Another run to Bitcoin all-time high would be completely realistic, for these reasons

- Crypto analysts evaluated the market trend and noted the mass creation of meme coins and inflow to Bitcoin ETFs.

- While the market’s sentiment may be negative on X, analysts argue that this does not align with capitulation.

- Social and on-chain data and meme coin analysis show that another attempt at BTC all-time high is likely.

Crypto analysts at intelligence tracker Santiment provided an overview of the crypto market and compared Bitcoin and meme coin performance with previous cycles, sharing its implications in a recent tweet on X.

Bitcoin could make another attempt to hit its all-time high, according to analysts.

Bitcoin could take another chance at rallying towards all-time high

Santiment analysts evaluated social and on-chain data and trader activity on platforms like X to identify the state of the market. The most prominent observations of the analysts are the large volume creation of meme coins – nearly 20,000 tokens created daily – and the institutional demand for long Bitcoin calls on margin.

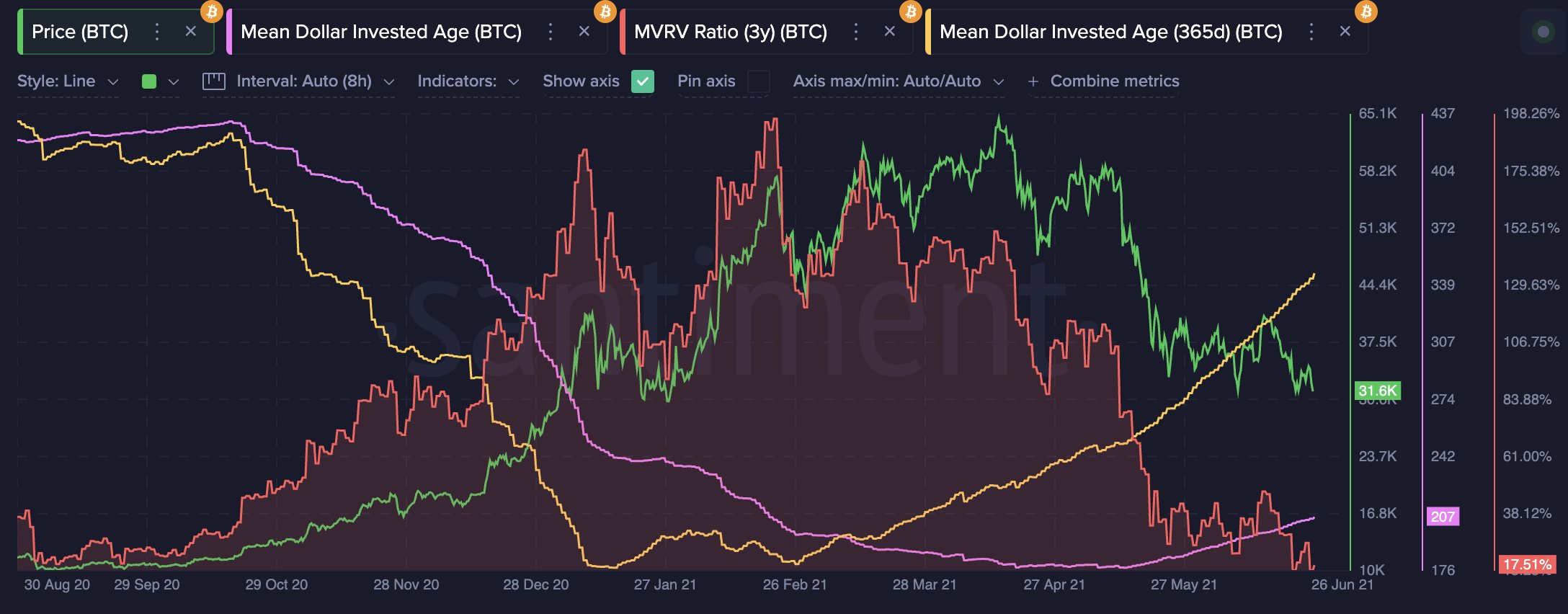

Bitcoin funds and Spot ETFs have injected fresh capital, pushing up the mean dollar invested age metric, which estimates the average age of every dollar invested in BTC’s market capitalization. Historically, periods of steep decline are considered a confirmation of a bull market, and reversals signal trend reversals in BTC.

Based on this metric, downtrend is likely inevitable and traders are riding the gains on “borrowed time,” per the report. Unless there is a steep decline, Bitcoin could suffer a correction, but another attempt at an all-time high is likely.

