Ethereum may continue outperforming Bitcoin as 'programmable money' may be ETH's new slogan

- Ethereum community members favor term 'programmable money' as its new slogan before the approval of ETF S-1 applications.

- Santiment analyst expects Ethereum to continue outperforming Bitcoin following sustained whale accumulation.

- Ethereum bulls seem to be stepping on the brakes as they await more clarity on S-1 applications.

Ethereum (ETH) followed a sideways trend on Tuesday as the crypto community seems to favor the term 'programmable money' as ETH's one-liner. Meanwhile, whales have continued accumulating ETH despite profiting from the recent price spike.

Also read: Ethereum may shoot past $4,000 as Michael Saylor believes spot ETH ETF will help Bitcoin

Daily digest market movers: Programmable money & whale accumulation

Ethereum's recent momentum is slowing down as ETF hype appears to be on hold. Here are the latest updates surrounding the largest altcoin:

- Following the approval of spot ETH ETFs, Bloomberg analyst Eric Balchunas suggested that Ethereum needs a simple one-liner like Bitcoin's "digital gold" narrative to penetrate the boomer world. In an X post on Tuesday, he conducted a poll with the top 3 suggestions from the crypto community:

Digital oil

Programmable money

World computer

At the time of writing, programmable money leads the poll with over 50% support.

In response to questions about when the SEC will approve spot ETH ETF S-1 applications, Nate Geraci, President of the ETF Store, said, "Nobody knows for sure." However, he speculated that the registration may happen within the next few weeks or at a maximum of two to three months.

Read more: Ethereum price yet to react to ETF approval, experts share reason for SEC's change of mind

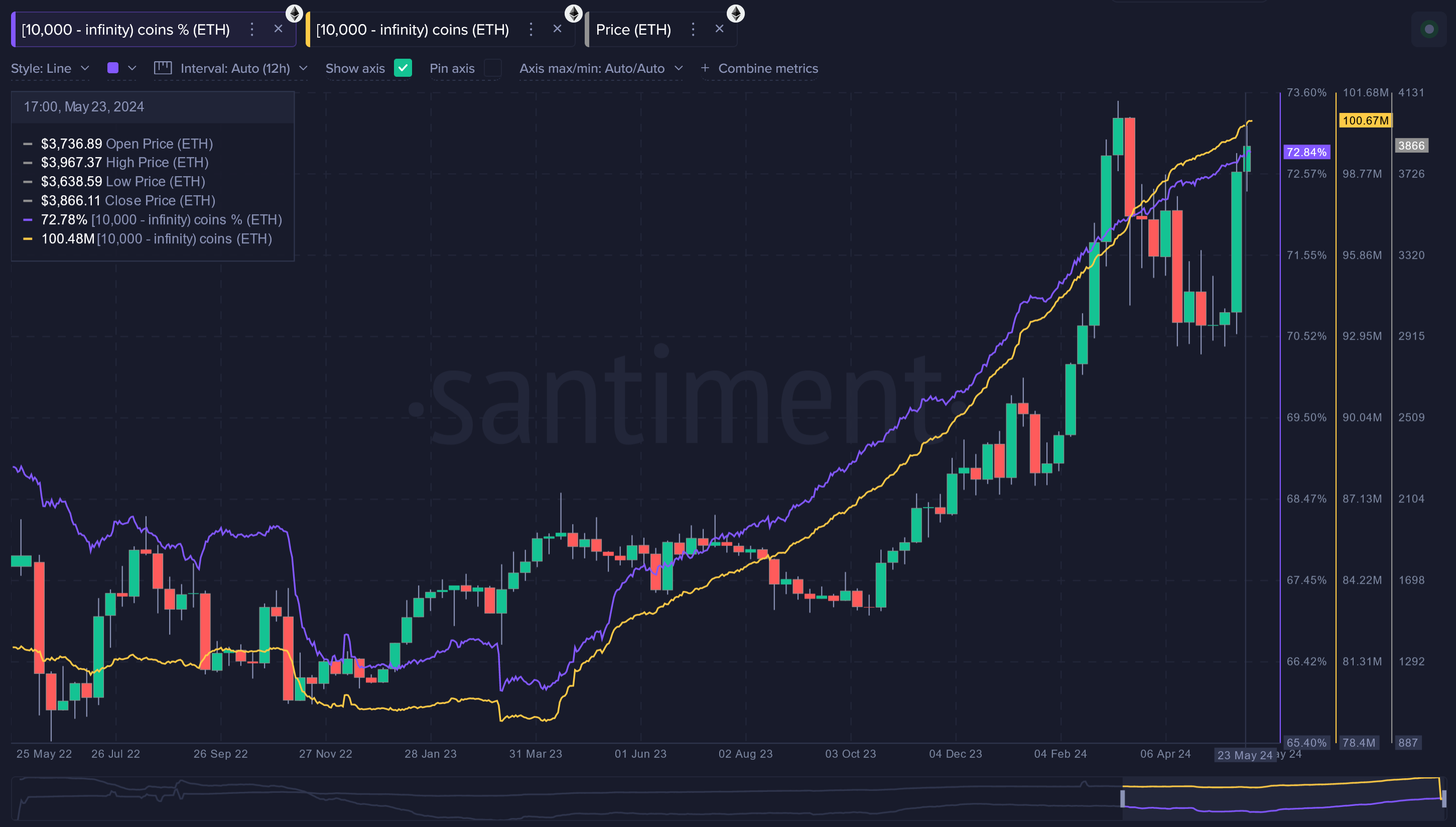

- In a recent analysis, Santiment analyst @brianq noted that Ethereum whales (wallets with at least 10,000 ETH) have accumulated about 21.39 million ETH in the past 14 months, i.e., 27% more than their initial holdings. @brianq suggested that this is a promising sign as it indicates ETH's price has the potential to continue rising.

