Ethereum Network Activity Hits Peak, but Why This Is Not Necessarily a Bullish Signal

The Ethereum network is experiencing its most active phase to date. However, this does not necessarily indicate a bullish outlook. Recent on-chain data shows Ethereum reaching a major milestone as transfer counts hit a record high. Historically, similar signals have not always led to positive price performance.

In addition, a sharp spike in exchange inflows raises concerns that selling pressure has not yet subsided.

How Does Ethereum’s Current Situation Compare to 2018 And 2021?

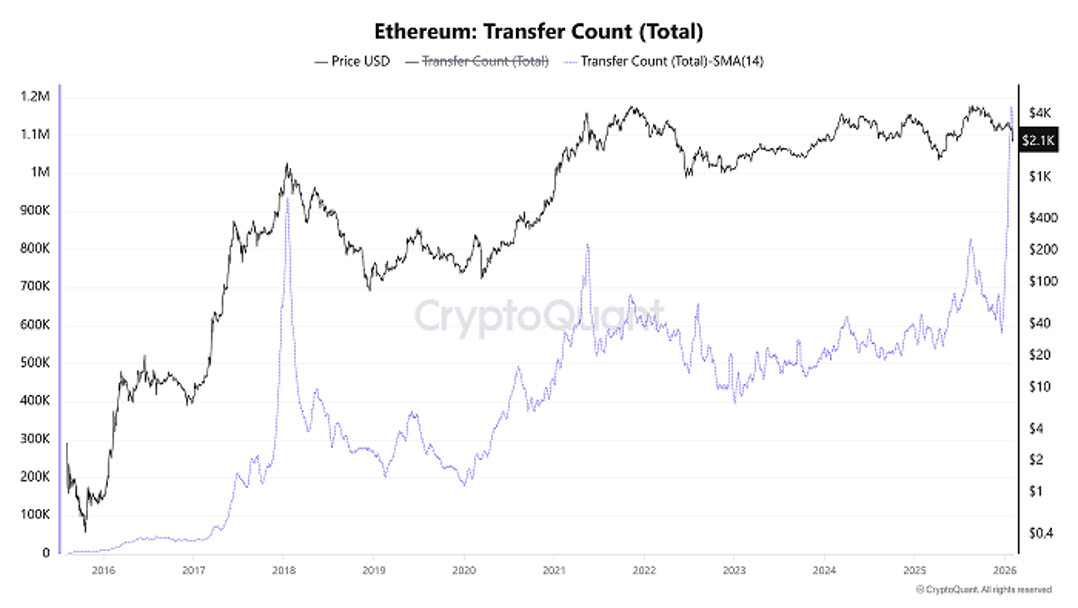

Entering February, CryptoQuant data shows that Ethereum Transfer Count—the total number of token transfers—measured by a 14-day moving average, reached a record level of 1.1 million.

At first glance, this figure appears promising. It suggests strong network growth and broader adoption of Ethereum.

Ethereum Transfer Count. Source: CryptoQuant.

Ethereum Transfer Count. Source: CryptoQuant.

However, deeper analysis indicates this may not be the bullish signal many expect. Instead, it could point to a correction phase or even a cyclical price peak, based on historical precedents.

CryptoQuant analyst CryptoOnchain highlights two periods when heightened Ethereum network activity signaled market tops.

- On January 18, 2018, at the peak of the ICO boom, Ethereum transaction counts surged. Shortly afterward, ETH collapsed from around $1,400 to below $100 by the end of the year. This decline dragged the entire crypto market into a two-year “crypto winter.”

- On May 19, 2021, amid the explosive growth of DeFi and NFTs, the metric reached another record high. The market then reversed sharply, with ETH falling from above $4,000 to below $2,000.

The reasoning is straightforward. Increased ETH movement often indicates that more investors are withdrawing funds from wallets, often in large transactions. This behavior may reflect attempts to sell amid deteriorating future expectations.

“The current scenario bears a striking resemblance to the setups seen in 2018 and 2021. While the macro environment changes, the on-chain behavior of network participants suggests we are in a zone of high risk,” CryptoOnchain stated.

