ONDO extends gains by 4% with rise in non-empty wallets, hits new all-time high

- Ondo extended gains by 75% increase in the past 11 days, per crypto intelligence tracker Santiment.

- The token ranks among top trending assets on the platform, with a massive spike in non-empty wallets.

- ONDO added 4% value to its price on Sunday, sustaining 40% gains from the week.

Data from crypto intelligence tracker Santiment shows that Ondo ranks among top trending tokens among cryptocurrency. The token has added 75% to its value in the past eleven days, per Santiment’s recent tweet on X.

ONDO hits new all-time high, extends gains

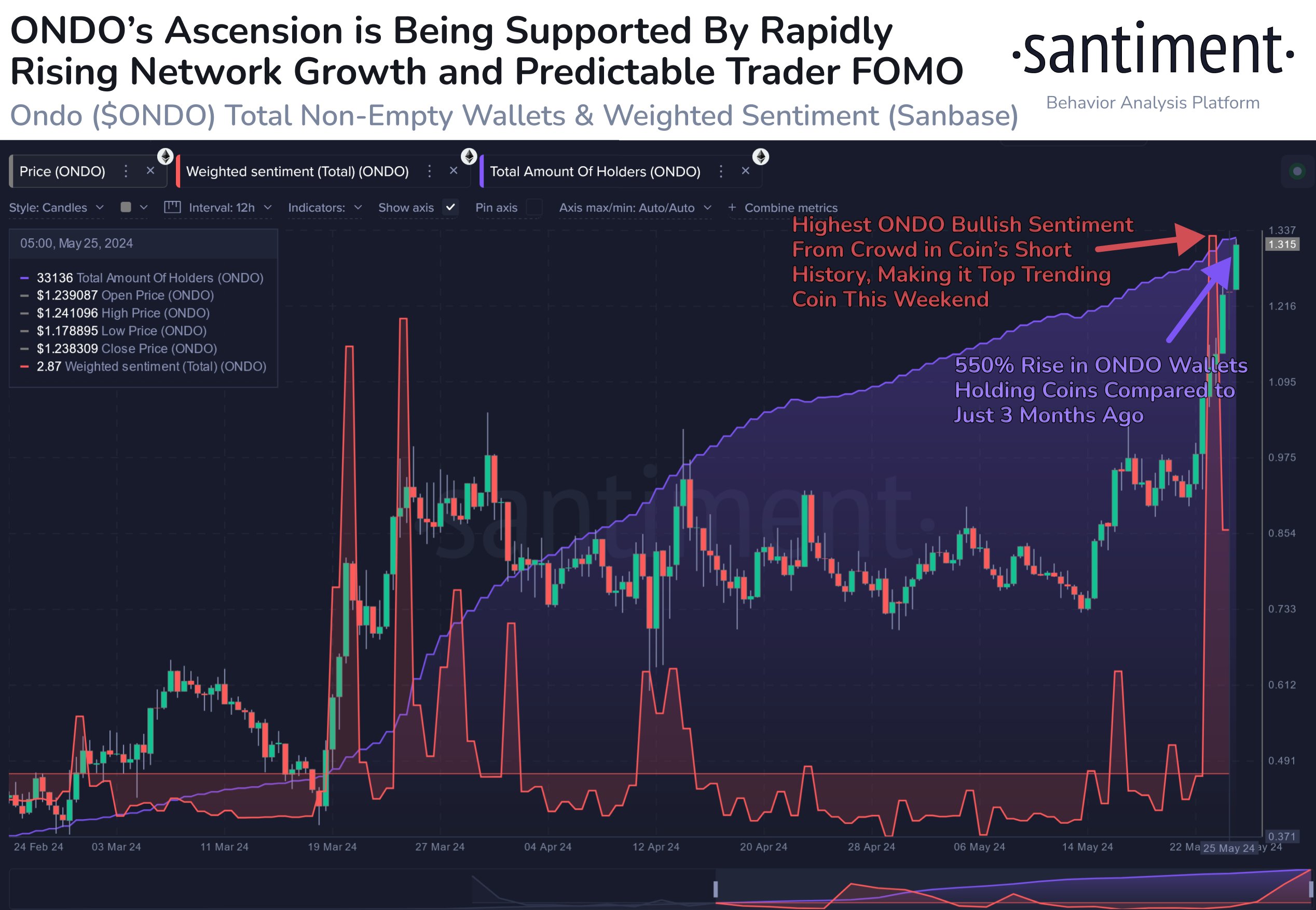

ONDO ranks among top trending tokens in cryptocurrencies and the token’s non-empty wallet count has increased 550% between February 26 and May 26, per Santiment data. The chart shows that the recent all-time high in ONDO corresponded with the highest bullish sentiment from the crowd in the token’s history.

The public blockchain’s token is the top trending asset on Santiment.

Ondo’s growth in non-zero wallets

Real-world asset (RWA) tokenization has taken center stage with rallies in assets like ONDO and TOKEN. Crypto analyst TimelessBeing shared their take on RWA in a recent tweet on X.

$RWA is in full focus at the moment

— TimelessBeing (@Timeless_Crypto) May 25, 2024

Massive moves across the board this week with momentum evident in leaders like $ONDO and $TOKEN

Another spot bag ive added to is $TOKEN with a lot of potential runway from this juncture

We simply position in perceived winners and wait… pic.twitter.com/cUqxnchKQX

The analyst behind the X handle @el_crypto_prof notes that RWA projects “shine” in response to the Ethereum ETF approval news.

ONDO price is $1.2857 on Binance, at the time of writing. The token hit a new all-time high of $1.33 early on Sunday, and extended gains by nearly 4% on the day. The RWA token has sustained nearly 40% gains from the week.

ONDO could extend gains further by nearly 20% and rally to the 127.2% Fibonacci extension of the rally from the March 19 low of $0.3850 to the May 26 high of $1.3300. In the event of a correction and a failure to close above May 25 high of $1.2500, ONDO could sweep support at $1.047, the May 24 low of the token.

Traders looking to enter a trade in ONDO need to be cautious as momentum indicator Relative Strength Index (RSI) signals the asset is overbought. RSI is 77.82, well above the 70 level. The Moving Average Convergence Divergence (MACD) indicator shows underlying positive momentum in ONDO price uptrend.

ONDO/USDT 1-day chart