ETH whale activity

- Several ETH investors earlier complained of its poor price performance compared to Bitcoin in the past few months. However, the rumors and eventual approval of spot ETH ETF 19b-4 filings helped the largest altcoin outperform Bitcoin in the past month. While whale activity spiking around the same time indicates profit taking, ETH "prices may continue to outperform Bitcoin as long as these 10K ETH wallets are still moving north instead of south through this volatility," said @brianq.

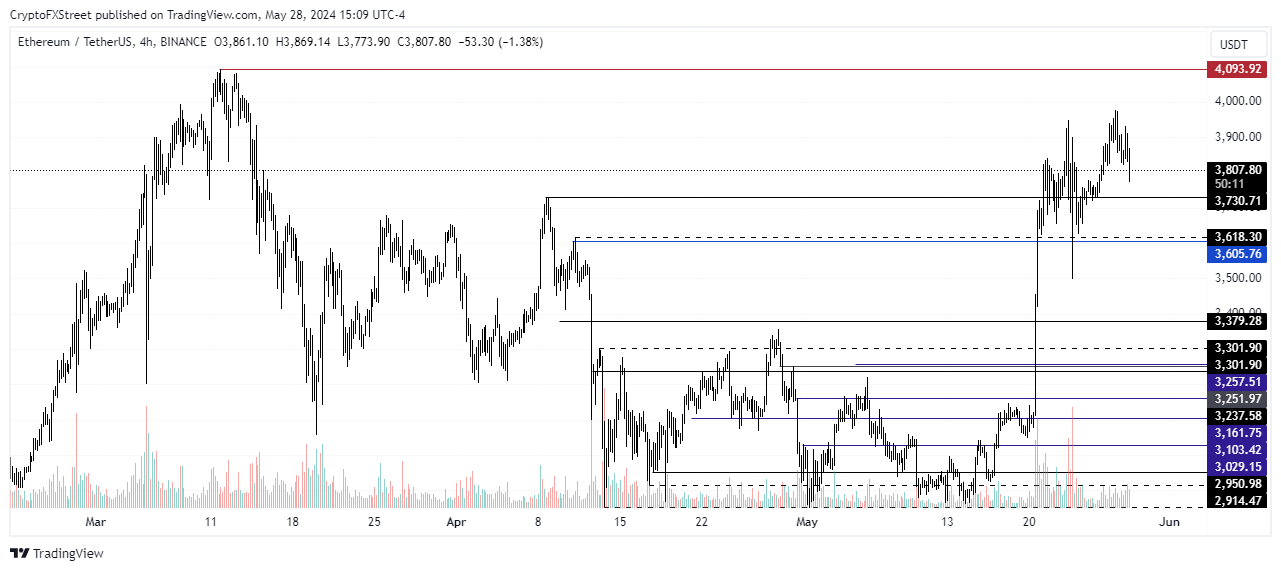

ETH technical analysis: Ethereum bulls halt momentum

Ethereum is trading around $3,837 on Tuesday as it enters a sideways movement. While current price movement suggests bulls may be running out of steam, it may also indicate a temporary slowdown until the market receives clarity on conversations surrounding the spot ETH ETF S-1 approvals.

Also read: Ethereum on the brink of 75% rally as SEC approves ETH ETFs

ETH needs a catalyst to break past the $4,000 key level, and that may come from optimistic updates surrounding the S-1 approval.

ETH/USDT 4-hour chart

The general crypto market is also trending horizontally, meaning the sideways move isn't peculiar to ETH. The $3,605 support level remains key in case of a potential brief bearish trend.

ETH liquidations show long liquidations at $27.99 million and shorts at $6.03 million in the past 24 hours. This also confirms the brief halt in bullish momentum.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Serving as the basal network for the Ether (ETH) cryptocurrency, it is the second largest crypto and largest altcoin by market capitalization. The Ethereum network is tailored for scalability, programmability, security, and decentralization, attributes that make it popular among developers.

Ethereum uses decentralized blockchain technology, where developers can build and deploy applications that are independent of the central authority. To make this easier, the network has a programming language in place, which helps users create self-executing smart contracts. A smart contract is basically a code that can be verified and allows inter-user transactions.

Staking is a process where investors grow their portfolios by locking their assets for a specified duration instead of selling them. It is used by most blockchains, especially the ones that employ Proof-of-Stake (PoS) mechanism, with users earning rewards as an incentive for committing their tokens. For most long-term cryptocurrency holders, staking is a strategy to make passive income from your assets, putting them to work in exchange for reward generation.

Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) mechanism in an event christened “The Merge.” The transformation came as the network wanted to achieve more security, cut down on energy consumption by 99.95%, and execute new scaling solutions with a possible threshold of 100,000 transactions per second. With PoS, there are less entry barriers for miners considering the reduced energy demands.