Jito Price Forecast: JTO surges over 23%, extending bullish trend

- Jito breaks out, posting over 23% intraday gains despite weakness in the broader crypto market.

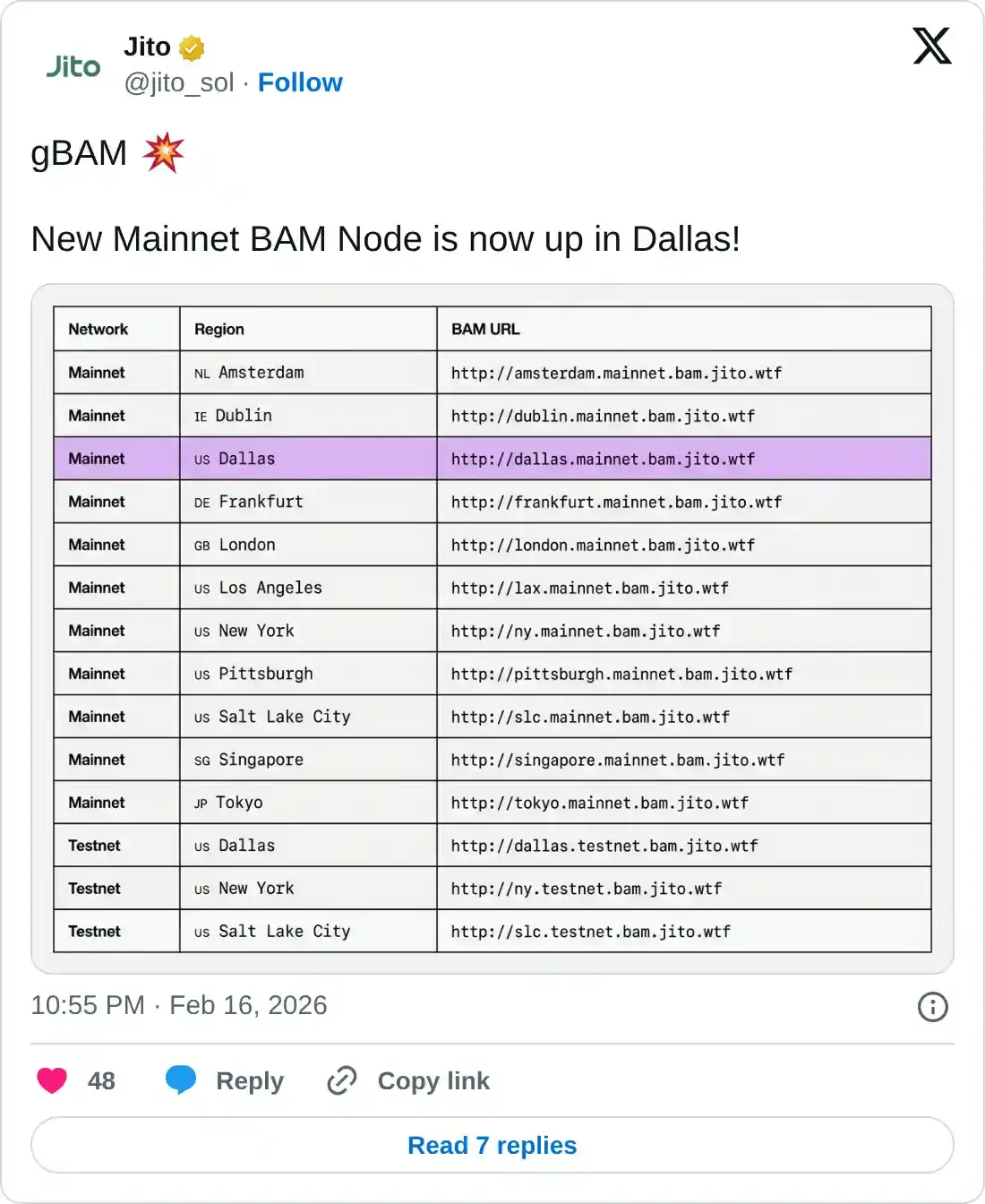

- Jito launches a new mainnet node to support an upgraded transaction scheduling system for the Jito-Solana client.

