Why are meme coins crashing?

- Meme coins like Shiba Inu, Dogwifhat and Floki are all down nearly double digits.

- The social volume of these dog-themed crypto coins has plummeted even more in the past 24 hours.

- Bitcoin’s lack of influence seems to play an important role in this slow decay of the crypto market.

The crypto market volatility has undeniably dropped in the past week and can be attributed to the sideways movement of Bitcoin (BTC) price. But despite this downturn, meme coins never failed to surprise investors. Of late, however, meme coins have taken a hit. In the past 24 hours, all dog-themed meme coins like Shiba Inu (SHIB), Dogwifhat (WIF), Floki (FLOKI) and others have shed nearly double-digits in market value.

Also read: Three reasons why meme coin enthusiasts need to stay away from Shiba Inu

Are meme coins fading?

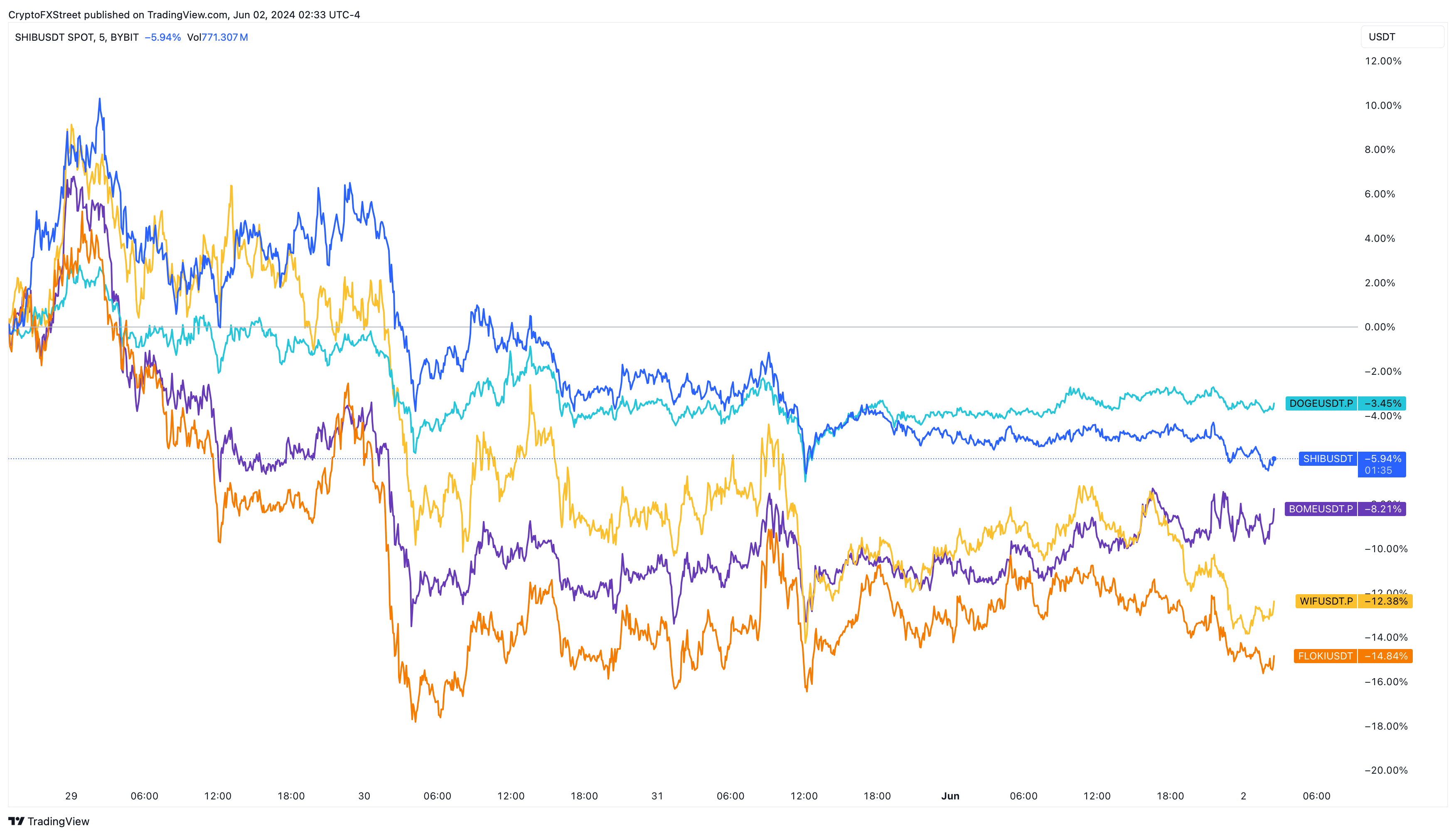

Regardless of Bitcoin’s sideways move, a select few altcoins have always been volatile and moving against the bearish trend. Meme coins were one of the rebel sectors that did this. However, as noted above, SHIB is down nearly 8%, and WIF and FLOKI are also down by 10% each.

Meme coin performance

This effect seems to be applicable to the entire crypto market. The crypto market capitalization is down by $65 billion in less than a week. With the market outlook starting to look bleak, it is likely that investors pull out of risk bets and either rotate their capital into stablecoins or less risky bets. Apart from Bitcoin’s lack of volatility, this could be another reason for meme coins fumbling.

Read more: As random celebs like Caitlyn Jenner embrace Solana Meme Coins, early hoarders fare best

Total crypto market capitalization

As a result, the social volume of these altcoins has also plummeted by more than 20% just int the last 24 hours. Signaling, effectively that the sentiment is also turning negative along with the decline in price.

Meme coins social volume

What to expect next?

Bitcoin’s bleed is unlikely to stop until it finds a stable support level. As mentioned in previous FXStreet publications, these two key levels are roughly $63,000 and $60,000. These footholds are great buy-the-dip levels for patient buyers who missed the initial entry during the May 1 crash.

Until Bitcoin reaches a place of strength, this outlook, whether for meme coins or altcoins, will likely continue. Until this happens, crypto traders are likely going to be playing musical chairs, trying to pick an altcoin winner that will most likely pump and dump. The best option is to exercise restraint and preserve capital until the opportunity rears its head.

Read more: Top trending meme coins BOME, TRUMP, WIF: Bullish signs persist