Ethereum price lags after ETF approval, experts share reason for SEC's change of mind

- Ethereum ETFs were approved partly because of Bitwise's correlation analysis.

- Analysts expect spot ETH ETF to disappoint due to key metrics.

- Ethereum faces temporary sell-off after its first double-digit gain in months.

Ethereum declined briefly on Friday as experts weighed in on why the Securities & Exchange Commission (SEC) approved spot ETH ETF applications and when to expect S-1 comments from the agency.

Read more: SEC approves spot Ethereum ETFs after shocking U-turn

Daily digest market movers: Why SEC approved ETH ETFs

Several experts have pointed out that the SEC approved 19b-4 spot ETH ETF filings on Thursday due to spot ETH price’s high correlation with CME Ethereum futures prices, similar to that of Bitcoin. As a result, it concludes that spot ETH is tightly linked to the regulated CME futures market. The SEC used Bitwise's correlation analysis filed with its spot ETH ETF to arrive at this conclusion.

Bitwise is publishing a new correlation analysis today as part of its new spot Ethereum ETF filing.

— Bitwise (@BitwiseInvest) March 28, 2024

This is the first ETH correlation analysis to replicate the specific methodology used by the SEC in their evaluation of bitcoin, and the results are encouraging.

The correlation… pic.twitter.com/dOLh0F50BE

Immediately after the ETFs were approved, Van Eck submitted an amendment to its S-1 application. This follows amended S-1 submissions from Fidelity and Grayscale.

BlackRock also unveiled ETHA as the ticker for its spot ETH ETF, according to a listing on DTCC.

Scott Johnsson, a general partner at Van Buren Capital, mentioned that the SEC's pace and breadth of first comments on S-1 filings are key to watch as they are the next key steps before a spot ETH ETF launch.

Bloomberg analyst Eric Balchunas speculated that the SEC's comments may come in four to six weeks. He also noted that one of the challenges ETH ETFs will face in attracting boomers is "distilling its purpose/value into an easy-to-understand sound bite a la "Bitcoin is digital gold."

Also read: Ethereum on the brink of 75% rally as SEC approves ETH ETFs

According to crypto researcher Noelle Acheson, spot ETH ETFs will meet a disappointing reception when they launch. He highlighted the CME's low interest in ETH derivatives — ranking fifth — as a signal suggesting spot ETH ETFs may not be attractive.

"The relatively low participation from the same institutions that will probably be expected to pour into the ETH spot ETF upon launch, suggests that the initial inflows could be disappointing," Acheson said.

He also pointed to ETH accounting for only 15% of the total assets under management (AUM) of Hong Kong's spot crypto ETFs. Additionally, he shared how some investors may not be willing to part ways with their staking yields to subscribe to these ETFs, as many experts suggest the SEC may not allow issuers to stake their assets.

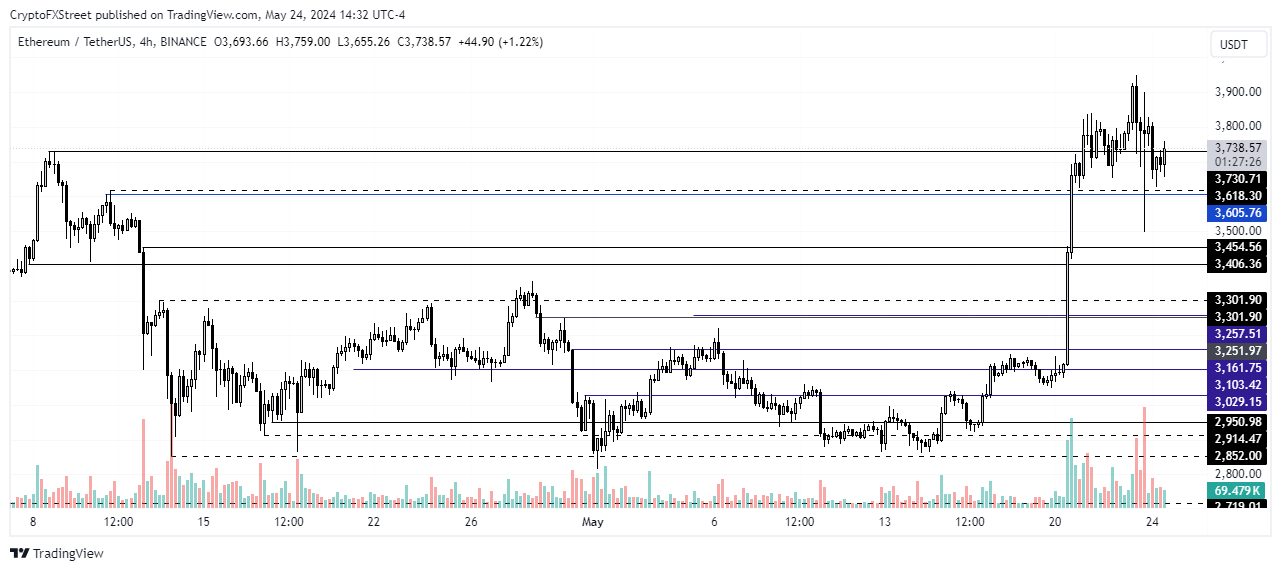

ETH technical analysis: Ethereum sell-off may be temporary

Ethereum is trading around $3,730 on Thursday after moving below the $3,730 price level. In the case of a further decline, the next level to watch out for is the $3,605 support. While prices have yet to react to the 19b-4 spot ETH ETF filings approval, the market may be awaiting the final approval of S-1 applications and the official launch before taking action.

ETH/USDT 4-hour chart

That said, investors may temporarily take profits at this level, considering the recent rise is ETH's first double-digit gain in nearly two months. With over 91% of holders in profit, ETH may have faced huge sell-offs ordinarily if there had been no expectation for a spot ETH ETFs.

Read more: Ethereum bulls await ETF approval as BlackRock, Bitwise, Grayscale submit amended ETH ETF filings

However, ETH is expected to rally in the coming weeks and set a new all-time high above $4,878 when spot ETH ETFs eventually launch. Coupled with this, as many didn't price in the approval of an ETF, ETH may likely trade higher in the coming weeks. This bullish thesis will be invalidated if ETH declines 10% to below the $3,301 support.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Serving as the basal network for the Ether (ETH) cryptocurrency, it is the second largest crypto and largest altcoin by market capitalization. The Ethereum network is tailored for scalability, programmability, security, and decentralization, attributes that make it popular among developers.

Ethereum uses decentralized blockchain technology, where developers can build and deploy applications that are independent of the central authority. To make this easier, the network has a programming language in place, which helps users create self-executing smart contracts. A smart contract is basically a code that can be verified and allows inter-user transactions.

Staking is a process where investors grow their portfolios by locking their assets for a specified duration instead of selling them. It is used by most blockchains, especially the ones that employ Proof-of-Stake (PoS) mechanism, with users earning rewards as an incentive for committing their tokens. For most long-term cryptocurrency holders, staking is a strategy to make passive income from your assets, putting them to work in exchange for reward generation.

Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) mechanism in an event christened “The Merge.” The transformation came as the network wanted to achieve more security, cut down on energy consumption by 99.95%, and execute new scaling solutions with a possible threshold of 100,000 transactions per second. With PoS, there are less entry barriers for miners considering the reduced energy demands.