AI, meme coins and prediction market tokens soar ahead of Ethereum ETF decision

- Crypto tokens in the Artificial Intelligence, meme coin and prediction markets category are rallying ahead of the Spot Ether ETF decision.

- AI, cat-themed meme coins, Solana-based meme tokens, prediction market assets added between 4% and 71% to their market cap in 24 hours.

- Spot Ethereum ETF anticipation has renewed optimism, nearly a third of the altcoins in top 20 posted gains.

Ethereum extended gains by 30% in the past seven days, as seen on CoinGecko. The optimism among market participants soared ahead of the Spot Ethereum Exchange Traded Fund (ETF) results. Several categories of altcoins, Artificial Intelligence (AI), cat-themed, Solana-based meme coins and prediction market tokens extended gains in the past 24 hours.

AI category tokens added 71% to their market capitalization, cat-themed meme coins added nearly 14%, Solana-based meme coins nearly 19% and prediction market tokens’ market cap increased by 4.5%.

AI, cat-themed and Solana-based meme coins extend gains

The crypto fear and greed index, a crypto market sentiment analysis tool, reflects extreme greed on Thursday, in the past week and in the month of May. Extreme greed implies tokens may be overvalued, or the market may be approaching a bubble, according to Zerocap.

Fear and Greed Index

Amidst increasing greed levels, AI, cat-themed meme tokens, Solana-based meme coins and prediction market tokens have witnessed increases in market capitalization, as seen on CoinGecko.

