Ripple Price Forecast: XRP tests breakout strength amid muted institutional and retail interest

- Ripple announced a partnership with Aviva Investors on Wednesday to tokenize funds on XRP Ledger.

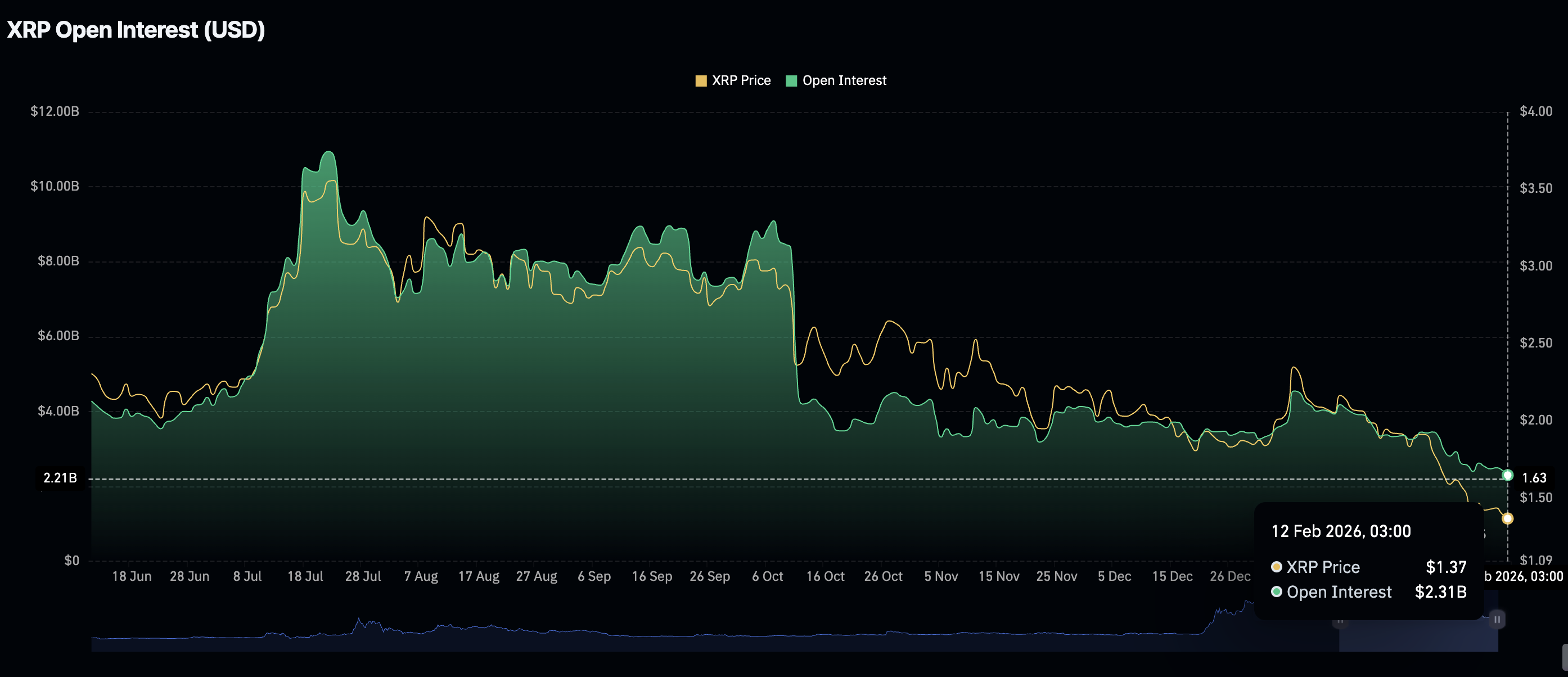

- The XRP retail market extends weakness as futures Open Interest drops to $2.31 billion.

