Bitcoin Price Forecast: BTC consolidates as on-chain data show mixed signals

- Bitcoin price has consolidated between $65,700 and $72,000 over the past nine days, with no clear directional bias.

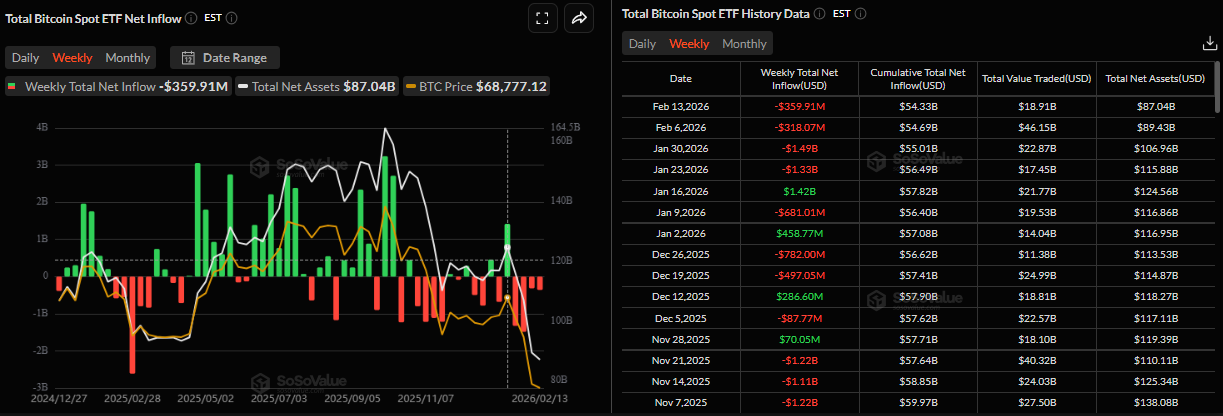

- US-listed spot ETFs recorded a $359.91 million weekly outflow, marking the fourth consecutive week of withdrawals.

- On-chain data show mixed signals, highlighting indecision among traders.

Bitcoin (BTC) price is trading sideways around $68,800 at the time of writing on Monday, within a defined range over the past nine days, with no clear directional bias. Institutional demand continues to weaken, with spot Exchange-Traded Funds (ETFs) recording a fourth consecutive week of outflows, signaling fading institutional investor interest. Meanwhile, on-chain data signals mixed signals, suggesting the Crypto King could remain in a consolidation phase as traders await a decisive catalyst.

Fading institutional demand

Institutional demand for Bitcoin continued to weaken last week. SoSoValue data shows that spot Bitcoin ETFs recorded total outflows of $359.91 million last week, marking the fourth consecutive week of withdrawals. If this trend continues and intensifies, BTC could see further correction.

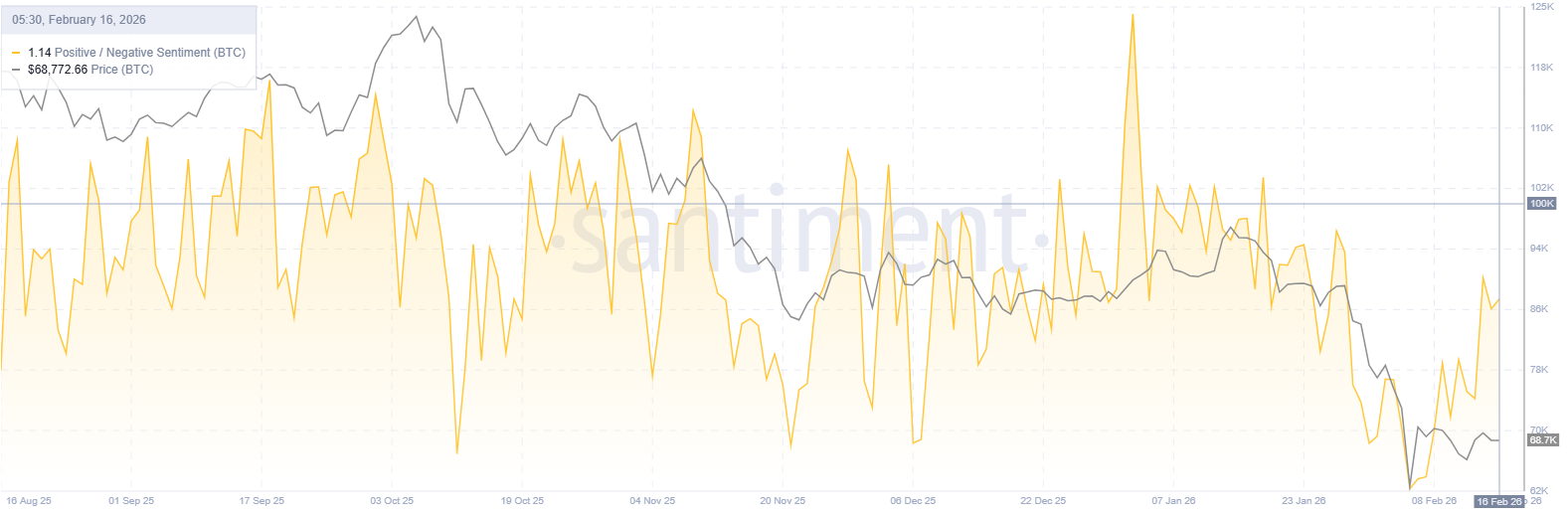

Mixed signals among traders suggest further consolidation

Santiment data indicate mixed on-chain signals among traders, with Bitcoin trading sideways for more than a week following a massive correction.