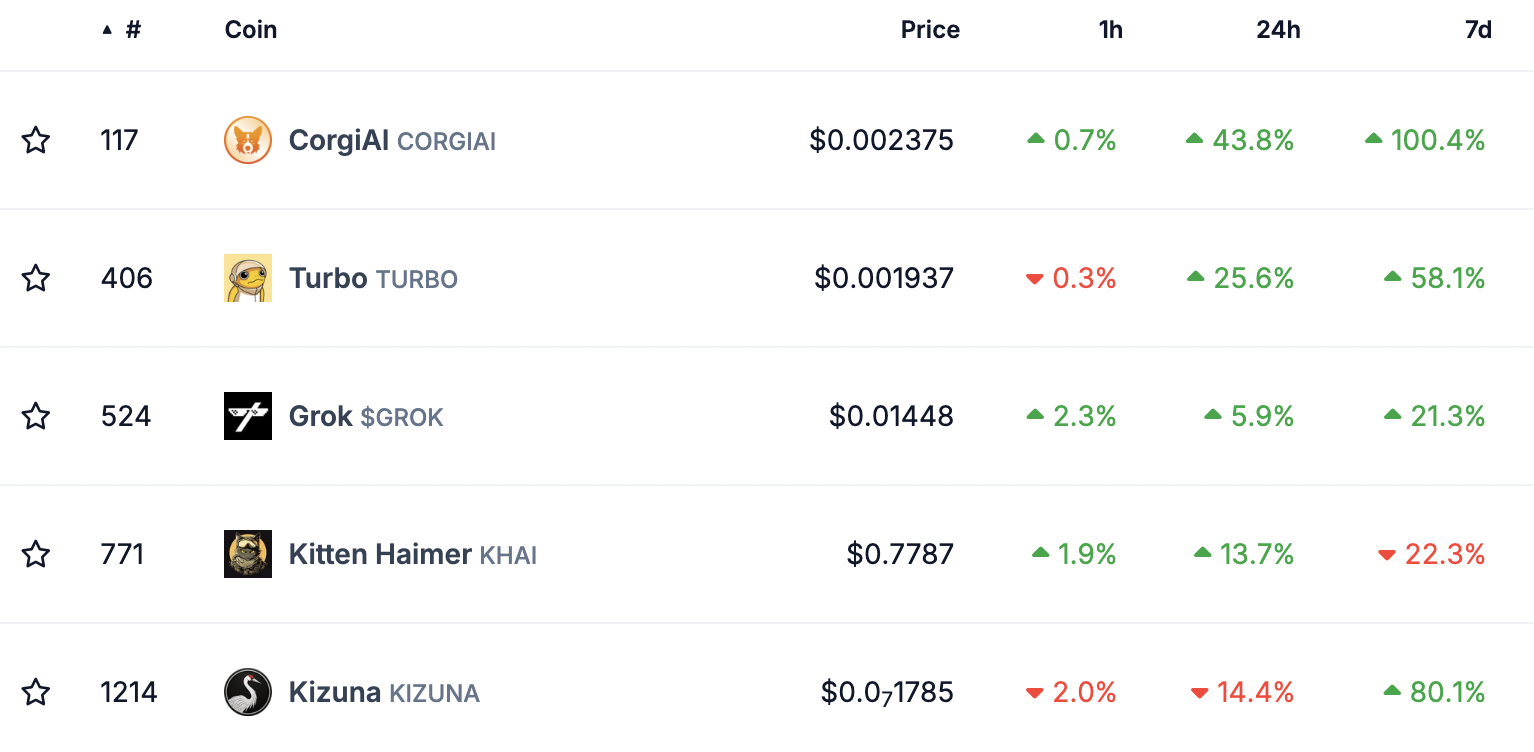

AI-based meme coins CorgiAI (CORGIAI), Turbo (TURBO), Grok (GROK) and Kitten Haimer (KHAI) rallied 43.8%, 25.6%, 5.9%, and 13.7%, respectively, in the past 24 hours. CORGIAI, TURBO, and GROK have sustained double-digit gains over the past seven days.