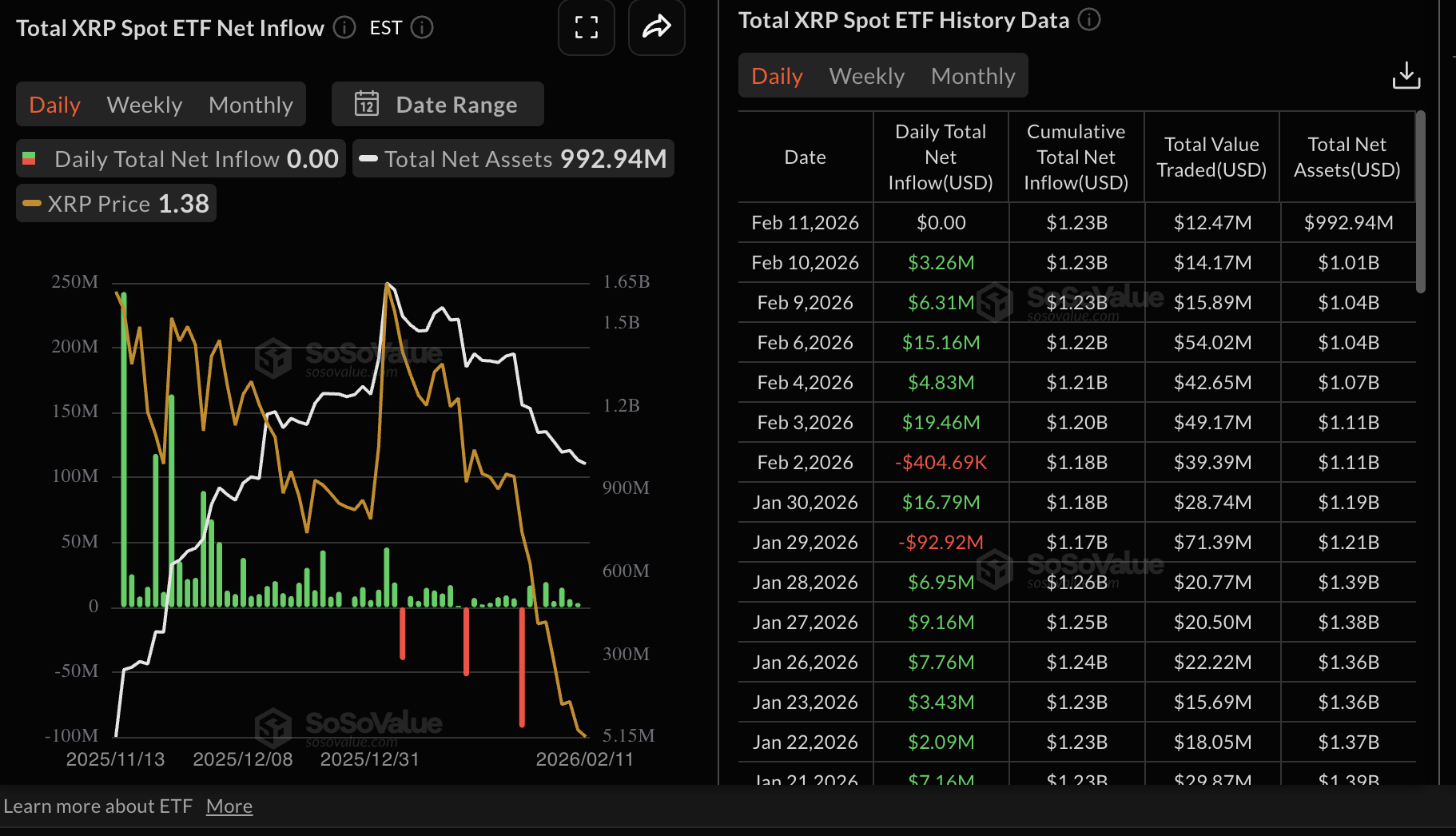

- Institutional investors pause XRP ETF uptake, with cumulative inflows averaging $1.23 million on Wednesday.

Ripple (XRP) exhibits subtle recovery signs, trading slightly above $1.40 at the time of writing on Thursday, as crypto prices broadly edge higher. Despite the metered uptick, risk-off sentiment remains a concern across the crypto market, as retail and institutional interest dwindle.

Holding above key levels such as $1.40 could shape XRP's short-term outlook in favour of the bulls. However, if technicals remain weak, the path of least resistance would remain downward, increasing the odds of a correction toward Friday's low at $1.12.

Ripple advances tokenization with Aviva Investors partnership

Ripple and Aviva Investors have entered into a strategic partnership as part of a broader mission to bring real-world assets onto the XRP Ledger (XRPL) through tokenization.

The announcement made on Wednesday will see the United Kingdom (UK) insurer and investment manager explore tokenisation of funds. Ripple, on the other hand, is expanding its presence in the UK and across Europe.

"We believe there are many benefits that tokenisation can bring to investors, including improvements in terms of both time and cost efficiency," said Jill Barber, Chief Distribution Officer at Aviva Investors.

Weak retail and institutional interest weigh on XRP

Retail interest in XRP is on the back foot, as futures Open Interest (OI) fell to $2.31 billion on Thursday, from $2.44 billion the previous day. OI has generally stayed in a downtrend since the record high of $10.94 billion in July, suggesting that investors lack confidence in XRP's ability to recover and sustain an uptrend.

XRP spot ETFs, on the other hand, remained quiet, with zero flows on Thursday, leaving cumulative inflows at $1.23 billion and net assets under management at approximately $993 million. Before this, the ETFs had sustained a five-day streak of inflows.

XRP technical outlook: XRP bulls eye short-term breakout

XRP hovers around $1.40 after rising 2% intraday. The remittance token's subtle rebound builds on slightly positive indicators, starting with the Relative Strength Index (RSI), which has recovered from oversold territory to 35 on the daily chart. An extended recovery in the RSI toward the midline could confirm a potential bullish transition.

Although the Relative Strength Index (RSI) holds below the signal line, the red histogram bars continue to contract, signaling a potential shift into bullish momentum.

Traders will watch for the MACD line to cross above its signal line as a signal to increase their exposure, anticipating a larger breakout toward Friday's high of $1.54. The 50-day Exponential Moving Average (EMA) at $1.78 may limit further price increases.

Conversely, XRP is still at risk of correcting below the immediate $1.40 support, especially if the aforementioned retail and institutional interest extends weakness. The October 10 support at $1.25 and Friday's low at $1.12 are in line to absorb selling pressure.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.