ETH could see a short-term bull run, SEC faces several hurdles in attempts to deny spot Ethereum ETFs

- Recent data showing Ethereum Mainnet underperformed Solana in terms of revenue sparks heated debate about ETH's long-term value.

- There's no legal path for SEC to deny spot ETH ETF, says Nate Geraci.

- Ethereum could be on verge of attempting short-term bull run.

Ethereum (ETH) is looking to attempt a short-term bull run on Wednesday after breaking out from a five-day horizontal movement. Reduced revenue in ETH Mainnet and the Securities & Exchange Commission's (SEC) potential decision on spot ETH ETFs have also sparked debate in the crypto community.

Read more: Ethereum bears attempt to take lead following increased odds for a spot ETH ETF denial

Daily digest market movers: ETH L2s, spot Ethereum ETF analysis

Ethereum Layer 2s and spot ETH ETFs are trending among crypto investors. Here are market movers for the largest altcoin:

- A recent X post on Tuesday by Dan Smith, an analyst at Blockworks, sparked debate among Ethereum community members. Smith shared a post indicating Solana generated more revenue — $2.24 million — from transaction fees and maximum extractable value (MEV) than Ethereum — $1.97 million — on May 12.

However, many argued that the data shared by Smith didn't include fees captured by Ethereum Layer 2s, which form part of the broader Ethereum ecosystem. Ethereum community member Ryan Berckmans argued that the decline in MEV and transaction fees isn't a bearish signal for Ethereum but an indication of improving user experience.

He mentioned how recent Ethereum upgrades have shifted most activity to L2s and hence caused an increase in blockspace supply and a subsequent reduction in fees. He also cited Ethereum's slow price growth in the recent bull cycle as a reason for the revenue reduction.

Berckmans argued that Ethereum's value will come from being "the world's economic hub and not based on fees/mev." Other community members expressed concerns that high-value transactions moving to L2s won't accrue any value to the ETH Mainchain and, as a result, would affect its price.

Also read: Ethereum trades horizontally as institutional whales dump heavily on Coinbase

- Meanwhile, more industry figures are sharing their thoughts on spot ETH ETFs as the May 23 deadline for the SEC to decide on Van Ecks' spot draws near. In an X post on Tuesday, President of ETF Store Nate Geraci stated that he does not see any legal path for the SEC to disapprove spot ETH ETF applications.

He cited the SEC's approval of an ETH futures ETF and issuers' removal of staking options from their applications as major reasons why it would be difficult for the agency to deny spot ETH ETFs. An X user, @Evan_ss6, speculated the SEC might deny the ETFs, using an "ongoing investigation into whether or not ETH should be classified as a security," as the reason.

However, it's important to note that court filings from Consensys revealed the SEC already began investigations into a potential Ethereum security classification in April 2023 and went ahead to approve ETH futures ETFs in September. This adds uncertainty to the mix regarding what the SEC would lean on as the potential reason for denying spot ETH ETFs.

- General Partner at Van Buren Capital Scott Johnsson also highlighted how the SEC would find it difficult to remove the Coinbase surveillance sharing agreement from the mix in its spot ETH ETF decision.

He also shared that recent history suggests the agency usually denies an ETF order within two business days of the final deadline, May 21 - 23, in the case of spot ETH ETFs.

The SEC previously requested the references to the CB SSA be removed from the BTC spot 19b-4 apps, and made clear that it was not a basis for approval in the BTC spot order on Jan 10. They can't do that again here. pic.twitter.com/CEe2KV77d7

— Scott Johnsson (@SGJohnsson) May 14, 2024

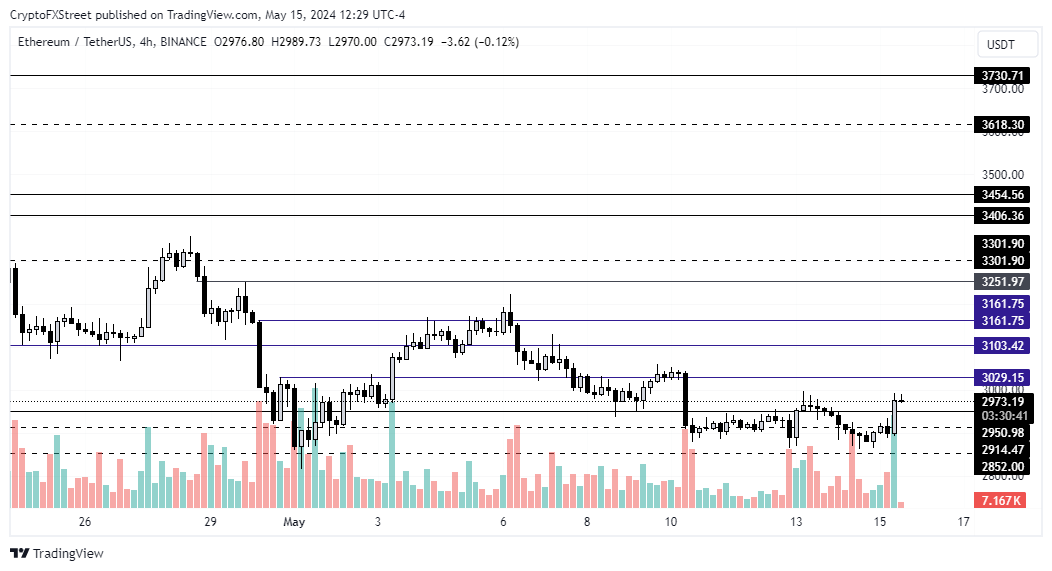

ETH technical analysis: Ethereum attempts a short-term price increase

Ethereum is trading around $2,990 on Wednesday as it attempts to claim the $3,000 key price level again. As previously predicted, the short-term price increase is playing out, and ETH may face strong resistance around the $3,103 and $3,161 mark.

ETH/USDT 4-hour chart

Also read: Ethereum knocking at support’s door

The resistance may prove hard to break due to weak bullish momentum for the largest altcoin. The $2,852 to $3,300 range remains crucial as ETH will likely not trade outside it in the next few days. However, after the SEC's initial decision on spot ETH ETFs on May 23, market participants' uncertainty may be reduced, and ETH would likely need a fresh outlook.

Also, ETH long liquidations have significantly reduced and are now almost equal with shorts. Open interest has risen slightly to 1.97%, confirming the short-term bullish thesis.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Serving as the basal network for the Ether (ETH) cryptocurrency, it is the second largest crypto and largest altcoin by market capitalization. The Ethereum network is tailored for scalability, programmability, security, and decentralization, attributes that make it popular among developers.

Ethereum uses decentralized blockchain technology, where developers can build and deploy applications that are independent of the central authority. To make this easier, the network has a programming language in place, which helps users create self-executing smart contracts. A smart contract is basically a code that can be verified and allows inter-user transactions.

Staking is a process where investors grow their portfolios by locking their assets for a specified duration instead of selling them. It is used by most blockchains, especially the ones that employ Proof-of-Stake (PoS) mechanism, with users earning rewards as an incentive for committing their tokens. For most long-term cryptocurrency holders, staking is a strategy to make passive income from your assets, putting them to work in exchange for reward generation.

Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) mechanism in an event christened “The Merge.” The transformation came as the network wanted to achieve more security, cut down on energy consumption by 99.95%, and execute new scaling solutions with a possible threshold of 100,000 transactions per second. With PoS, there are less entry barriers for miners considering the reduced energy demands.