US Presidential candidate Donald Trump is open minded to cryptocurrency, supports right to self custody

- US Presidential candidate Donald Trump embraces crypto, says he is open-minded towards crypto companies.

- Trump says that US must be the leader in the field and there is no second place, in his post on Truth Social.

- Trump says he will support the right to self custody for the country’s 50 million crypto holders.

US Presidential candidate Donald Trump shared positive views on crypto, posting on social media platform, “I am very positive and open minded to cryptocurrency companies and all things related to this new and burgeoning industry.”

Crypto has emerged as a key topic in the upcoming presidential election in the US with Trump expressing his support for self custody.

Donald Trump addresses pro-crypto voters on social media

Per a report from Washington-based Politico, crypto is used by a fraction of the voters in America. Despite this it has an outsized impact on US politics. Cryptocurrency firms and groups are preparing to spend over $80 million in 2024 elections, per the report.

The Federal Reserve’s May 2024 report on “Economic Well-being of US households” shows that only 7 percent of adults held or used cryptocurrency in 2023, a decline of 5 percentage points from 2021.

US Presidential candidate Trump posted on his Truth Social account,

I am very positive and open minded to cryptocurrency companies and all things related to this new and burgeoning industry. Our country must be the leader in the field and there is no second place.

Trump supports US voters’ right to self custody of crypto and has taken a pro-crypto stance in the elections, per his posts on social media, and his statements when addressing rallies.

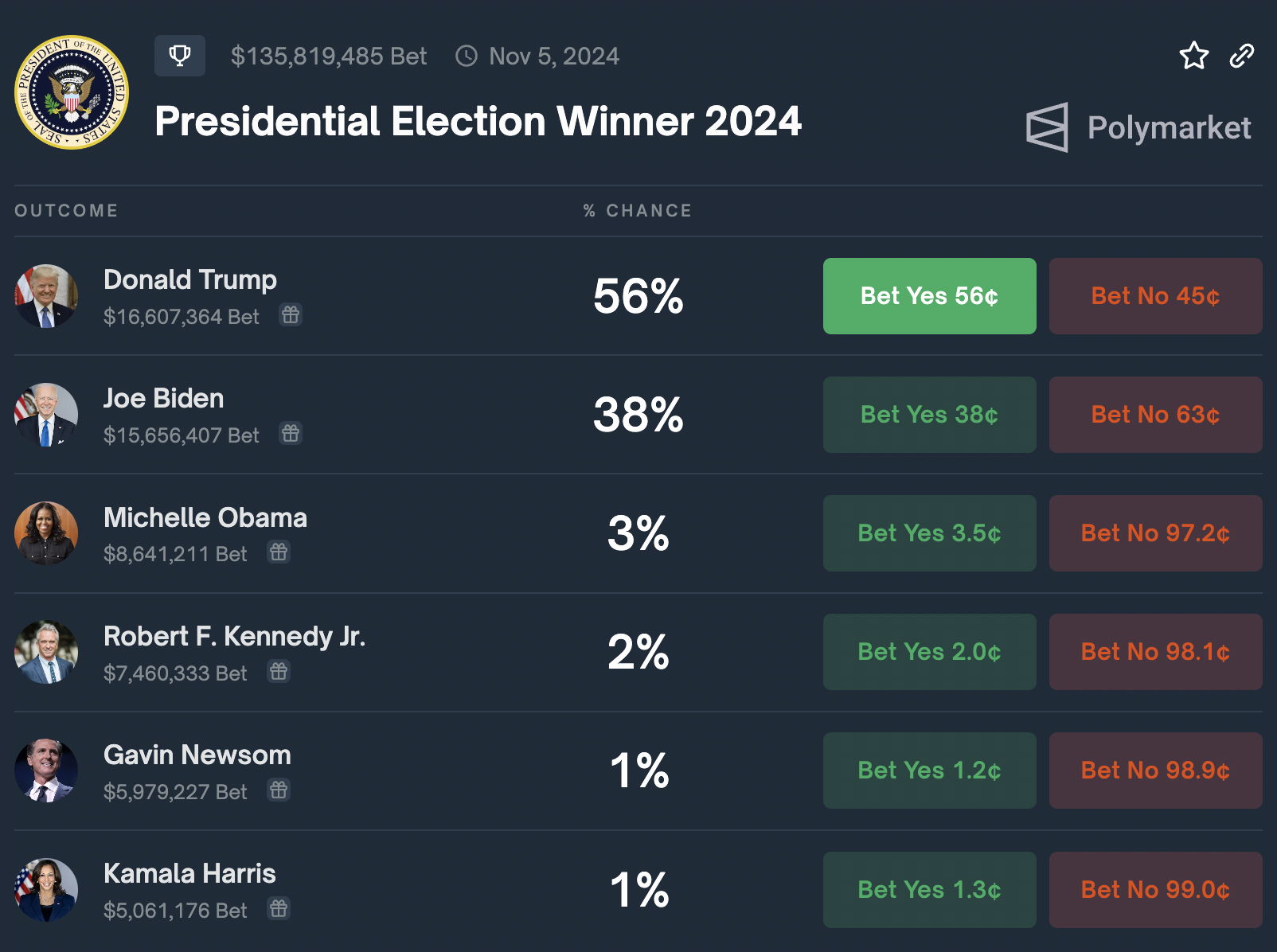

The Polymarket prediction platform shows that there is 56% chance of former President Trump winning the US election.

US Presidential campaign bet on Polymarket

With a crypto bill FIT21 being passed in one House of the Congress and crypto’s dominant role in the Presidential elections, it remains to be seen how Securities and Exchange Commission’s (SEC) lawsuits against Ripple and Coinbase will end.