Arbitrum community opens vote for 200 million ARB Gaming Catalyst Plan proposal

- Arbitrum community has opened a snapshot vote for Gaming Catalyst Plan proposal, to allocate 200 million ARB.

- The Arbitrum Foundation will create legal entities to support the Gaming Catalyst Program and Fund.

- ARB price sustains 17.60% gains from the week, rallies to $1.2176 on Sunday.

Arbitrum community opened a vote for its Gaming Catalyst Program (GCP) to boost support for game builders in the ARB ecosystem. The plan is to strategically allocate 200 million ARB to game projects within Arbitrum. The token has sustained its gains from the week.

Arbitrum sustains gains from the week as community votes on GCP

Focused on strategically allocating resources to game builders within the Arbitrum ecosystem, the community has opened a snapshot vote for the Gaming Catalyst Program.

The concept is to allocate 200 million ARB to projects within the ecosystem and evaluate whether the Decentralized Autonomous Organization (DAO) has reached a consensus.

The foundation will use time and resources to create legal entities for the Game Working Group, considered the interim custodian until the mission is defined and the DAO approval obtained.

The necessary details of the proposal will be mapped out and submitted to the DAO. The group will return with a final staffing plan and interim funding request within 30 days of the proposal’s adoption.

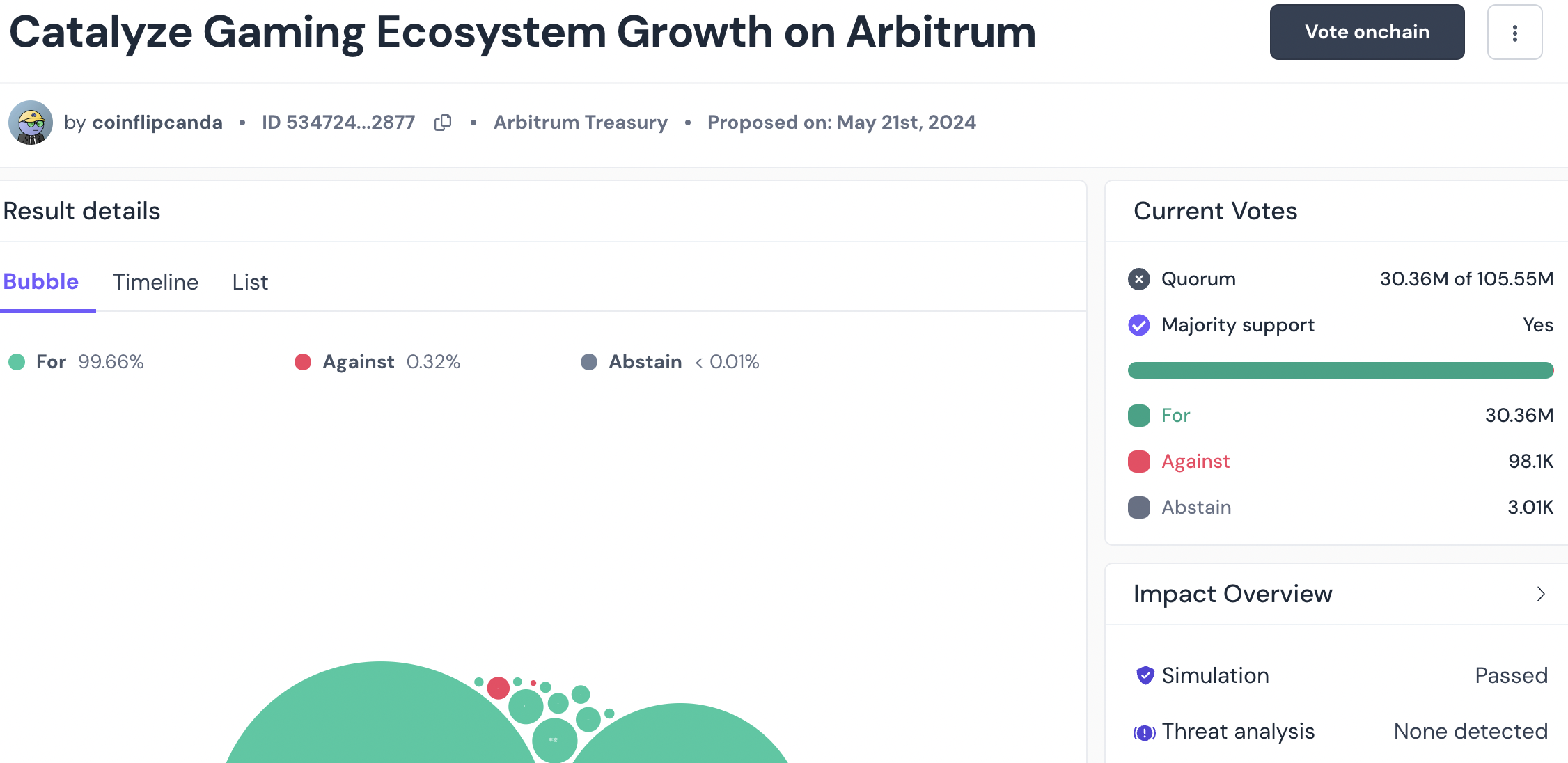

The proposal has majority support as seen on Tally.xyz.

Arbitrum vote on catalyzing gaming ecosystem growth

At the time of writing, ARB price is $1.1927, up nearly 20% since Sunday, May 12.

ARB has sustained its gains of 17.60% from the week, rallying towards the May 23 high of $1.2600.