The chart below shows that wallets often referred to as "smart money whales," holding 10 to 10,000 BTC, have added roughly 18,000 BTC over the last four days. During the same period, small retail wallets holding less than 0.1 BTC have also been aggressively buying. Historically, a market bottom occurs when whales buy while retail sells out of fear, so the current dynamics suggest a ‘perfect’ bottom has not yet occurred.

[13-1771234149921-1771234149923.43.48, 16 Feb, 2026].png)

In addition, BTC’s 365-day Market Value to Realized Value (MVRV) ratio, which indicates if BTC is undervalued or overvalued, sits at -29.42% on Monday, nearing the lows of December 2022 before BTC rallied, and highlights that the average long-term holder is down significantly on their investment.

[14-1771234272237-1771234272238.36.56, 16 Feb, 2026].png)

The market sentiment data indicate that traders are turning slightly optimistic. The ratio of bullish to bearish comments on social media is hovering around 1, indicating a balanced-to-positive bias. Historically, markets move against the crowd’s expectations. Rising confidence during a price advance could signal complacency, increasing the risk of a short-term pullback rather than a sustained breakout. As a result, the largest cryptocurrency could continue to trade sideways until a stronger catalyst emerges to drive a decisive move.

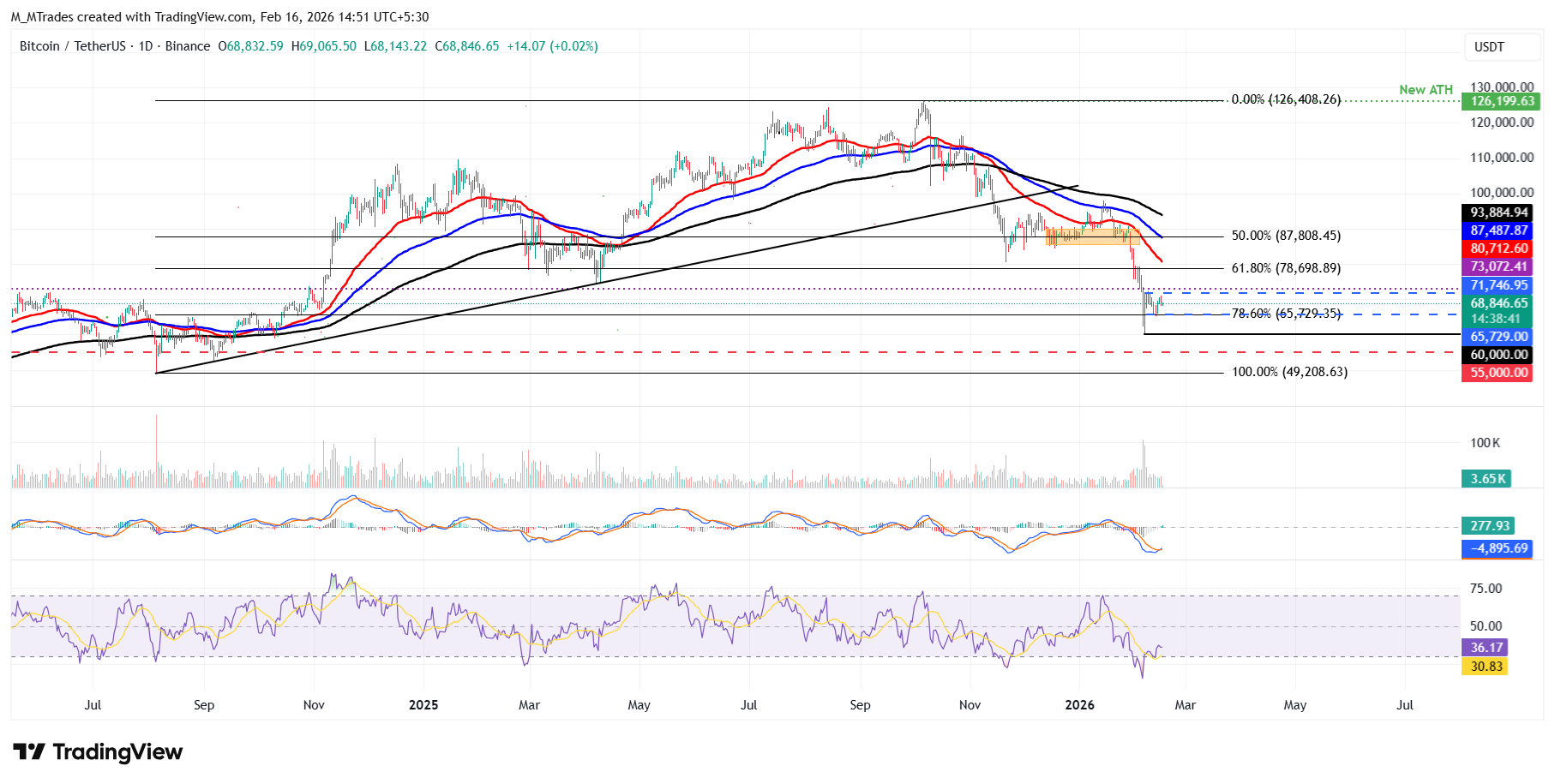

Bitcoin Price Forecast: BTC trades sideways within the $65,700 and $72,000 range

Bitcoin price has been consolidating between $65,729 and $71,746 since February 7. As of Monday, BTC is trading inside this range at $68,800.

If BTC breaks above the upper consolidation range at $71,746, it could extend the recovery toward the daily resistance at $73,072.

The Relative Strength Index (RSI) on the daily chart reads 36, rebounding from oversold levels, signaling easing bearish momentum. The Moving Average Convergence Divergence (MACD) showed a bullish crossover on Sunday, further supporting the recovery thesis.

On the other hand, if BTC closes below the lower consolidation level at $65,729, it could extend the decline toward the key support level at $60,000.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.