AI-based meme coins

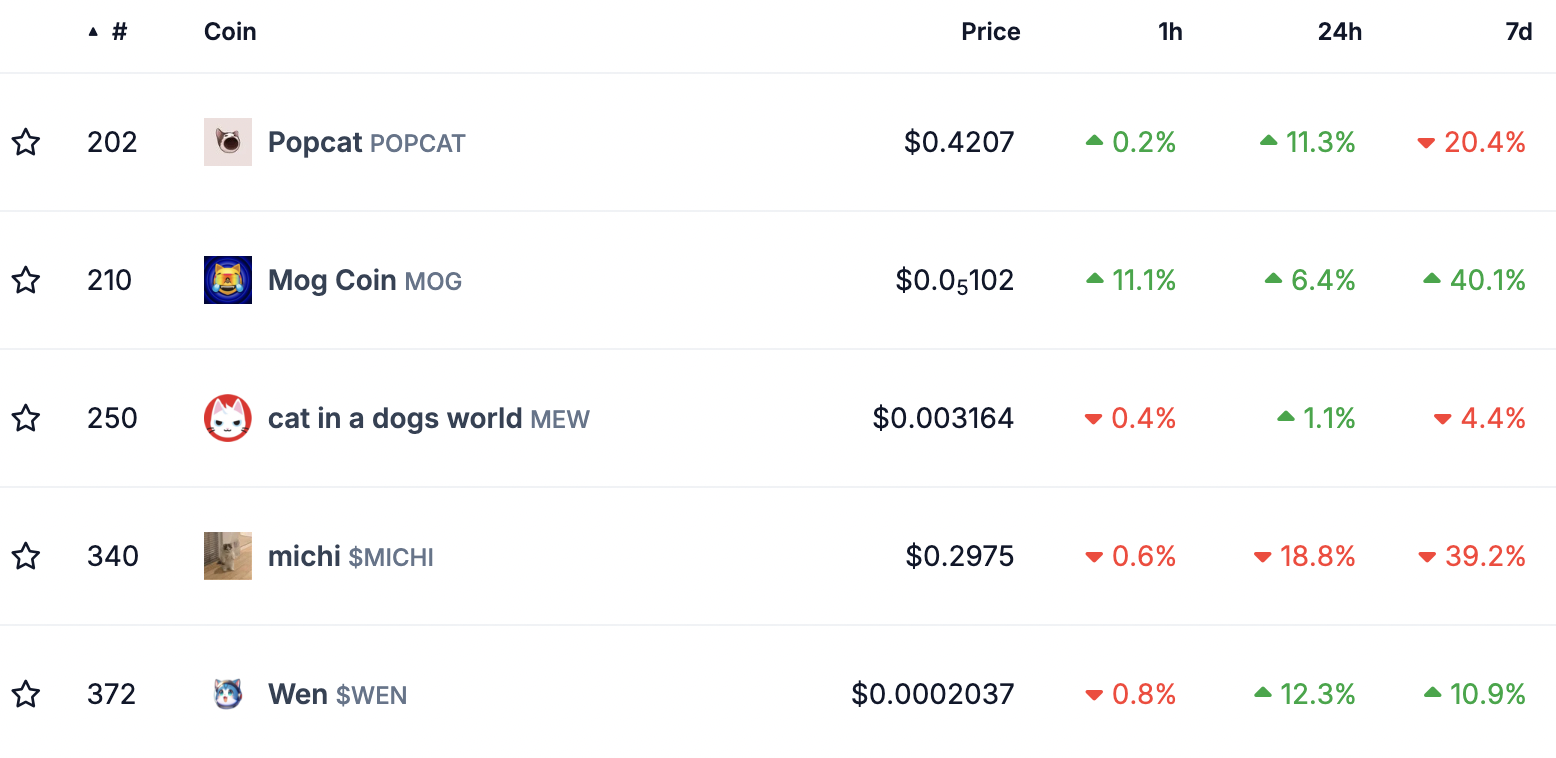

Cat-themed meme coins Popcat (POPCAT), Mog Coin (MOG), cat in a dogs world (MEW) and Wen (WEN) added 11.3%, 6.4%, 1.1% and 12.3% gains in the past 24 hours. Of these assets, MOG and WEN sustained their seven-day gains of 40% and 10%, respectively.

Cat-themed meme coins

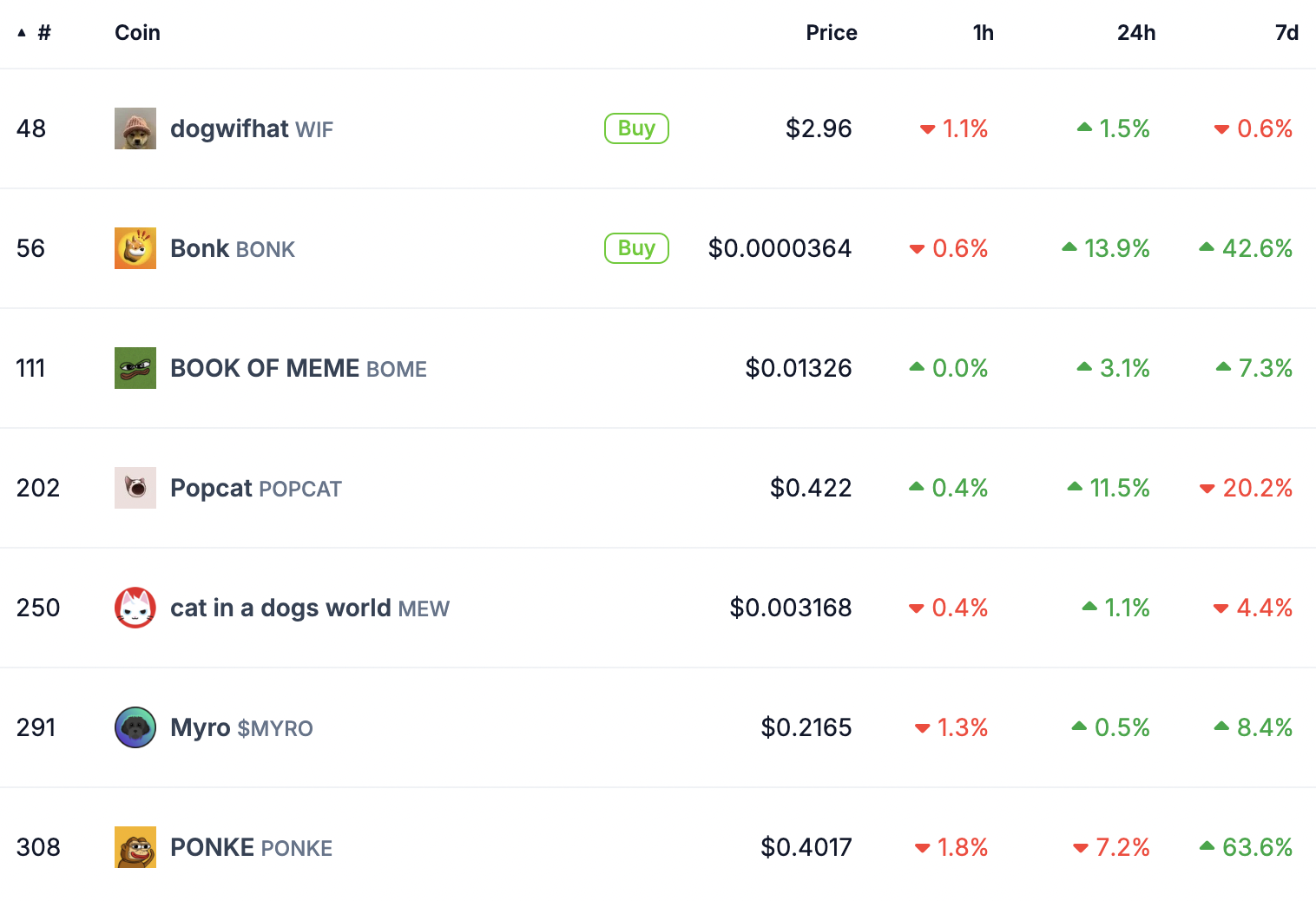

Solana-based meme coins Dogwifhat (WIF), Bonk (BONK), BOOK OF MEME (BOME) and Myro (MYRO) added 1.5%, 13.9%, 3.1%, 11.5% and 0.5% value to their prices in the past 24 hours. Of these assets, BONK, BOME, MYRO and PONKE sustained their gains over the past seven days.

