Ethereum may shoot past $4,000 mark as Michael Saylor softens tone on spot ETH ETF

- Ethereum bulls push ETH's price as Fear and Greed Index shows investors' overconfidence.

- Michael Saylor changes perspective, now believes spot ETH ETFs are net positive for Bitcoin.

- Ethereum Pectra upgrade scheduled to launch in Q1 2025.

Ethereum (ETH) gained nearly 3% on Monday as investors exhibited high bullish sentiment. Michael Saylor also commented on the recent spot ETH ETF approval by the Securities & Exchange Commission (SEC).

Also read: Ethereum price yet to react to ETF approval, experts share reason for SEC's change of mind

Daily digest market movers: Bullish sentiment, Michael Saylor, Pectra upgrade

Following ETH's price gain on Monday, trading firm QCP Capital noted that market participants are becoming more bullish on the largest altcoin, considering potential institutional demand when spot ETH ETFs go live.

ETH has gained about 27% since last week after it became apparent that the SEC would approve issuers' 19b-4 filings submitted by exchanges. While the regulator has yet to approve S-1 applications, several analysts have expressed that these approvals are a matter of when and not if; hence, most investors are extremely bullish. This is visible in the ETH Fear and Greed Index, which hit 76 on Wednesday, signifying increased investor confidence.

However, QCP Capital noted, "While we are structurally positive ETH, we don't see a major breakout until we have more clarity on the S-1 approvals and get some inflow data, which should only be a matter of time."

Read more: SEC approves spot Ethereum ETFs after shocking U-turn

Meanwhile, Grayscale CEO Michael Saylor, who earlier predicted that the SEC would deny spot ETH ETF applications, has said, "You have to rethink all your models" after the approval. He said that a spot Ethereum ETF is good for Bitcoin as it, together with other crypto assets, "serves as another line of defense for Bitcoin."

Also, Ethereum developers have projected Q1 2025 to potentially launch the Pectra upgrade after the Dencun upgrade in March. Pectra will feature several updates, including:

- Ethereum Improvement Proposal EIP-7251, which will increase the limit of maximum number of staked ETH per validator from 32 ETH to 2,048 ETH.

- EIP-7702 replacing EIP-3074 to enable account abstraction where Ethereum addresses can temporarily function as smart contracts during a transaction.

- Ethereum Virtual Machine Object Format (EOF), aimed at improving the EVM code framework for the Main Chain and Layer 2 functionalities.

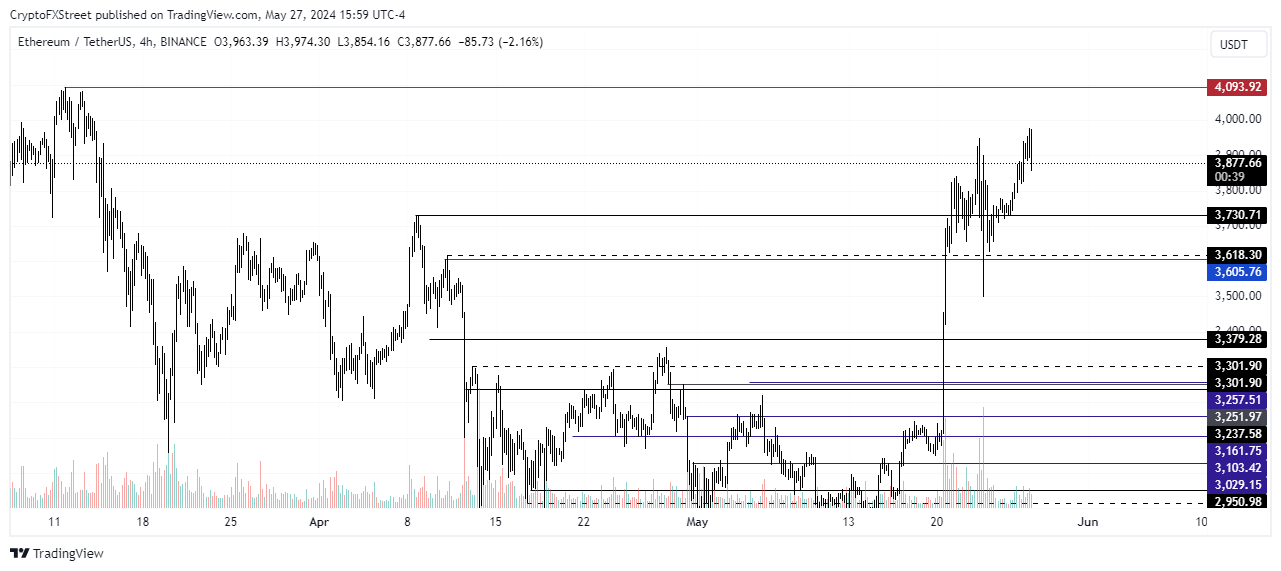

ETH technical analysis: Ethereum attempts to break past key level

Ethereum is trading around $3,924 on Monday after gaining nearly 3%. ETH bulls are showing strength with only $7.76 million in long liquidations compared to $15.59 million in short liquidations.

While ETH has rejected the $4,000 key level twice since the ETF approval, it may break past this level when the market fully resumes on Tuesday. If ETH successfully overcomes $4,000, it would aim for the $4,093 resistance — its highest level since December 2021. The $3,605 level may serve as a good support level in case the bullish momentum cools.

ETH/USDT 4-hour chart

However, many expect ETH to see more significant gains in the coming weeks as it's barely performed in this cycle compared to previous cycles. Additionally, spot ETH ETF inflows after potential issuers' S-1 approvals would help boost ETH price to a new all-time high above $4,878.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Serving as the basal network for the Ether (ETH) cryptocurrency, it is the second largest crypto and largest altcoin by market capitalization. The Ethereum network is tailored for scalability, programmability, security, and decentralization, attributes that make it popular among developers.

Ethereum uses decentralized blockchain technology, where developers can build and deploy applications that are independent of the central authority. To make this easier, the network has a programming language in place, which helps users create self-executing smart contracts. A smart contract is basically a code that can be verified and allows inter-user transactions.

Staking is a process where investors grow their portfolios by locking their assets for a specified duration instead of selling them. It is used by most blockchains, especially the ones that employ Proof-of-Stake (PoS) mechanism, with users earning rewards as an incentive for committing their tokens. For most long-term cryptocurrency holders, staking is a strategy to make passive income from your assets, putting them to work in exchange for reward generation.

Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) mechanism in an event christened “The Merge.” The transformation came as the network wanted to achieve more security, cut down on energy consumption by 99.95%, and execute new scaling solutions with a possible threshold of 100,000 transactions per second. With PoS, there are less entry barriers for miners considering the reduced energy demands.