85% of 2025 token launches now trade below TGE price

Crypto markets in 2026 look ugly for new tokens. About 85% of token launches in 2025 now trade below their TGE price, according to a chart from Galaxy Research lays it out clearly. Having a “Top VC” on the cap table used to spark rallies. That boost is fading fast.

Back in Q2 2022, crypto venture funds raised nearly $17 billion in one quarter. More than 80 new funds launched. LPs poured money into anything with “crypto” in the pitch deck. That rush is gone. VC ROI has dropped every year since 2022.

The number of new funds just hit a five-year low. Fundraising last quarter reached only 12% of Q2 2022 levels. At the same time, some point out, “But VCs invested $8.5 Billion last quarter, up 84% QoQ!”

VCs burn old cash as Bitcoin slides and spot selling intensifies

The money going into crypto deals is not exactly new, though, according to Galaxy. Companies are using capital raised in 2022.

Total capital deployed from 2023 through 2025 is roughly equal to what was raised in 2022 alone. The old model was simple. Raise a round. Launch a token. Dump on retail. That model is fading.

As VC influence shrinks, projects with real users and real revenue are the ones left standing. Launches look fairer. Insider selling slows. Fewer chains pop up. More teams focus on the product instead of the next raise.

Pressure spread to crypto majors. Bitcoin fell to $60,000. That drop hit so-called diamond hands hard. The mood felt similar to the May 2022 LUNA crash. In both periods, the 7D EMA of Long-Term Holder SOPR dropped below 1 after staying above it for one to two years.

Long-term holders realized losses. That kind of shift usually appears in deeper bear phases.

Since October 6, when Bitcoin marked its last all-time high, price is down 46%. The drawdown at one point passed 52%.

That makes this the largest pullback of the current cycle. The slide reflects normal crypto volatility. It also lines up with a rough external backdrop. Macroeconomic and geopolitical conditions worsened. Risk assets felt the strain.

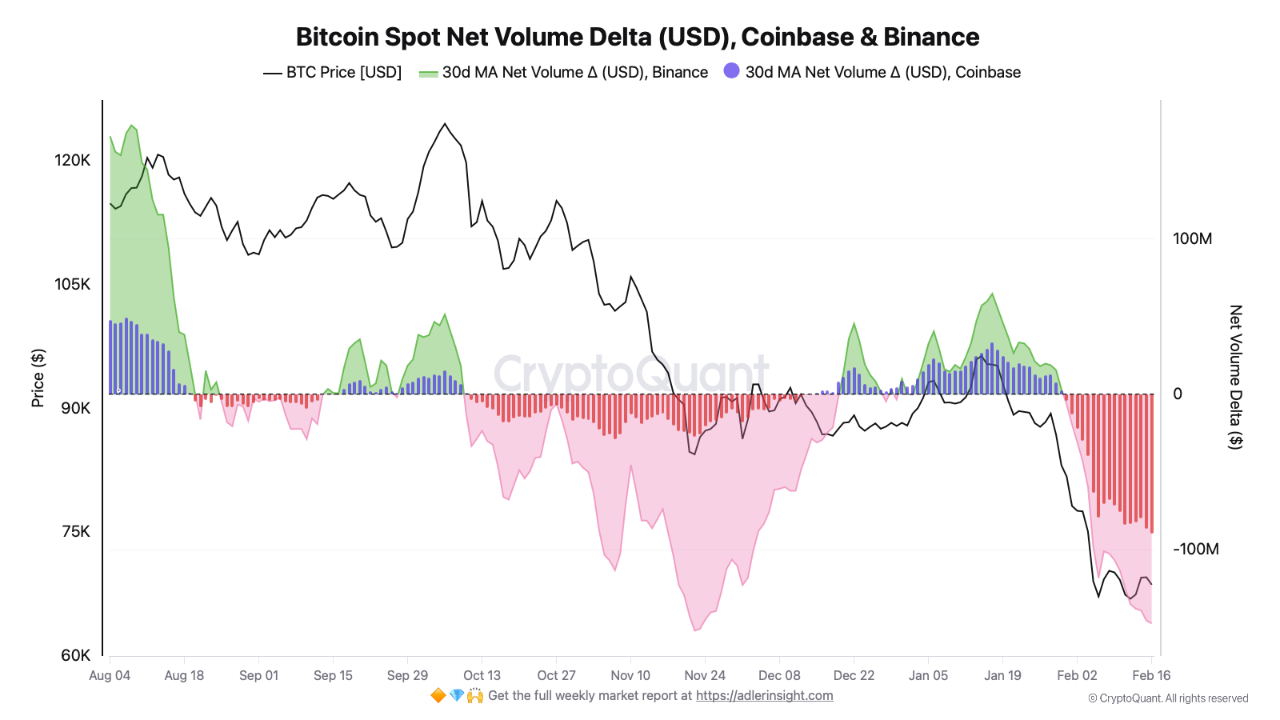

Last summer told a different story. Strong buying dominated the tape. Delta volume analysis showed steady demand. Prices climbed. Since October, that flipped. Spot net volume Delta turned sharply negative on major exchanges.

Binance and Coinbase both show heavy selling. On Coinbase, monthly flows average negative $89 million. On Binance, the average sits near negative $147 million. Sellers control the spot market.

Sharpen your strategy with mentorship + daily ideas - 30 days free access to our trading program