Santiment’s tweets

Mean Dollar Invested Age (BTC)

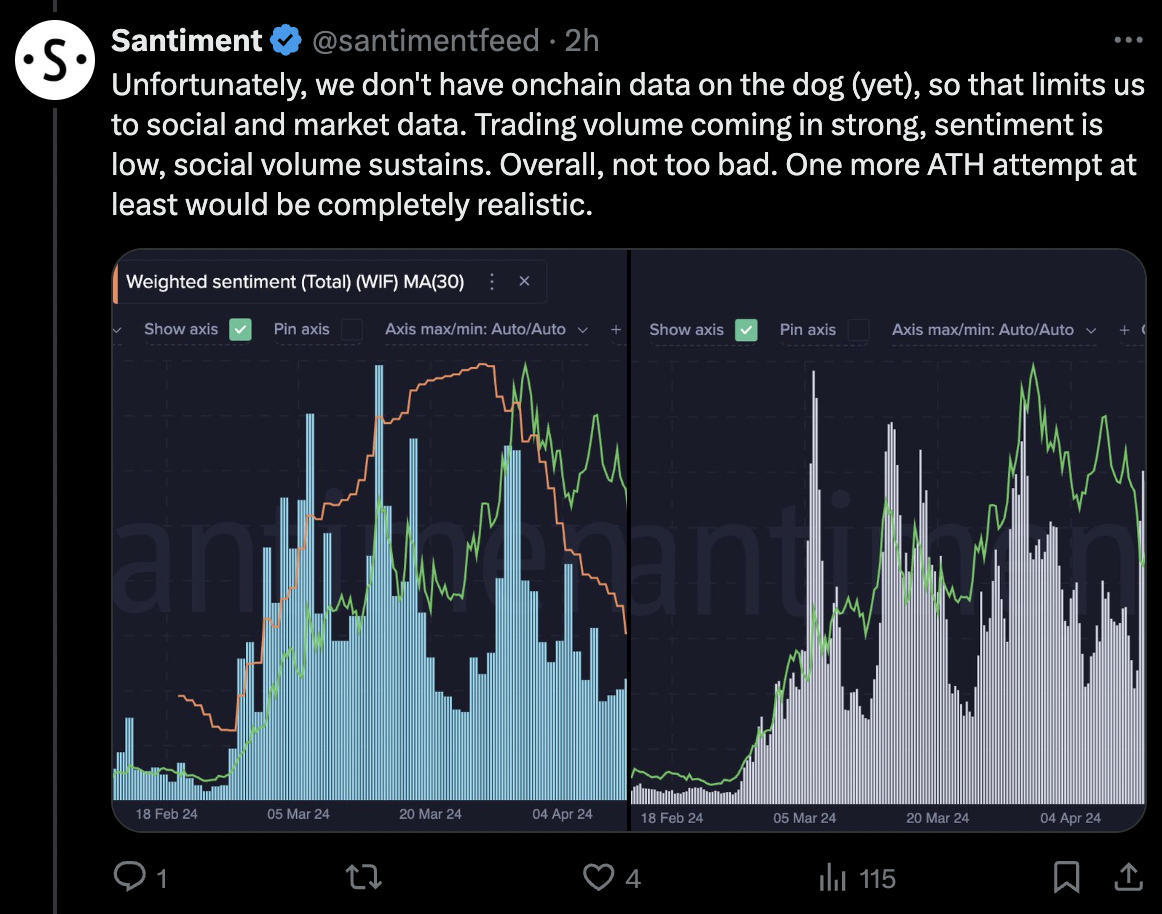

Social and market data show that trading volume has gained strength, sentiment is low and social volume sustains. Analysts say, “Overall, not too bad. One more ATH attempt at least would be completely realistic.”

Meme coins are an important point of consideration in the current market cycle and the two most popular memes Pepe (PEPE) and Dogwifhat (WIF) are analyzed.

Santiment analyst’s take on PEPE and WIF

Analysts consider PEPE cooked, as the meme coin has sustained its gains for the past week and is up nearly 3% on Monday.

Busy week for crypto

Crypto analyst behind the X handle @0xGumshoe tweeted that this week is important for crypto markets as the US Federal Reserve (Fed) will publish the minutes of the May meeting, NVIDIA earnings result will come out and the Ethereum ETF decision will likely be out. These major events are scheduled to occur alongside May’s Purchasing Manager’s Index (PMI) data, which will be released by US, China, UK and the Euro Zone.

These economic events of the week could influence crypto prices as seen in previous cycles, where NVIDIA (NVDA) earnings results catalyzed gains in Artificial Intelligence (AI) tokens, and US macroeconomic releases impacted Bitcoin’s cycle.

Crypto

— gumshoe (@0xGumshoe) May 20, 2024

Bitcoin weekly closed above 2021's ATH

This is the first time in a month

If we want to see continuation it should be this week - not the time to cool off. pic.twitter.com/qS6tgbB1nT