AI tokens see explosive gains as Vitalik Buterin says GPT 4 passed the Turing test

- Vitalik Buterin commented on whether OpenAI’s GPT 4 passed the Turing test, in an update on Farcaster.

- Buterin believes GPT 4 has passed the test, meaning it exhibits intelligent behaviour equivalent to or indistinguishable from humans.

- AI tokens see massive gains, FET, GRT, TAO, AKT, AGIX among other assets posted double-digit gains in the last 24 hours.

Open AI’s Large Language Model (LLM) GPT 4 has allegedly passed the Turing test per a Senior Oxford researcher, Toby Ord. The test is considered as a means to identify whether the AI exhibits the same level of intelligence or is indistinguishable from humans.

Ethereum co-founder Vitalik Buterin took into account the research shared by a Senior Oxford Researcher Toby Ord, and said he believes GPT 4 passed the test.

AI tokens continue to post double-digit gains, extending their rally in the past 24 hours.

AI tokens rally fueled by GPT 4 likelihood of having passed the Turing test

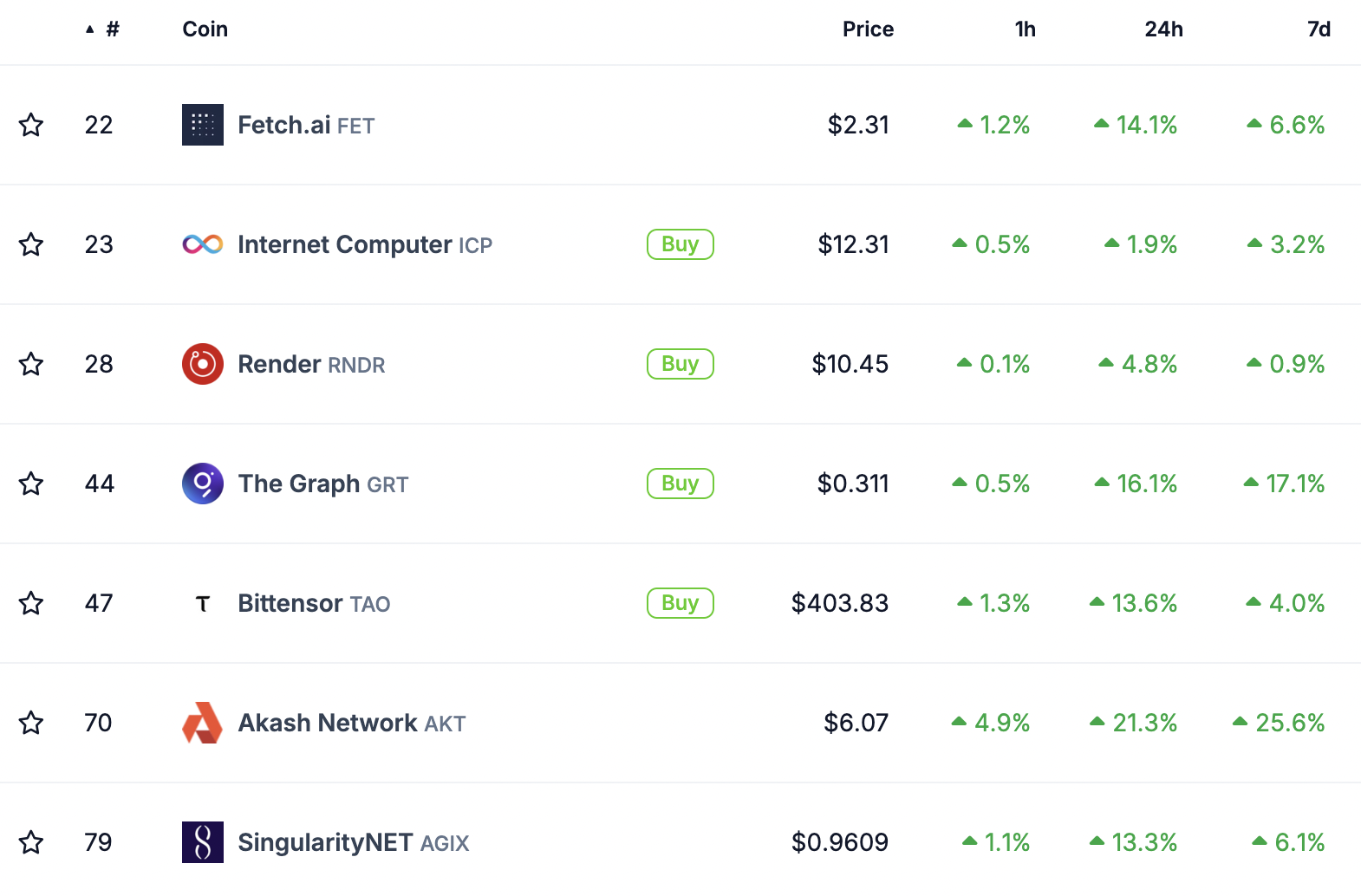

AI tokens Fetch (FET), The Graph (GRT), Bittensor (TAO), Akash Network (AKT), and SingularityNET (AGIX) have posted double-digit gains in the past 24 hours. The AI tokens have extended their rally and remain in positive territory in the last seven days timeframe, as seen on CoinGecko.

AI token performance in the last 1 hour, 24 hours and 7 days

Several AI developments have catalyzed gains in AI tokens, including OpenAI’s announcement of GPT 4 o where O stands for Omni and news of Apple’s agreement with the artificial intelligence firm.

Ethereum co-founder Vitalik Buterin joined the debate on X whether GPT 4 has passed the Turing test. Buterin cited Senior Oxford researcher Toby Ord’s research and said “To me, this counts as GPT4 passing the Turing test. Still an important update that it took all the way until GPT4 to get there!”

Buterin thereby accepts that Open AI’s GPT 4 is equivalent to human intelligence, supporting the AI narrative fueling the rally in the sector’s tokens.