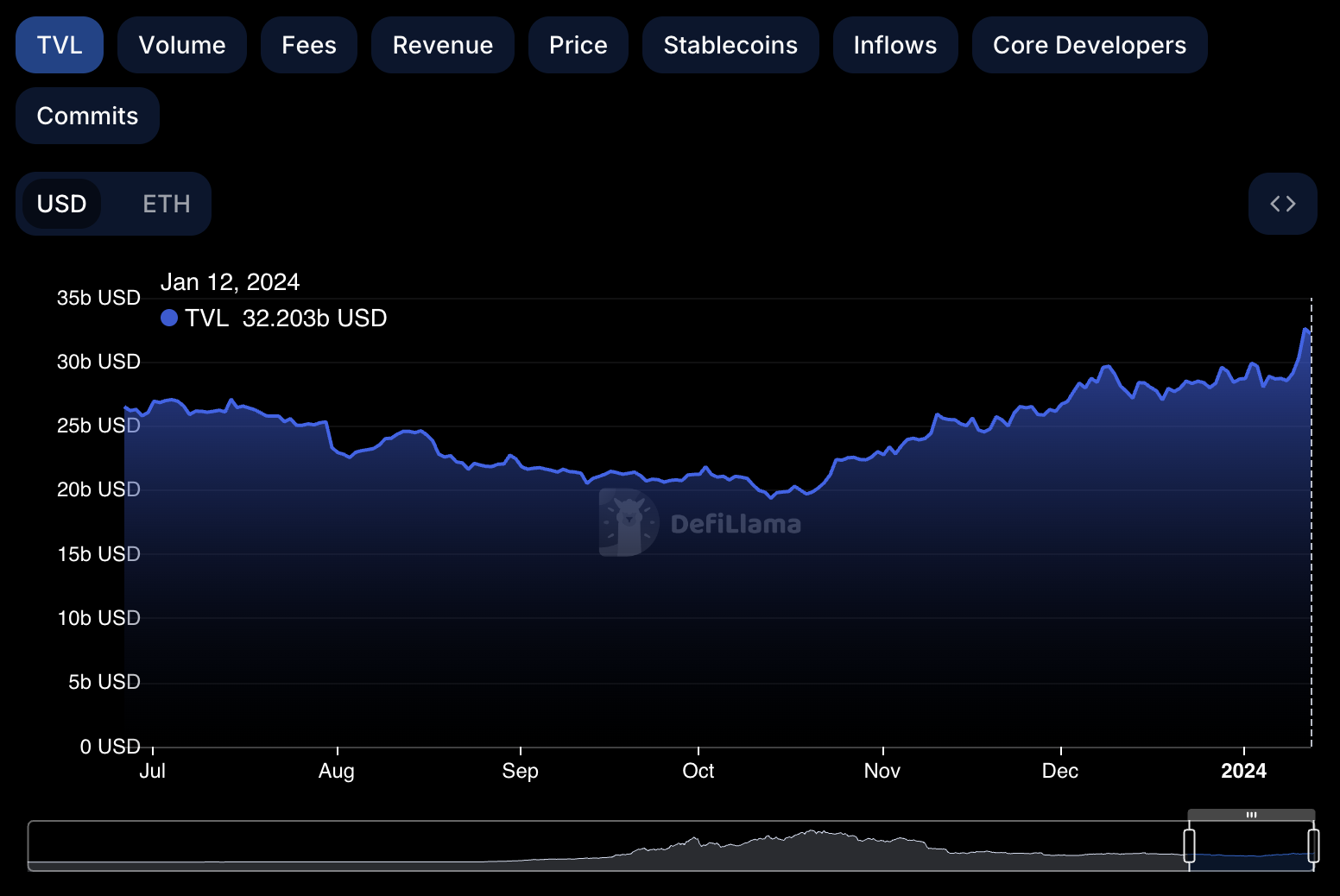

With Ethereum stealing the SEC’s spotlight, the Total Volume of assets Locked (TVL) in ETH’s ecosystem is on the rise. Crypto expert behind the Twitter handle @Axel_bitblaze69 believes that higher TVL translates to higher revenue and this creates a positive feedback loop for all projects in the Ethereum ecosystem.

TVL of Ethereum. Source: DefiLlama

The expert notes that the ETHBTC ratio is at what is termed a “pico bottom,” the beginning of an Ethereum season. The gains in the Ethereum Layer 2 ecosystem and ETH tie back to the approval of Bitcoin ETFs, as Ether traders speculate ahead of the final deadline, in May 2024.

Vitalik Buterin’s comments in the 11th Ethereum Foundation Research Reddit AMA are likely another factor that fueled ETH price gains post BTC ETF approval. In the AMA, Buterin noted that Ether’s gas limit has not been increased for nearly three years and this the longest time in the protocol’s history. In the days leading up to the ETF’s approval, Buterin tweeted about “portfolio diversification” and its benefits.