Bitdeer Sells Entire Bitcoin Stash as Mining Profits Near Record Lows

Singapore-based Bitcoin miner Bitdeer has liquidated its entire BTC treasury, abandoning the industry’s standard holding strategy.

This drastic move comes as plunging mining profitability forces the company to restructure its debt and accelerate its AI pivot.

Why did this Bitcoin Miner dump its Holdings?

On February 20, the crypto mining company disclosed it held zero Bitcoin, completely draining its reserves. Notably, this excludes its customer deposits.

The firm confirmed that it had sold its entire recent output of 189.8 Bitcoin, and posted a massive net reduction of 943.1 Bitcoin.

Indeed, this aggressive sell-off highlights a deepening crisis for operators caught in a severe margin squeeze.

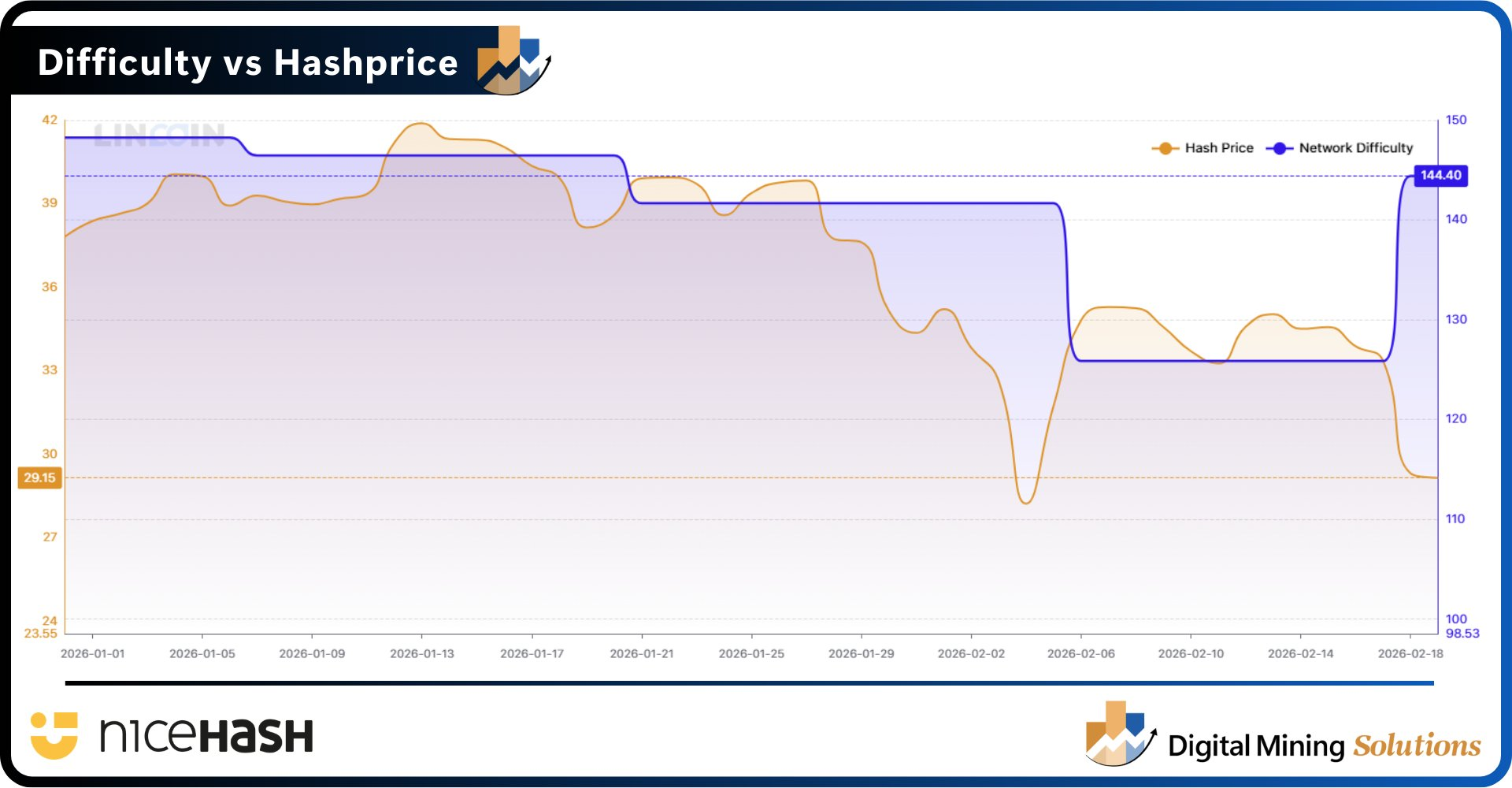

Following a temporary reprieve caused by US winter storms that knocked domestic mining fleets offline, the Bitcoin network experienced a rapid V-shaped recovery.

This week, network difficulty surged 14.7%. This is the largest upward adjustment since May 2021 and erases the operational relief miners experienced earlier in the year.

Consequently, mining profitability, measured by hashprice, plummeted to under $30 per petahash per day. The critical metric now sits inches above its all-time low, pushing production costs higher.

Bitcoin Mining Difficulty vs. Hashprice. Source: Nicehash

Bitcoin Mining Difficulty vs. Hashprice. Source: Nicehash

Bitdeer Seeks Funding for AI Pivot

To navigate the crunch, Bitdeer is turning heavily to Wall Street to fund its pivot into artificial intelligence.

On February 20, the company announced an upsized $325 million private sale of convertible senior notes.

The sale, expected to close on February 24, includes an option for the initial purchasers to purchase an additional $50 million in notes.

The financial maneuvering is highly defensive. Bitdeer will allocate $138.2 million to repurchase its existing 5.25% convertible senior notes due in 2029. This effectively extends the miner’s runway by restructuring its debt.

Another $29.2 million will fund capped call transactions, an insurance policy that protects existing shareholders from dilution if the stock price rises.

The remaining proceeds signal a clear strategic departure from pure-play crypto mining.

Bitdeer stated it will use the fresh capital to expand its high-performance computing and AI cloud businesses, develop proprietary ASIC mining rigs, and fund data center expansion.

Meanwhile, the treasury liquidation and strategic pivot occur alongside a paradoxical industry milestone: Bitdeer is now the largest publicly traded self-miner in the world.

Recent reports have revealed that Bitdeer’s self-managed hash rate reached 63.2 exahashes per second, surpassing competitor Marathon Digital’s 60.4 EH/s. This makes the Singapore-based firm the largest publicly traded company with the highest self-managed Bitcoin hashrate.