Solana-based meme coins

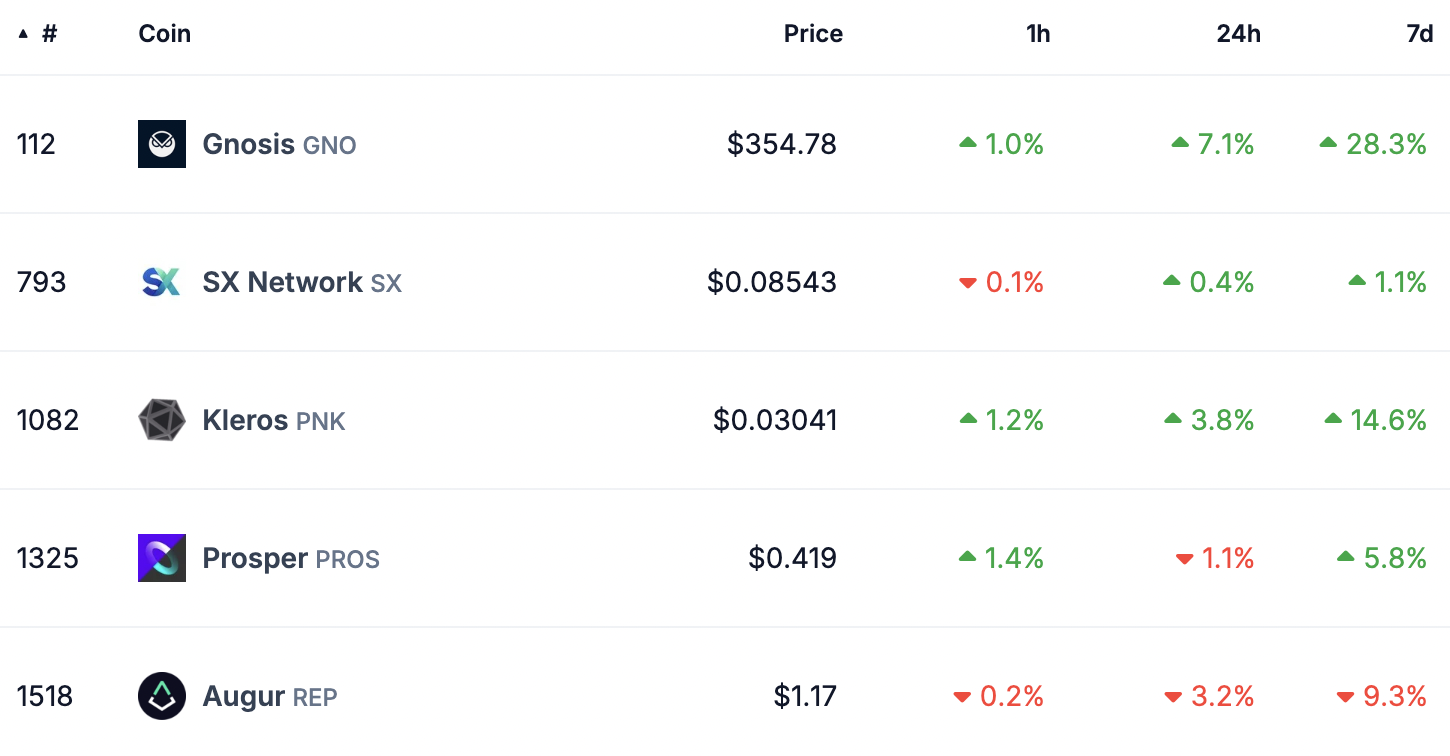

Among prediction market tokens, Gnosis (GNO), SX Network (SX) and Kleros (PNK) rallied 7%, 0.4% and 3.8% in the past 24 hours. These tokens have extended their gains from the past seven days, as seen on CoinGecko.

Prediction market tokens

Given the “extreme greed” state of the market assessed by the Fear and Greed Index, traders could take profits in assets that are rallying, fearing a correction or an approaching bubble. Nearly a third of the top 20 cryptocurrencies by market capitalization have seen a positive gain in their prices as market participants await the US Securities and Exchange Commission’s (SEC) decision on the Spot Ethereum ETF.