Ethereum fails to overcome key resistance, predictions pour in as SEC will decide on spot ETH ETF next week

- Evan Van Ness says that Ethereum spot ETFs may see approval despite lingering security status investigation.

- X user shares unique opinion that SEC may neither approve nor deny spot ETH ETFs.

- Ethereum investors still show uncertainty as they await fresh market outlook after ETH ETF decision.

Ethereum again went below the $3,000 key level on Thursday after posting signs of a rally. The recent price action follows several predictions from the crypto community regarding the Securities & Exchange Commission's (SEC) decision on spot ETH ETFs next week.

Read more: Ethereum shows slight bullish signs, SEC faces several hurdles in attempts to deny spot Ethereum ETFs

Daily digest market movers: Crypto community shares predictions on spot Ethereum ETFs

Ethereum community members are sharing their predictions with only a week left until the deadline day for the SEC to decide on spot ETH ETFs. Their comments reveal key details about why the agency might or might not approve the ETFs.

Former chief decentralization officer at the Ethereum Foundation Evan Van Ness said the market is underestimating the chance that SEC boss Gary Gensler approves spot ETH ETF "while still trying to claim that ETH is a security." The comment follows several predictions that the SEC's recent crackdown on Ethereum-related firms is aimed at classifying the largest altcoin as a security and, in turn, denying spot ETH ETF applications.

Also read: Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Altcoins rescued as BTC acts on CPI data

However, Larry Fink, the CEO of asset manager BlackRock, has earlier stated in an interview on CNBC that the SEC could still approve spot ETH ETFs even if it classifies Ethereum as a security. This aligns with recent revelations that the SEC has considered ETH a potential security since April 2023 and yet approved ETH futures ETFs in September.

Eric Conner, co-author of Ethereum Improvement Proposal EIP-1559, expressed confidence that the SEC would approve spot ETH ETFs on May 23.

Another X user, @fewture, gave a unique view suggesting the agency may not approve or deny spot ETH ETF applications.

My new theory is the SEC doesn't approve or deny it. They offer nothing in writing. Means it's de facto approved, but then I foresee SEC contesting that process judicially, without speaking to ETH analysis itself.

— fewture (@fewture) May 15, 2024

They will seek an injunction so listing cannot happen.

Bankless podcast host Ryan Sean Adams also shared his take in an X post:

I see no signs the SEC will approve the Ethereum ETF next week save one

— RYAN SΞAN ADAMS - rsa.eth (@RyanSAdams) May 15, 2024

IF (and this is a BIG IF)...IF Biden and D's wake up at the 11th hour & realize anti-crypto Gensler is about to lose them the white house they may pressure him to approve.

A long shot but anything can…

Many expect the SEC to easily deny the spot ETH applications from Van Eck, ARK 21Shares and Hashdex this month but expect the regulator to face challenges when it is dealing with those of Grayscale, Fidelity, BlackRock and Invesco.

ETH technical analysis: Ethereum traders still uncertain

Ethereum is declining again after briefly breaking past the $3,000 mark on Wednesday. The largest altcoin has been witnessing slow growth compared to Bitcoin and Solana, which have risen rapidly in this cycle.

For example, the ETH/BTC ratio has been on a steady decline since the beginning of the year. However, many have predicted that it's reaching a bottom and may bounce back up soon. Any light rally could cause capital to flow back into Ethereum, which, in turn, will boost its price.

Read more: Ethereum bears attempt to take lead following increased odds for a spot ETH ETF denial

However, the ETH/USDT pair still reveals market uncertainty, especially as open interest hovers around 0.5%. ETH liquidations sit at $23.79 million, with $18.29 million coming from liquidated long positions.

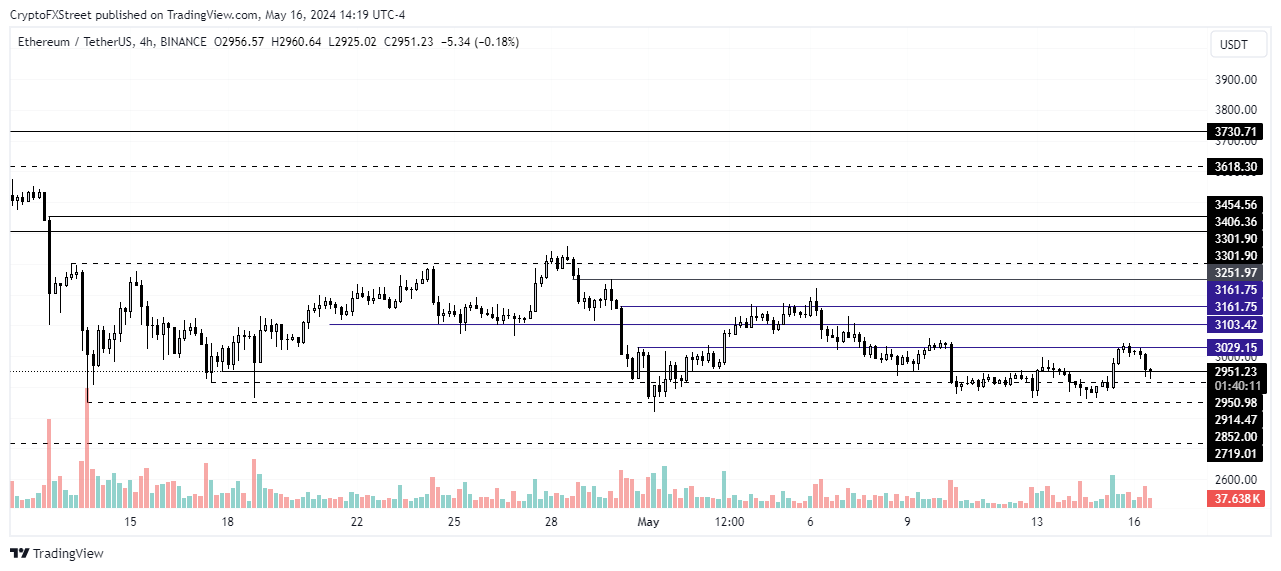

ETH/USDT 4-hour chart

ETH failed to overcome the $3,103 resistance of April 26 and is expected to hold the $2,852 key support level in hopes of a potential bounce back. However, continued uncertainty won't see it making any sustained bullish move in the next few days.

As stated in a previous analysis, investors are awaiting a fresh outlook after the SEC's initial decision on VanEck’s spot ETH ETF on May 23 before opening positions.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Serving as the basal network for the Ether (ETH) cryptocurrency, it is the second largest crypto and largest altcoin by market capitalization. The Ethereum network is tailored for scalability, programmability, security, and decentralization, attributes that make it popular among developers.

Ethereum uses decentralized blockchain technology, where developers can build and deploy applications that are independent of the central authority. To make this easier, the network has a programming language in place, which helps users create self-executing smart contracts. A smart contract is basically a code that can be verified and allows inter-user transactions.

Staking is a process where investors grow their portfolios by locking their assets for a specified duration instead of selling them. It is used by most blockchains, especially the ones that employ Proof-of-Stake (PoS) mechanism, with users earning rewards as an incentive for committing their tokens. For most long-term cryptocurrency holders, staking is a strategy to make passive income from your assets, putting them to work in exchange for reward generation.

Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) mechanism in an event christened “The Merge.” The transformation came as the network wanted to achieve more security, cut down on energy consumption by 99.95%, and execute new scaling solutions with a possible threshold of 100,000 transactions per second. With PoS, there are less entry barriers for miners considering the reduced energy demands.