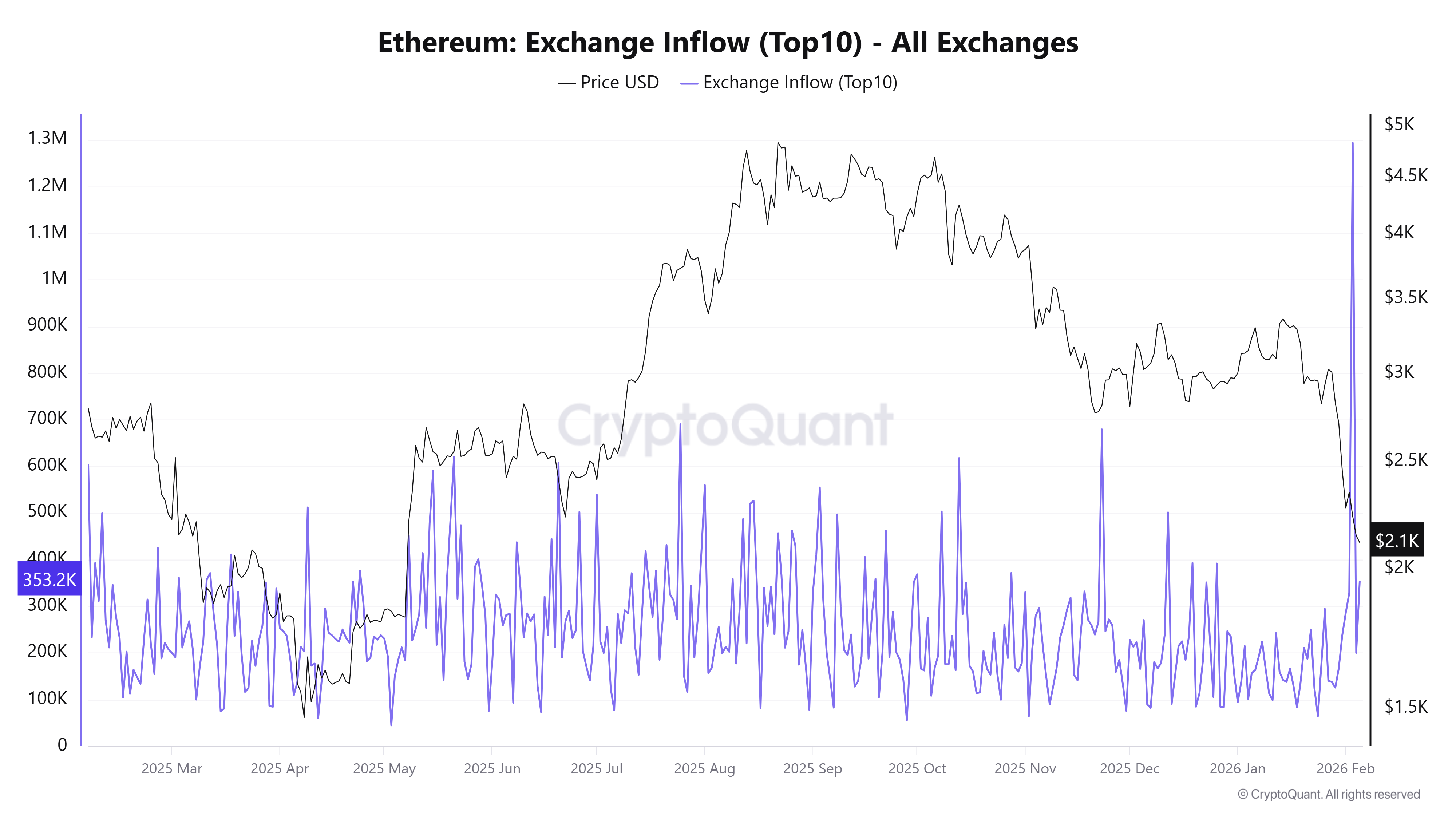

This view is further supported by a spike in Ethereum Exchange Inflow (Top 10) as ETH dropped below $2,300 in early February.

Ethereum Exchange Inflow (Top 10) measures the total amount of coins from the ten largest inflow transactions to exchanges. High values indicate an increase in investors depositing large amounts at once. This often signals rising selling pressure and the risk of further price declines.

Ethereum Exchange Inflow (Top 10). Source: CryptoQuant.

Ethereum Exchange Inflow (Top 10). Source: CryptoQuant.

On February 3, this metric surged to 1.3 million, the highest level in a year. Two days later, ETH fell from $2,230 to below $2,100.

According to analysis from BeInCrypto, a confirmed trend reversal would require Ethereum to recover to at least $3,000. In the short term, ETH may continue to decline toward the $2,000 support level, as selling pressure remains unresolved.