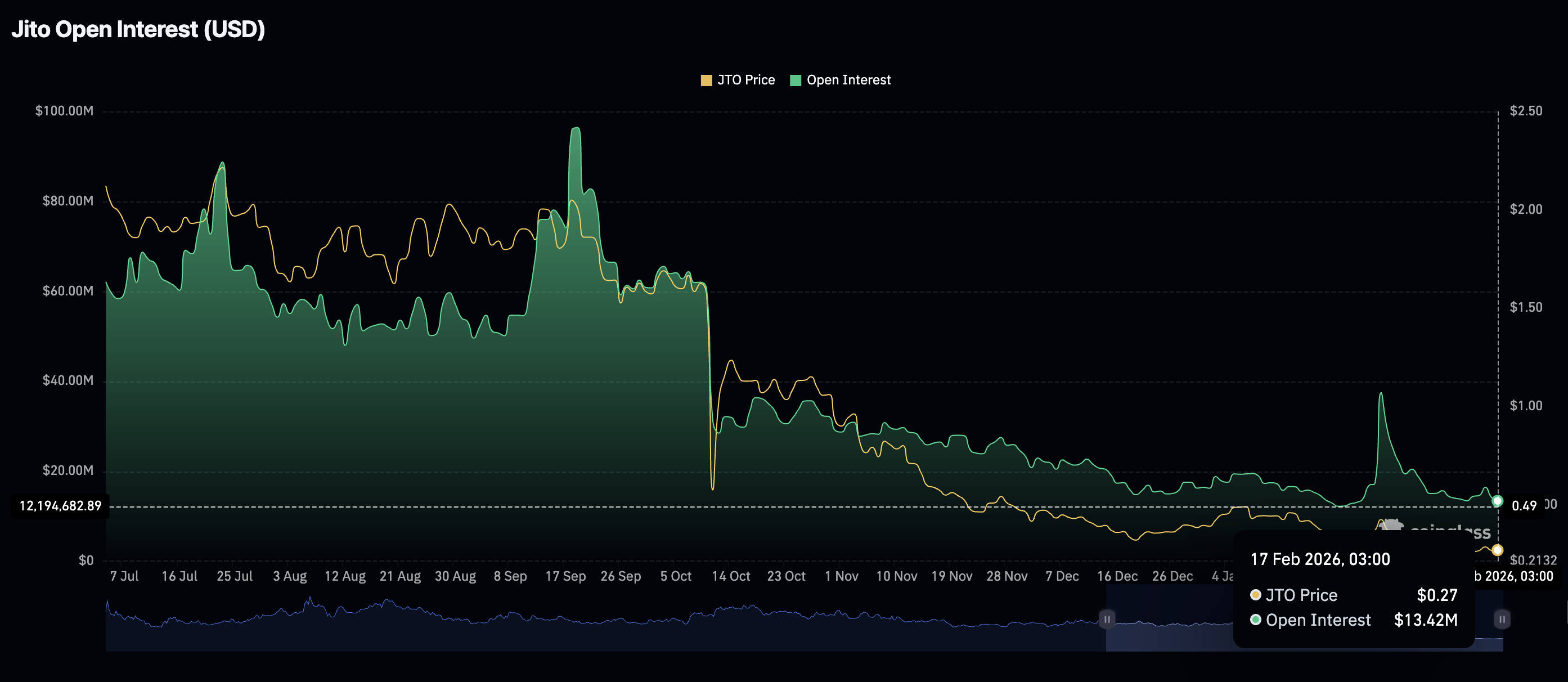

- Low retail activity, with futures Open Interest declining to $13.42 million, may limit further upside in JTO.

Jito (JTO) has accelerated its rebound by more than 23%, trading at around $0.33 at the time of writing on Tuesday. The isolated price uptick comes amid widespread drawdowns in the crypto market and weak sentiment.

Jito extends BAM mainnet node support to the Jito-Solana client

Jito has announced the launch of a new Blockspace Assembly Market (BAM) node in Dallas, United States (US), supporting an upgraded transaction scheduling system for the Jito-Solana client. The new system separates transaction ordering from validation, with validators delegating scheduling decisions to specialized BAM nodes.

Jito states that the new BAM node preserves privacy by ensuring that transaction content remains private during scheduling. The system achieves verifiable scheduling through cryptographic attestations. Additionally, a BAM node adds a layer of flexibility, allowing validators to switch between different environments, such as the normal and block engine.

Technical outlook: Can JTO extend rally amid low retail interest?

Jito shows signs of a bullish turnaround, extending intraday gains toward the psychological $0.40 threshold. Key technical indicators, such as the Moving Average Convergence Divergence (MACD) and the Money Flow Index (MFI), are rising, supporting the uptrend.

The MACD holds above the signal line on the daily chart as both rise toward the zero line, suggesting that bullish momentum is increasing. Green histogram bars also expand, prompting traders to increase their exposure.

Meanwhile, the MFI at 59 on the same chart indicates that more money is flowing into Jito, as the token tests breakout strength. Still, the 50-day Exponential Moving Average (EMA) limits the upside at $0.35. A decisive break above this level is required to uphold the bullish outlook toward the supply zone at $0.40. Closing the day below the moving-average resistance could spur profit-taking and prompt a sudden correction toward support at $0.30.

Traders should temper their expectations given that Jito faces a weakening derivatives market. According to CoinGlass data, the futures Open Interest (OI) has narrowed to $13.42 million on Tuesday, from $14.43 million the previous day.

A persistently weak derivatives market suggests that Jito may lack follow-through momentum to sustain the uptrend. However, if retail investors increase their risk appetite for JTO, a steady uptrend would take shape.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.