Solana price pumps 7% as SOL-based POPCAT hits new ATH, JITO becomes largest protocol on TVL metrics

- Solana price has become top performer among crypto top 10 amid anticipation for a marketwide uptrend.

- SOL-based meme coin Popcat hits new ATH of $0.6100, leading the meme coin sector with nearly 30% in gains.

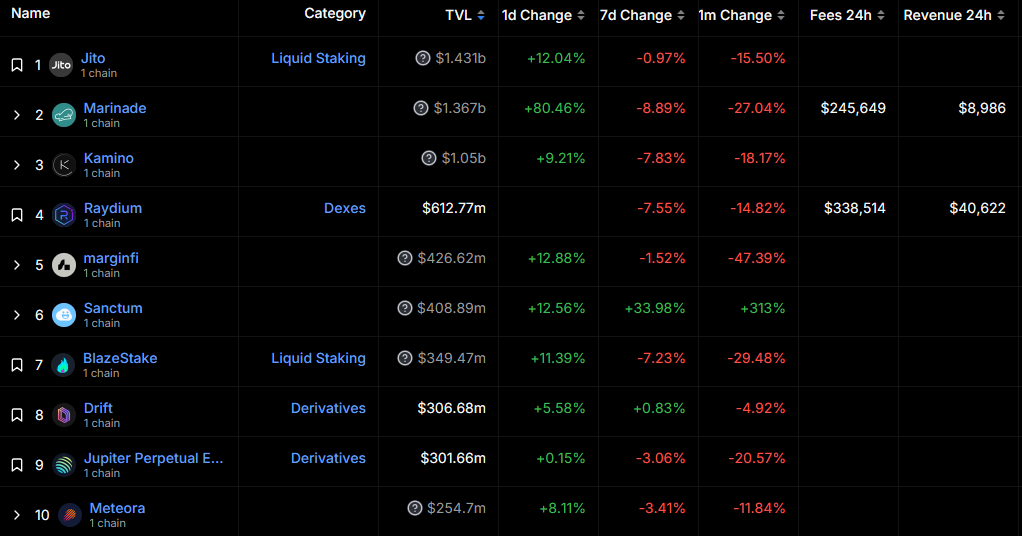

- JITO has become largest Solana protocol on TVL metrics at $1.43 billion, DeFiLlama shows.

Bitcoiners and cryptocurrency enthusiasts are calling for a marketwide recovery after the flash crash that saw Bitcoin price drop to the $56,000 range. It comes following the fourth BTC halving and, more recently, the Federal Open Market Committee Meeting (FOMC). If a fully-fledged bull market does not commence, token holders will settle for an altcoin season.

Also Read: Solana memecoin hits a whopping $328T market cap – But for all the wrong reasons

Solana makes latest crypto market sensation

Solana (SOL) price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

Meme coins on Solana, including Dogwifhat (WIF) and Bonk Inu (BONK), had their time in the spotlight with WIF going as far as to dethrone Pepe coin (PEPE) before the frog-theme token reclaimed its position as the third meme coin on market capitalization metrics.

While the WIF and BONK season has subsided, along with their peers in the dog-themed faction, a new meme coin class is emerging: cat-themed tokens.

While Cat in a Dogs World (MEW) is the biggest token in this category on market capitalization metrics, Solana-based Popcat (POPCAT) is the biggest gainer on Thursday with almost 30% in gains, hauling the altcoin to a new all-time high of $0.6100 and market capitalization upwards of $577.58 million. Popcat price is up 6X in a two-week span.

$Solana memes to the moon

— Julius Elum (@JuliusElum) May 2, 2024

All the Solana memes I called are always the first and quick to recover.

Some with a good pump$POPCAT did a new All time high with over 50% pump today $Solama held so strong and currently on it way to the moon $BORK is…

Another success story on Solana is Jito (JTO), which ascended to the helm of the Solana protocol, leading its peers with a Total Value Locked (TVL) of $1.43 billion, according to data on DefiLlama. This represents a TVL growth of over 12% in 24 hours.

When there is a rise in TVL, it generally indicates that more assets are being deposited and locked into that particular DeFi protocol. It signifies growing user participation and confidence in the platform. It may also indicate increased liquidity and trading volume within the protocol, which can potentially lead to higher returns for users and a stronger ecosystem overall.

Solana protocol TVL

Read More: Will Jito’s second chance trigger a rally to $6 for JTO bulls?